Global equities remain on the back foot; with Asian and Euro bourses tracking North American equities lower overnight amid investor fears over global trade and FAANG stocks.

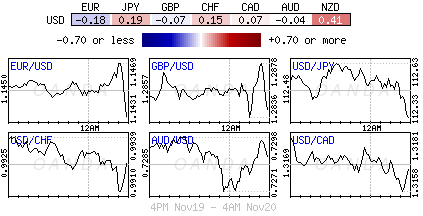

The ‘big’ dollar is little changed in Euro trading, Euro bonds are a tad lower, while U.S 10-year notes trade atop of +3.06% ahead of a holiday shortened U.S Thanksgiving week.

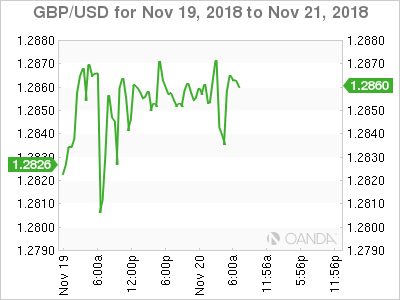

Elsewhere, sterling (£1.2839) trades relatively stable in a tight range as PM Theresa May reaches out to the business community to help her deliver ‘her’ Brexit deal. Also, there is mounting evidence that a plot to try and oust her from power is waning. Nevertheless, uncertainty is likely to loom for the foreseeable future, given that no date has been set for the U.K Parliament to vote on the Brexit deal and PM could still face a no-confidence vote.

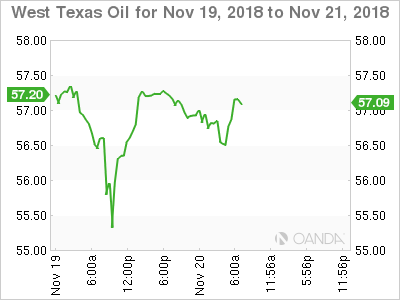

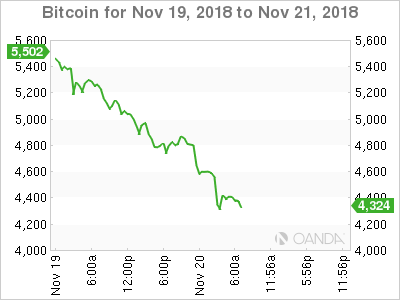

Bitcoin is trading well below the psychological $5,000 ($4,382) for the first time in 13-months, crude trading around $57 a barrel.

1. Stocks see red

Yesterday, U.S equities came under heavy selling, as investors dumped Apple, internet and other tech stocks, aided by conflicting signals between the Sino-U.S trade dispute. The theme remains the same in overnight trading.

In Japan, the Nikkei fell to a three-week low as a drop in Nasdaq dragged down Japanese tech names, and while Nissan Motor plummeted on news of Chairman Carlos Ghosn’s arrest and dismissal. Also, gains in the yen and bond prices have pressured equities. The Nikkei share average ended -1.1% lower, while the broader Topix shed -0.7%.

Down-under, Australia’s ASX 200 dropped -0.38% though managed to pare majority of the losses as financials and miners notched surprise gains late in the day. In S. Korea, the Kospi was -0.8% lower, with Samsung and Hynix down -2-3% after the tech-led slide stateside.

In China, stocks dropped the most in three-weeks overnight, led by financial and tech shares. The blue-chip CSI300 index fell -2.3%, while the Shanghai Composite Index lost -2.1%. In Hong Kong, stocks gave up -2% to log their biggest one-day loss in more than a week.

Note: Chinese stock markets had been largely insulated from recent negative market moves on hopes of further stimulus measures from authorities.

In Europe, regional bourses trade lower on Brexit uncertainty as well as continuing trade tensions.

U.S stocks are set to open deep in the ‘red’ (-0.8%)

Indices: Stoxx600 -0.9% at 352, FTSE -0.6% at 6958, DAX -1.3% at 11095, CAC-40 -1.0% at 4935, IBEX-35 -1.1% at 8909, FTSE MIB -0.7% at 18655, SMI -0.4% at 8780, S&P 500 Futures -0.8%.

2. Oil prices slip despite expected OPEC cuts, gold unchanged

Understanding the oil market has become a tad more difficult due to rising geopolitical uncertainties and U.S foreign policies concerning OPEC and other top producers. The ‘black stuff’ has again come under pressure despite expectations that OPEC will introduce new output curbs.

