The British pound lost about 2% on Thursday, as Brexit talks provoked a number of ministerial resignations. Meanwhile, stocks of British banks were under threat, as the declared parameters of the deal would negatively affect their influence in Continental Europe.

The GBPUSD pair has returned to the bottom, trading near this year’s lows. The focus of investors has shifted to the events regarding to Brexit, and thus the current position of the British currency is majorly affected by the market sentiment.

U.K. macroeconomic statistics has been temporarily in the shadow, although this week’s data indicate possible problems in the country’s economy.

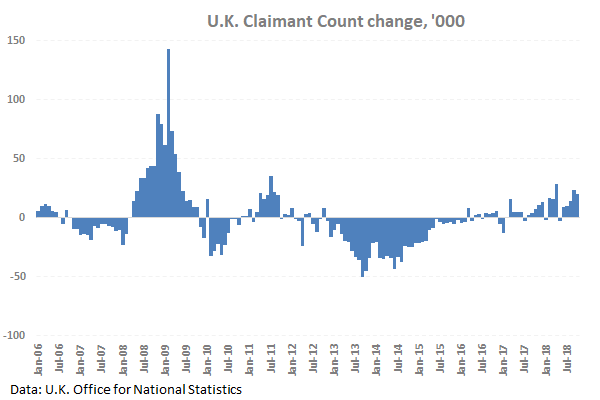

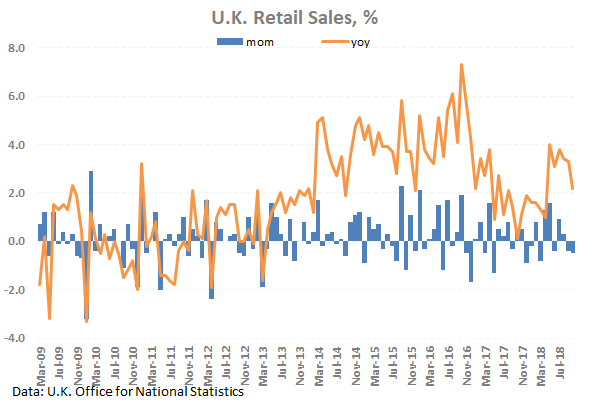

Uncertainty around Brexit is manifested in the reports. Yesterday, the Retail sales indicator has clearly illustrated the economy’s weakening. In October, sales fell for the second month in a row, losing 0.5%, subsequent to a 0.4% decline the past month. The claimant number had grown for the fifth consecutive month. The Unemployment rate increased unexpectedly, and Consumer inflation shows no signs of acceleration. All these further reflect the decline of the consumer demand.

Now markets are shifting their focus to the Macroeconomics, and that may increase the pressure on the pound on speculation that the Bank of England may abandon its plans to raise the rates in the coming months.

It is worth to pay attention to the dynamics of the GBPUSD near support area at 1.2700. A fall below this point may be a signal of a serious prospects revaluation, which can cause a fairly rapid reduction of the pair to the post-Brexit lows, just a little above 1.2000.