Bank of Canada is to release its interest rate decision today (14:00 GMT) and is expected to hike rates from +1.50% to +1.75%. Currently, CAD OIS imply a probability of 93.31%, for the bank to hike rates by 25 basis points. The recently accelerated GDP growth rate and the stable NAFTA view could be providing arguments for hawkish comments. On the other hand, the slowdown of the CPI rate in September, along with concerns about household consumption could be advising caution. Should the rate hike occur as expected and the accompanying statement have more dovish elements, we could see the Loonie weakening, while on the other hand if hawkish elements prevail the CAD may get some support. Be advised that volatility could also emerge during the following press conference.

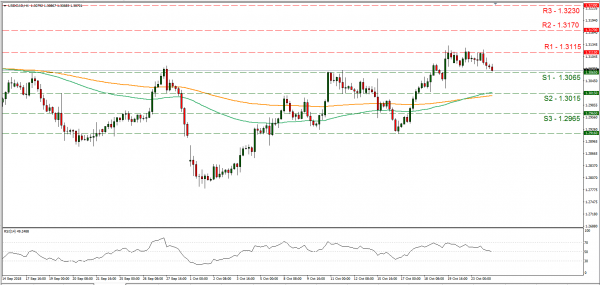

USD/CAD maintained a rather sideways movement over the past few sessions between the 1.3115 (R1) resistance line and the 1.3065 (S1) support line testing the latter, during today’s Asian session. The pair’s direction could prove to be dependent to BoC’s interest rate decision later today and should there be a rate hike accompanied by some hawkish comments we could see the pair dropping as the CAD side could strengthen. Should the bears take over, we could see the pair breaking the 1.3065 (S1) support line and aim for the 1.3015 (S2) support barrier. Should on the other hand the bulls dictate the pair’s direction we could see it, breaking the 1.3115 (R1) resistance line and aim for the 1.3170 (R2) resistance hurdle.

Pound jumps on Brexit

The pound jumped yesterday after media reported that the EU may offer a UK wide customs union. Analysts point out that such an offer on behalf of the EU, could be indicative of the two sides moving closer in resolving their differences. In the inner political front, the UK cabinet seems divided and tensions are leading from crisis to crisis. On other news, Theresa May is expected to meet with Conservative lawmakers this evening about her Brexit plans. Should May fail to be convincing in the meeting about her Brexit strategy, more members may be pushed to call for a confidence vote. Further volatility is expected for the pound as more headlines are expected.

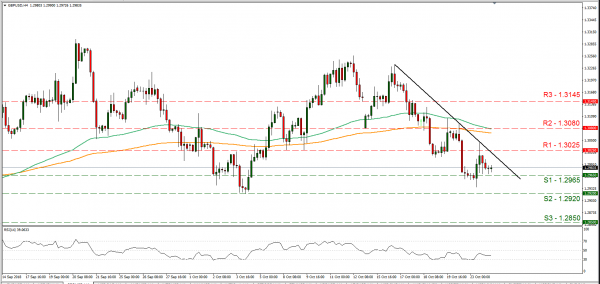

Cable spiked yesterday, breaking consecutively the 1.2965 (S1) resistance line (now turned to support) and the 1.3025 (R1) resistance level, however corrected later on lower, testing the 1.2965 (S1) support line. Technically, the pair’s price action remained below the downward trendline incepted since the 16th of October as it shifted to the right, hence we retain our bearish bias for the time being. Should the pair continue to be under selling interest we could see the pair, breaking the 1.2965 (S1) support line and aim for the 1.2920 (S2) support zone. Should on the other hand, the market favour the pair’s long positions, we could see cable breaking the prementioned downward trendline, the 1.3025 (R1) resistance line and aim for the 1.3080 (R2) resistance level.

In today’s other economic highlights:

In the European session we get Germany’s preliminary manufacturing PMI for October and from Sweden, Riksbank’s interest rate decision. In the American session, the preliminary US manufacturing PMI for October, the US new home sales figure and the EIA weekly crude oil inventories figure will be released. Please be advised that the API weekly crude oil inventories figure yesterday, came out to be a substantial injection of 9.88 million barrels, causing oil prices to drop, but for more fundamentals regarding the oil market, please refer to our weekly oil outlook, later today. As for speakers, Minneapolis Fed President Neel Kashkari and Cleveland Fed President Loretta Mester speak.

USD/CAD H4

Support: 1.3065 (S1), 1.3015 (S2), 1.2965 (S3)

Resistance: 1.3115 (R1), 1.3170 (R2), 1.3230 (R3)

GBP/USD 4H

Support: 1.2965 (S1), 1.2920 (S2), 1.2850 (S3)

Resistance: 1.3025 (R1), 1.3080 (R2), 1.3145 (R3)