Brent crude oil futures are at +$66.37 a barrel, down -42c, or -0.6% from Monday’s close, while U.S West Texas Intermediate (WTI) crude futures are at +$56.94 per barrel, -26c, or -0.5%, below their last settlement.

Market consensus sees oil-demand growth over the next couple of quarters will help balance rising supplies, but demand could structurally slow further into 2019-2020.

In this scenario, OPEC and company will be required to act decisively and quickly with a combined supply cut if they want to avoid a much deeper pull back in oil prices.

The North American crude ‘bears’ continue to see further price downside risks from the growth in U.S shale production as well as the deteriorating economic outlook.

Note: U.S crude oil production has climbed by almost +25% this year, to a record of +11.7M bpd.

Concerned about an emerging production overhang, OPEC is expected to push for cuts at its December 6 meeting – expectations for a supply cut are in the region of -1M to -1.4M bpd.

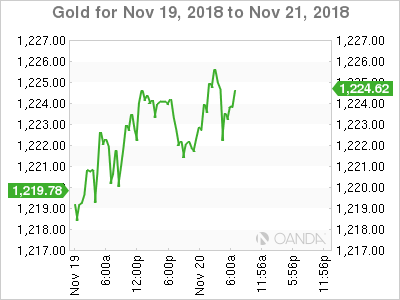

Ahead of the U.S open, gold prices are trading steady, after moving in a tight range in holiday-thinned trading. The ‘yellow’ metal is holding above the psychological +$1,220 level as the ‘big’ dollar was pressured by weaker U.S economic data and a clouded interest rate outlook.

Spot gold is little changed at +$1,224.45 per ounce, while U.S gold futures are flat at +$1,224.8 per ounce.

3. Italian government bond yields soar

Italian BTP yields have jumped to a one-month highs earlier this morning, pushed higher on risk aversion triggered by sharp tech equity losses, tensions over Brexit and concerns about the Italian budget.

Italian BTP yields have backed up as much as +13 bps, with five-year yields rising to +2.97%, and those on 10-year bonds reaching a one-month high of +3.70%.

Germany’s 10-year Bund yield has hit a three-week low at +0.347%.

With little sign of any easing in the Italian government’s budget dispute with the E.U Commission and with the vulnerability of the Italian bond market likely to remain very high has widened the BTP/Bund spread. The 10-year Italy/German Gov’t bond spread has widened by over +10 bps to +333 bps for a one-month high.

Note: The market is waiting for the E.U Commission’s expected response to the Italian budget draft tomorrow, Wed Nov 21.

Elsewhere, the yield on U.S 10-year notes has dipped -1 bps to +3.06%, hitting the lowest in more than seven-weeks with its eighth straight decline. In the U.K, the 10-year Gilt yield has gained +1 bps to +1.378%.

4. Bitcoin loses 30% in a week

Bitcoin (BTC) has fallen -18% in the last day. Since the market began to drop last Wednesday, it’s down -30% and in the context of BTC all-time high of $19,783.06 in mid-December of last year, the cryptocurrency is down -75% from its high print. A new version of Bitcoin cash was introduced last week (Bitcoin ABC) and this has provided some of the immediate weakness.

EUR/USD (€1.1433) initially tested the €1.1470 area overnight before running into strong resistance – widening of the Italian/Bund spread has aided the EUR ‘bear’ as they see little sign of an easing in the Italian government’s budget dispute with the E.U Commission. The E.U Commission is expecting a response to the Italian budget draft tomorrow.

GBP/USD (£1.2862) remain in a tight range. No date has been set yet for the U.K Parliament to vote on the Brexit deal and PM May could still face a no-confidence vote before then. BoE Carney is currently testifying to the Treasury select committee on its Brexit preparations.

Note: Brexiteers remain short of the 48 signatures needed to trigger a no confidence vote in PM May. The confidence vote now appears to be on hold until after Parliament votes next month on PM May’s Brexit deal, which will itself be seen as a referendum on her leadership.

5. BoE’s Carney says central bank a sideshow in “No Deal” Brexit

This morning, BoE Governor and several MPC members are testifying on U.K inflation and the economic outlook before Parliament’s Treasury Committee.

Governor Carney has noted that if the U.K crashes out of the E.U without a deal on its future relationship with the bloc the central bank’s response will be “a sideshow.”

In testimony to lawmakers, Carney says whether the BoE cuts or raises interest rates are of less importance that what such an outcome would mean for the economy.

“This is not the financial crisis round two, where the Bank of England and other central banks were center-stage,” he says. “This is a real economy shock and therefore central banks have a role but we’re more of a sideshow.”