Here are the latest developments in global markets:

FOREX: The dollar index is nearly flat on Wednesday (+0.05%), consolidating the modest losses it posted yesterday. The defensive yen outperformed amid fragile market sentiment, though it has stabilized somewhat today. In the UK, the pound jumped higher on reports the EU may offer a UK-wide customs arrangement, but pared most of its gains on speculation PM May is likely to face a mutiny soon. In Canada, the loonie ignored a sharp tumble in oil prices, ahead of the BoC’s policy meeting later today.

STOCKS: US markets closed in the red on Tuesday, as a spectacular late-session comeback was not enough to push these indices back within positive territory. The S&P 500 ended 0.55% lower, while the Dow Jones (-0.50%) and Nasdaq Composite (-0.42%) were a similar story, with disappointing corporate earnings from the likes of Caterpillar (-7.71%) amplifying the familiar concerns that have tormented markets lately. Futures tracking the S&P, Dow, and Nasdaq 100 are pointing to a notably lower open today as well. Asia was mixed on Wednesday, with Japan’s Nikkei 225 (+0.37%) and Topix (+0.08%) inching higher, but the Hang Seng in Hong Kong (-0.47%) pulling back. In Europe, all the major indices besides Spain’s IBEX 35 were set to open higher, futures suggest.

COMMODITIES: Oil prices fell off the cliff on Tuesday, amid a combination of poor risk appetite and hints of more supply from Saudi Arabia. The Saudi energy minister said his country would raise its production to “meet any demand that materializes”, perhaps dispelling some fears of shortages once sanctions on Iran fully kick in on November 4. WTI fell by more than $3 to $66.51 a barrel, while Brent slipped by roughly $3.5 dollars to $76.30 per barrel. In precious metals, gold spiked higher to touch a fresh 3-month high of $1239 yesterday, as investors sought safety. The fact that gold is now printing higher highs confirms the short-term outlook has turned to positive, and a clear close above $1239 is needed to open the way for the $1265 zone

Major movers: Risk aversion takes a breather in late US session; sterling bounces

Investors remained on the defensive yesterday, with the Japanese yen advancing across the board. US stock markets recorded sharp losses at the open, with the benchmark S&P 500 falling by roughly 2.3%, before staging a spectacular intraday comeback to recover most of its losses, and close only 0.55% lower.

As has been the case lately, there wasn’t any fresh catalyst behind these moves other than the “usual suspects”, namely Italian budget worries, the trade conflict, the diplomatic crisis involving Saudi Arabia, and elevated bond yields. On the latter, US Treasury yields briefly declined yesterday early in the session as risk aversion intensified, and that pullback may have aided the subsequent recovery in stocks, via alleviating some worries around rising interest rates. Looking ahead, risk sentiment is not out of the woods yet as futures tracking the major US equity indices are currently flashing red. That said, the yen has paused its advance for now – perhaps signifying that risk aversion is losing some steam. Separately, the earnings season goes in full swing, and the results from heavyweights like Microsoft (today) could also play a large role in driving sentiment.

Elsewhere, the pound spiked higher after reports suggested the EU is willing to offer Theresa May a UK-wide customs union arrangement, to help solve the Irish backstop issue. The EU had previously rejected this idea as giving the UK a “competitive advantage”, and if such reports are confirmed, the road to a deal would become much clearer. However, sterling gave back most of its gains on news Conservative lawmakers are set to mount a leadership challenge against May, as her handling of Brexit is considered “soft”. Hence, while the EU appears increasingly willing to strike a deal, it’s becoming increasingly questionable whether PM May will be there to accept it, as any replacement of hers would potentially have less-compromising views on Brexit.

In Europe, the EU Commission officially rejected Italy’s budget proposal, and now, Rome’s has to send a revised version within three weeks. Italian politicians appear willing to negotiate future deficits in 2020 and 2021, but not the one for 2019. Hence, further confrontation appears all but inevitable, though investors appear to be in a wait-and-see mode for now, judging by the tentative stabilization in Italian bond yields and the subdued moves in the euro.

Day Ahead: Canada unveils rate decision; May to speak before Conservatives

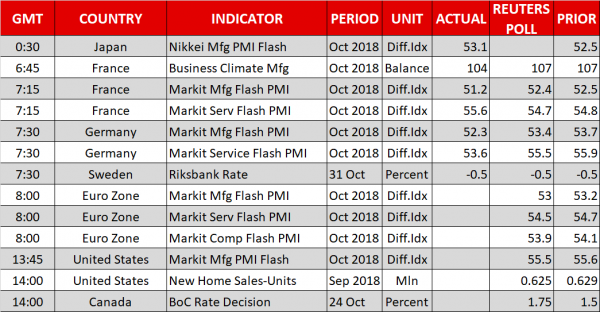

On Wednesday, the IHS Markit institute will publish its initial October PMI survey for the US, the Census bureau will inform on new home sales in the US, while all eyes will be in Canada where the central bank will be meeting to decide on monetary policy.

