The Bank of Canada (BoC) is nearly certain to raise interest rates by 25bps when it announces its decision on Wednesday, at 1400 GMT. Such a move is virtually fully priced in already and hence, price action in the loonie will hinge mainly on what signals the Bank sends regarding the likelihood of further hikes going forward. Following a marked slowdown in wages, policymakers may prefer to err on the side of caution for now, which renders the loonie vulnerable to a so-called “dovish” rate hike.

The Canadian dollar underperformed in recent weeks, giving back all the gains it recorded after a new NAFTA deal was announced in late September, to trade even lower against its US counterpart. The loonie tumbled even as investors priced in more and more tightening by the BoC over the coming years, as the new-found clarity around trade was expected to lead to faster rate increases. Indeed, it seems the currency’s latest troubles were driven by third factors, such as declining oil prices and a deterioration in market risk appetite, rather than anything related to monetary policy per se.

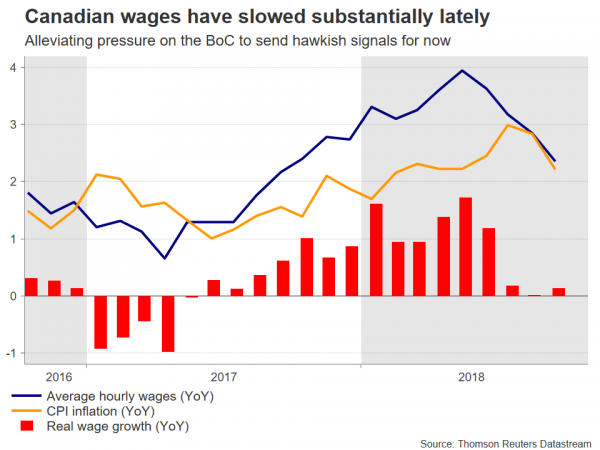

With respect to Canada’s economy, the situation is still solid, but some recent data suggest caution is warranted. On the bright side, the unemployment rate continues to hover near four-decade lows, while core inflation as measured by the BoC continues to track near its 2% target. Meanwhile, the Bank’s latest business survey – that is crucial for policy decisions – was quite upbeat, reporting rising expectations of future sales by firms and a rebound in investment intentions. In fact, considering this survey was conducted prior to the NAFTA-deal news, business optimism may be even higher now.It’s not all rosy though, with a notable slowdown in wages over recent months likely to give policymakers pause for thought. Real wage growth is back to virtually flat, which is particularly discouraging for an economy where households still carry high debt levels, but interest rates are rising. In such an environment, consumers may increasingly struggle to make ends meet, generating downside risks for consumption and hence, economic growth. Besides wages, retail sales data and forward-looking surveys like the PMIs have also disappointed lately, while headline inflation has eased back towards 2% faster than the Bank had anticipated.

Market-implied odds currently suggest a 95% probability for the BoC to raise rates by a quarter-point on Wednesday, according to Canada’s OIS. With a hike being practically fully factored in already, the market reaction will hinge on the signals policymakers send regarding the prospect of further action before long. Will the Bank place more emphasis on trade risks dissipating, stoking expectations for more hikes and thereby boosting the loonie? Or will officials err on the side of caution and signal little urgency for another move soon, triggering a negative reaction in the currency?

It’s a close call, but the latter scenario of a “dovish” hike appears slightly more likely. Markets have already priced in quite some tightening by the BoC in the coming quarters and thus, for the loonie to rally on the back of policy signals it may require very optimistic commentary from policymakers – which seems unlikely against a backdrop of slowing wages. Indeed, from a risk-management perspective, officials have little reason to signal faster hikes now, and risk having to backpedal on that commitment later should the data deteriorate.

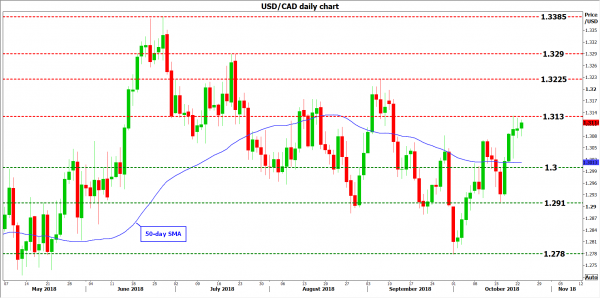

If the Bank disappoints those looking for hawkish signals, then the loonie could come under renewed selling interest. Technically, advances in dollar/loonie could encounter preliminary resistance near 1.3130, the October 19 high. An upside break could see scope for a test of the September 6 peak at 1.3225, before the July 19 top of 1.3290 come into view.

Conversely, a hawkish tone that stokes speculation for more hikes could see dollar/loonie drop, initially towards the round figure of 1.3000. If the bears pierce below it, support may come near 1.2910, this being the October 16 low, with even steeper declines aiming for the 5-month low of 1.2780.

In the (highly unlikely) event of no hike at all, the loonie could plunge.

Beyond monetary policy, the direction of oil prices will also prove crucial for the loonie given Canada’s status as a major crude exporter; higher prices are positive for the currency, and vice versa.