Here are the latest developments in global markets:

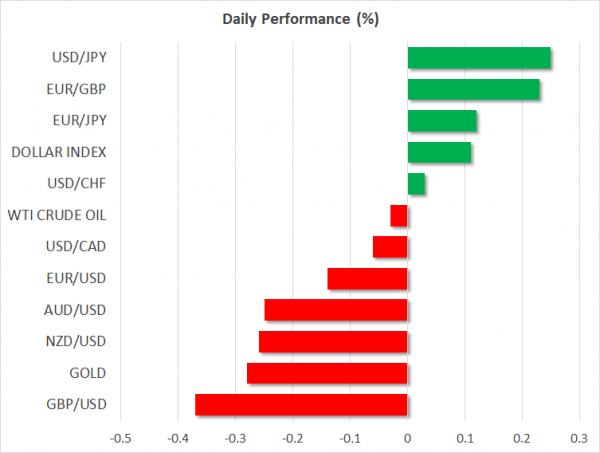

- FOREX: Sterling was declining by 0.25% against the US dollar on Monday as uncertainties around the Irish border weighed on hopes that a Brexit deal is close ahead of the UK Prime Minister’s speech in the Parliament. Pound/yen was fairly steady, while euro/pound increased by 0.23%. Euro/dollar reversed earlier gains to trade at 1.1494 (-0.16%) after Italy’s Finance Minister backed the 2019 draft budget even after EU’s warning letter last week (see below). Dollar/yen traded up by 0.24%, posting an almost 2-week high at 112.87, while the US dollar index was flat at 95.73. In the antipodean sphere, aussie/dollar and kiwi/dollar gained by 0.20% and 0.21%, rising towards 0.7100 and 0.6580 respectively. Dollar/loonie was down by 0.08% at 1.3086 following steep gains on Friday. The chinese offshore yuan jumped by 0.18% versus the US dollar as China committed to use fiscal relief to support the economy amid rising trade protectionism from the US.

- STOCKS: European equities edged higher on Monday as traders turned their attention on earnings and sentiment bounced back after Moody’s kept Italy’s sovereign outlook stable. The pan-European STOXX 600 index and the blue-chip Euro STOXX 50 advanced by 0.34% at 1100 GMT with almost all sectors in positive territory. The German DAX 30 was up by 0.53%, the French CAC 40 rose by 0.27%, while the Italian FTSE MIB gained 0.64%. The UK’s FTSE 100 increased by 0.63%. In Asia, equities closed in positive territory, with Shanghai stocks outperforming by 4.0%. In the US, futures tracking the S&P 500, Dow Jones, and Nasdaq 100 are pointing to a higher open today. In corporate news, Ryanair’s profits for the second quarter declined unexpectedly on the back of higher oil prices and strikes.

- COMMODITIES: Oil prices moved up today after Saudi Arabia’s energy minister referred that has no intention of unleashing an oil embargo on Western consumers. West Texas Intermediate crude oil and London-based Brent added 0.20% to their price challenging $69.32/barrel and $80/barrel respectively. Turning to precious metals, gold prices were on the downside below the 3-month high of $1233, losing 0.24% on the day.

Day Ahead: Theresa May speaks before Parliament; Italian budget and Trade to be in focus as well

Brexit could make headlines later in the day as the UK Prime Minister is widely expected to explain her Brexit strategy at the Parliament at 1430 GMT after the EU summit failed to break the deadlock around the sticking Irish border issue last week. Still, May is anticipated to use a positive tone in front of lawmakers, probably saying that a Brexit agreement is almost done, and a few details remain to be solved. But some of her Conservative Eurosceptic partners as well as some counterparts in the Labor party are likely to challenge her by asking for answers about her willingness to extend the two-year transition period as well as her softer stance regarding the timeline of the Irish border after reports unveiled that May’s administration could accept an open-ended timeframe. Note that pro-Brexit members in the Cabinet favor an end day for the backstop to avoid any delay in the UK’s departure from the EU.

On Wednesday, May could face a leadership challenge at the 1922 Conservative Committee meeting if she finally attends the event, as the body threatens to call for a no-confidence vote against the British Prime Minister and her Brexit plans.

As a response to the European Commissions’ letter to Italy which outlined that the submitted budget draft was not in compliance with policy obligations written in the Stability and Growth pact, the Italian Finance Minister, Giovanni Tria, messaged that the deficit target for 2019 is not likely to change and the government is ready to intervene if this is not respected. Yet Tria mentioned that the government does not intend to raise the deficit in 2020 and 2021, adding that Rome will continue to have a constructive dialogue with the EU. Confidence, however, remained fragile in the euro market, with investors eagerly waiting the European Commission to determine the next steps in assessing Italy’s budget on Tuesday, where a rejection of the spending plan is a highly likely outcome.

Trade uncertainties will also remain pinned in the background following China’s decision to cut personal income taxes to mitigate the negative consequences from the US-Sino trade war. The action could be a sign that Beijing is not afraid of US tariffs even if those have already started to weigh on the country’s economic performance and thus the dispute might continue for longer.

Turning to the economic calendar, data releases will be relatively light with the Canadian wholesale trade figures attracting the most interest in major markets.

In stock markets, Logitech International will be among companies to report results after the US markets close.

As for public appearances, RBA members including the Deputy Governor, Guy Debelle, will be talking at the Sibos 2018 Conference in Sydney overnight.