In the Eurozone, the preliminary Markit PMIs for October have already been released. Both the manufacturing and the services prints dissapointed, declining by more than expected, signalling that the bloc’s growth likely lost further steam to start Q4.

In the US, the flash manufacturing PMI for the month of October is also anticipated to inch down, from 55.6 to 55.5 but investors might not react much to the data as they might prefer to wait for the ISM Manufacturing PMI due next Thursday which has a longer history and a bigger impact on the dollar. A few minutes later at 1400 GMT, new home sales will gather some interest, while at 1800 GMT, the focus will shift to the Federal Reserve’s Beige book which states economic conditions in 12 Federal districts. The report is also used for interest rate decisions by the FOMC.

Meanwhile in Canada, the central bank is widely awaited to raise interest rates by 0.25 bps to 1.75% when it unveils its rate decision at 1400 GMT, delivering its fifth hike since July 2017. With the turbulent NAFTA story coming to an end, the Bank of Canada will likely be more confident to reduce stimulus as inflation holds slightly above the 2.0% midpoint target and the unemployment rate is currently at the lowest in four decades. However, recent evidence on wages indicated that average hourly earnings for permanent workers softened for the fourth month to 2.17% in September, flagging that consumers in the highly-indebted country might turn more careful on their spending as interest rates rise. Should the Bank raise rates but use a cautious tone on future economic trends and overall downplay the prospects of further near-term tightening, the loonie could lose strength. On the other hand, if policymakers appear positive, probably saying that softness in wage growth is temporary, the loonie may find the opportunity to crawl higher. BoC Governor Stephen Poloz and Deputy Governor Carolyn Wilkins will be holding a press conference at 1515 GMT.

On the Brexit front, Theresa May will be addressing the “1922 Conservative Committee” event later today which won’t be an easy task for the British Prime Minister as some of her Eurosceptic counterparts are said to challenge her future as a leader by forcing a no-confidence vote. Anxiety escalated after May surprisingly showed willingness to accept an open-ended Irish backstop and an extension of the transition period at a time when Conservatives were looking to leave the EU the sooner. If May faces another showdown with her Conservative Party, the pound could come under renewed selling. Otherwise, a leadership survival could provide some tailwinds to the currency amid hopes that support for the UK Prime Minister and her Brexit plans could be secured before a potential Brexit agreement is presented to the Parliament.

In oil markets, the Energy Information Administration will issue its weekly report on US oil inventories at 1430 GMT.

In equities, Boeing and Hilton Worldwide Holdings will be among companies to release earnings results before US markets open. Meanwhile, Microsoft will release its own figures after the closing bell.

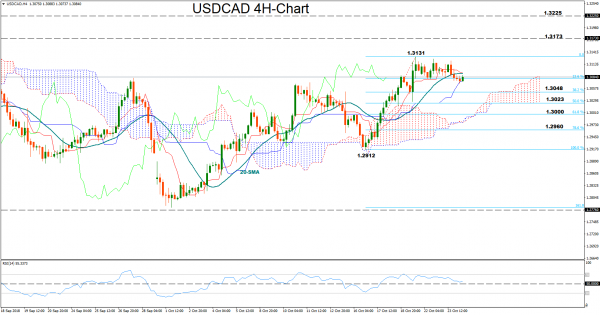

Technical Analysis – USDCAD technical signals neutral in short-term

USDCAD has been moving sideways so far this week after Friday’s rally towards a one-month high of 1.3131 and consolidation is likely to continue according to the RSI which fluctuates marginally above its 50 neutral mark. The red Tenkan-sen line also looks to be flattening above the blue Kijun-sen line suggesting that the pair might lack direction in the near term.

However a dovish rate hike from Bank of Canada could benefit the dollar and send the pair up, probably towards the 1.3131 top. Above from here, the next stop could be around 1.3173 where the market found significant resistance back in August, while if this fails to hold bulls could then challenge the area between 1.3200 and September’s peak of 1.3225.

On the flip side, if BoC policymakers increase borrowing costs remaining positive on the economy, the pair would probably move south to meet immediate support at 1.3048, where the 38.2% Fibonacci of the upleg from 1.2912 to 1.3131 is standing. Even lower the area between the 50% Fibonacci of 1.3023 and the 61.8% fibo of 1.30 may come into view ahead of 1.2960.