The US dollar index was little moved in the Asian session ahead of the US mid-term elections. These elections have been referred to by commentators as the most important in modern times. This is because a loss by the President’s party is likely to have a significant impact on the country and the financial market. For example, Democratic leaders have pledged to reverse the tax cuts that were passed by the Trump administration.

The Japanese yen weakened slightly against the USD after government data showed falling household spending. In October, spending fell by minus 1.6%. This was the lowest level since June this year when spending declined by an annualized rate of minus 3.9%. On a MoM basis, spending declined by minus 4.5%, which was worse than the minus 1.8% that traders were expecting. While the Japanese economy is doing well, policymakers have found it difficult to stimulate consumer spending and inflation.

The Australian dollar was little moved against the USD after the RBA made its interest rates decision. The bank left interest rates unchanged at 1.5%. In the accompanying statement, RBA Governor Philip Rowe, said that the economy was doing well with the unemployment rate being at the lowest level in 6 years. In the third quarter, the economy expanded by 3.4%. The bank also revised the forecast for the economy for 2019 and 2020. It expects the economy to grow by 3.5% in 2019 and then to slow slightly the following year. Regarding interest rates, the bank said the following:

The low level of interest rates is continuing to support the Australian economy. Further progress in reducing unemployment and having inflation return to target is expected, although this progress is likely to be gradual. Taking account of the available information, the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.

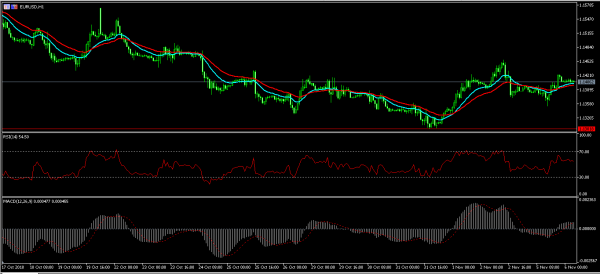

EUR/USD

The EUR/USD pair was unchanged in the Asian session ahead of the mid-terms and the Fed decision. The pair is currently trading at 1.1407, which is slightly higher than yesterday’s low of 1.1352. The 15-day and 30-day EMA are neutral, which is an indication that the pair could move in either direction. This is also proven by the RSI which is currently at 54 and the MACD as shown below. This means that the pair could breakout in either direction.

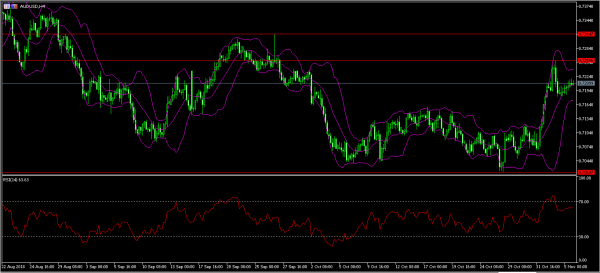

AUD/USD

This month, the AUD/USD pair has moved from 0.7065 to a month-to-date high of 0.7260. This is a 2.7% gain. Today, the pair moved up slightly after the RBA left interest rates unchanged as expected. It is now trading at 0.7210. This level is along the middle band of the Bollinger Bands as shown below. On the four-hour chart, the RSI has moved from 72 to the current 63. The next major movements will likely happen overnight today as results from the US mid-term elections start to stream in.

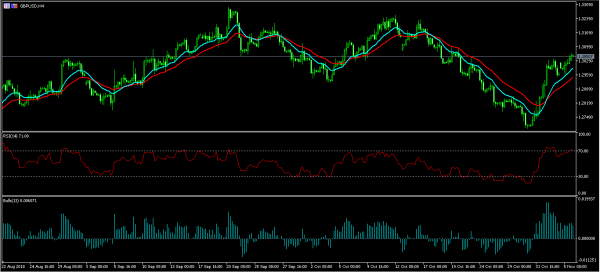

GBP/USD

The GBP/USD pair rose in the Asian session after data from the British Retail Consortium (BRC) showed an improvement in retail sales. It reached an intraday high of 1.3067, which was the highest level since October 24. The double EMA shows that the pair will likely continue the upward momentum. The RSI has risen to above 70. However, the strength of the Bulls Power has weakened signaling that the upward trend will likely not be as strong going forward.