Cable dropped as market worries about Brexit, as well as a possible leadership challenge in the Tory party, intensified yesterday. A possible proposal on behalf of UK’s PM Theresa May, of extending a customs union within the EU, has angered hard Brexiteers, according to media. Analysts point out that the leadership challenge is hanging over the sterling which is (also) waiting for another steer on Brexit. Conservative parliament members seem to play down the risks of a possible challenge, as they stated yesterday that a leadership challenge this week is unlikely. Should there be more negative headlines about Brexit, we could see the pound weakening even further.

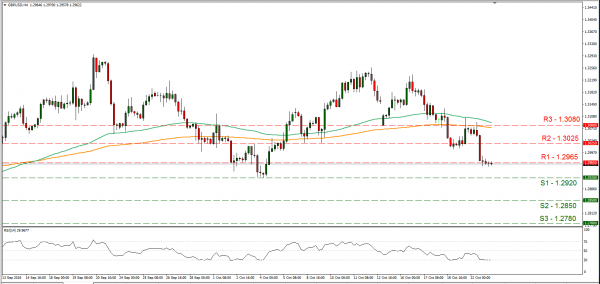

Cable dropped yesterday, from the highs of the 1.3080 (R3) resistance level, breaking the 1.3025 (R2) and the 1.2965 (R1) support lines (now turned to resistance). The pound is expected to continue to be heavily Brexit driven (inner political stage as well as Brexit negotiations with EU) today, as there is an absence of important financial releases. Should there be further negative headlines regarding the UK political scene or the ongoing Brexit negotiations we could see the pound weakening and vice versa. Technically it should be noted that the pair’s RSI indicator in the 4 hour chart, is testing the reading of 30 implying an overcrowded short position. Should the bears be in charge of the pair’s direction we could see the pair breaking the 1.2920 (S1) support line and aiming for the 1.2850 (S2) support barrier. Should on the other hand the pair’s direction be dictated by the bulls, we could see the pair breaking the 1.2965 (R1) resistance line and aim for the 1.3025 (R2) resistance hurdle.

Euro weakens on Italian budget issue

The common currency lost ground against the USD yesterday, as the market feared further political instability in the Eurozone due to the Italian budget issue. The weakening of the common currency took place despite a large drop in Italian government borrowing costs. It should be noted that rating agency Moody’s had downgraded Italy’s credit rating, however kept the outlook at stable. Analysts point out, that there are signs of more conciliatory tones from both sides, but it is clear that this dispute is not over yet. Fundamentally the dispute’s significance, especially should Brussels reject Rome’s budget, would test the strength of one member against the rest of Eurozone’s members as well as the possible countermeasures, Brussels have in their arsenal in case of a lonely rebellion. Should there be further negative headlines about the issue or an escalation, we could see the Euro weakening.

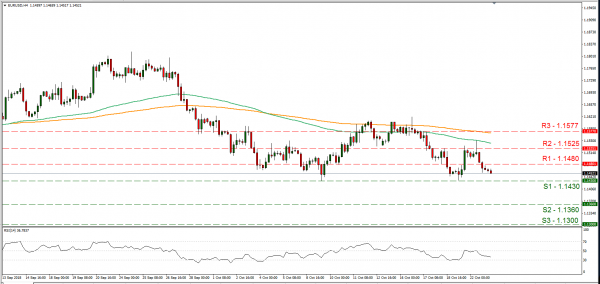

EUR/USD dropped yesterday, after rallying for a short period of time above the 1.1480 (R2) resistance line, breaking the 1.1430 (R1) support line (now turned to resistance). The pair may continue to trade in a bearish market today, should the forecasts of today’s financial releases be realised or if there are more negative headlines for the Italian budget issue or Brexit. Should the market to favour the pair’s long positions, we could see the pair breaking the 1.1480 (R1) resistance line and aim for the 1.1525 (R2) resistance level. Should the pair continue to be under the market’s selling interest, we could see it breaking the 1.1430 (S1) support line and aim for the 1.1360 (S2) support zone.

In today’s other economic highlights:

In the European session we get Germany’s Producer prices growth rate for September, while in the American session, we get Eurozone’s Consumer Confidence indicator for October and from the US the API weekly crude oil figure. As for speakers, BoE’s governor Mark Carney and Andy Haldane, as well as Minneapolis Fed President Neel Kashkari, Atlanta Fed President Raphael Bostic and Dallas Fed President Robert Kaplan speak.

EUR/USD 4H

Support: 1.1430 (S1), 1.1360 (S2), 1.1300 (S3)

Resistance: 1.1480 (R1), 1.1525 (R2), 1.1577 (R3)

GBP/USD 4H

Support: 1.2920 (S1), 1.2850 (S2), 1.2780 (S3)

Resistance: 1.2965 (R1), 1.3025 (R2), 1.3080 (R3)