Here are the latest developments in global markets:

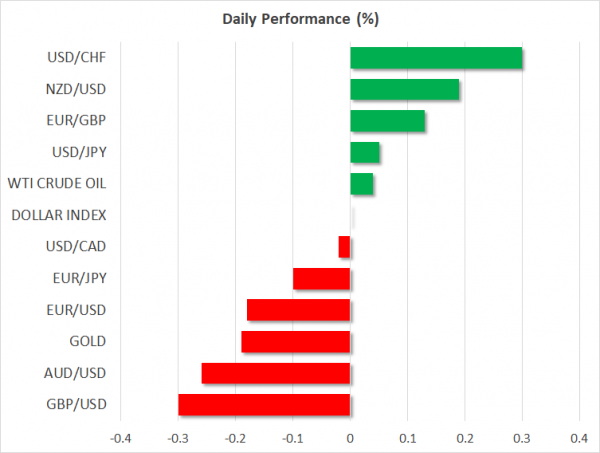

- FOREX: Questions about whether the UK Parliament would ever accept the draft divorce deal approved by the UK and the EU on Tuesday derailed investors’ mindset early in the European session, and ahead of a Cabinet meeting later today. While forecasts are for the Cabinet to accept the agreement, investors think that the Parliament will vote against it, especially if the deal involves an extension of the transition period beyond 2020. Pound/dollar slid to 1.29 before inching up to 1.2941 (-0.22%), while pound/yen fell back to 147.40 (-0.14%). The euro also felt pressure from Brexit uncertainty, while Italy’s budget was another reason for investors to avoid buying the common currency after Rome refused to revise its draft budget targets opposed by the European Commission. The EU said it will respond on the Italian budget on November 21. Fears over US import tariffs on EU cars were running high as well, with the EU trade commissioner saying the EU will hit back with countermeasures if Washington proceeds with its tariffs. Earlier, flash data revealed that the German economy contracted surprisingly by 0.2% q/q in Q3, for the first time since Q2 2014. Euro/dollar pulled back by 0.12% to 1.1276, whereas euro/pound rose by 0.08%. Dollar/yen and the dollar index were flat at 97.35 and 113.85 respectively. In antipodean currencies, aussie/dollar and kiwi/dollar were mixed, with the former weaker by 0.14% and the latter stronger by 0.25%.

- STOCKS: European stocks were on the back foot on Wednesday at 1220 GMT as numerous factors, including the ongoing Italian budget standoff, tumbling oil prices, trade and an unexpected growth slowdown in Japan and Germany raised risk aversion in the markets. The pan-European STOXX 600 retreated by 0.42% to two-week lows, with all sectors being in the red. The blue-chip Euro STOXX 50 fell by 0.48%. The German DAX 30 declined by 0.33%, the French CAC 40 lost 0.43%, while the British FTSE 100 was steady. The Italian FTSE MIB was the worst performer, losing 0.89%. In Asia, equities closed mostly in the red, with Japanese stocks adding marginal gains to their performance. In the US, futures tracking the S&P 500, Dow Jones and Nasdaq 100 were in the red, flagging further losses to follow up later today.

- COMMODITIES: After a more than 7% free-fall in oil prices on Tuesday, discussions about a supply cut by OPEC and its allies seem to have resumed, with sources unveiling on Wednesday that the aforementioned oil producers may proceed with a 1.4 million bpd reduction in 2019. Despite raising output a few months ago, OPEC and its partners are now thinking to limit production to drain oversupply and avoid further price declines arising from a slowing global economy. On Tuesday the Paris-based EIA agency, which downgraded demand forecasts for non-OECD countries – key oil consumers – said that global oil supply will surpass demand throughout 2019. WTI crude was last seen slighly up at $55.79/barrel but close to one-year lows, while the London-based Brent was printing stronger gains at $65.95 (+0.73%) near 8-month lows. In precious metals, gold slipped by 0.20% to $1,200/ounce.

Day Ahead: US CPI figures and Australian employment report on the agenda; Brexit deal in center stage

In the remainder of the day traders will focus on the Brexit deal agreement, US consumer prices and the Australian employment report.

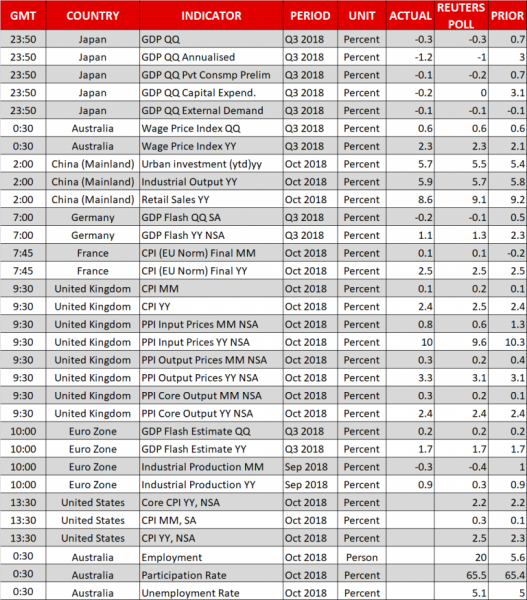

The US Bureau of Labor Statistics will publish figures on consumer prices for the month of October at 1330 GMT. The headline CPI is expected to stand at 2.5% y/y from 2.3% in the previous month. Excluding food and energy, the core index will likely remain unchanged at 2.2% y/y. Note that the Fed primarily compares its inflation target of 2.0% with the core PCE index instead and adjusts its monetary strategy accordingly, as this includes a wider range of consumer products. Yet any upside surprise in the CPI data may increase chances for steeper rate hikes by the Fed in 2019.

On the Brexit front, the UK PM Theresa May is scheduled to discuss with her Cabinet the details of the draft accord that reached on Tuesday with the EU at 1400 GMT. If the cabinet signs it off, the EU Commission is expected later to publish the details of the 500-page draft withdrawal agreement as well as the much shorter declaration on future economic and security relations. Sterling will likely see an improvement in case of a cabinet agreement on the draft text.

Meanwhile, in oil markets, investors will look forward to the API weekly report due at 2130GMT which tracks the level of the US crude, gasoline and distillates stocks as concerns over rising US output linger in the market.

Overnight, the Australian employment report is scheduled to be released at 0030 GMT. The unemployment rate is forecasted to tick up to 5.1% in October from 5.0% in the preceding month, which was the lowest jobless rate since April 2012. Moreover, the net change in employment is expected to show that the economy gained 20,300 jobs, more than September’s 5,600.

In terms of public appearances, Federal Reserve Vice Chair for Supervision Randal Quarles (permanent voter) will be giving a semiannual testimony at 1500 GMT. Later in the day and more importantly, Federal Reserve Chairman Jerome Powell will be discussing national and global economic issues with Dallas Fed President Robert Kaplan (non-voter) at 2300 GMT. Meanwhile, Bank of England deputy governor Dave Ramsden will be taking part in an online Q&A on the future of money.