Tuesday October 16: Five things the markets are talking about

The ‘big’ dollar came under pressure yesterday and is finding it difficult to gain much traction this morning as investors taking profit on U.S assets outweighs concerns about Italy, Brexit and a Sino-U.S trade war. Furthermore, twin U.S deficits and prospects of a halt in Fed’s rate hike cycle are also weighing on the dollar.

Elsewhere, it has been mixed picture across regional stock markets overnight as investors await the next wave of corporate earnings and further developments across the aforementioned geopolitical issues.

Note: Any hint of a slowdown or stronger growth could affect the pace of Fed’s rate hikes.

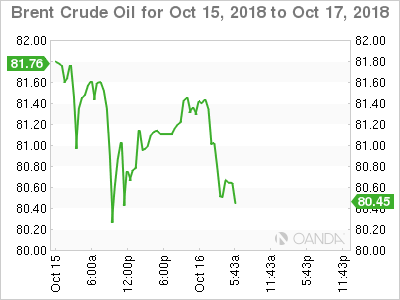

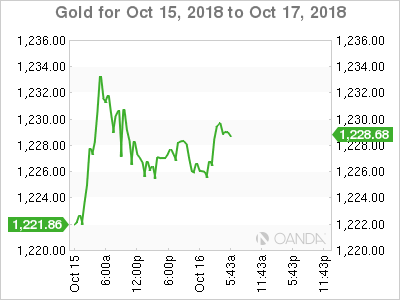

Oil prices continue to fluctuate within striking distance of recent highs amid tensions between Saudi Arabia and the U.S over the disappearance of Jamal Khashoggi, a prominent journalist with U.S citizenship, while the precious ‘yellow’ metal holds its gains.

On tap: FOMC minutes are due Wednesday (02:00 pm EDT), with investors focused on projections for further interest rate rises.

1. Stocks mixed results

In Japan, the Nikkei rebounded overnight, supported by short covering in index heavyweights (automakers and SoftBank), but retailers came under pressure on worries about domestic personal consumption and slowing demand from China. The Nikkei share average closed +1.3% higher, after tumbling -1.8% yesterday. The broader Topix rallied +0.7%.

Down-under, Aussie shares rebounded overnight, as mining and financials bounced back from Monday’s -1% drop and six-month low, but rising tensions between Saudi Arabia and the West and weaker PPI data in China capped broader market gains. The S&P/ASX 200 index rose +0.6%. In S. Korea, the Kospi stock index closed flat on Tuesday as global uncertainties capped gains during the day.

In China, stocks ended lower overnight, after data showed factory-gate inflation had cooled for a third consecutive month in September amid lean domestic demand. The blue-chip CSI300 index ended -0.8% weaker, while the Shanghai Composite Index also closed -0.8% lower. In Hong Kong, the Hang Seng was up +0.1%.

Note: Chinese inflation was boosted by food while prices were mostly subdued elsewhere. China Sept CPI y/y came in as expected at +2.5% vs. +2.5%e (a seven-month high): PPI y/y was +3.6% vs. +3.5%e.

In Europe, regional bourses trade mostly higher across the board with the Italian FTSE MIB outperforming following the submission of its draft budget to the E.C, while the U.K’s FTSE underperforms on Brexit uncertainty.

U.S stocks are set to open in the ‘black’ (+0.3%).

Indices: Stoxx600 +0.4% at 361, FTSE -0.2% at 7012, DAX +0.2% at 11638, CAC-40 +0.1% at 5099, IBEX-35 +0.9% at 9004, FTSE MIB +1.1% at 19500, SMI +0.3% at 8678, S&P 500 Futures +0.3%

2. Oil dips on expectations of higher U.S stocks, gold unchanged

Oil prices have eased a tad amid expectations of an increase in U.S crude inventories, but signs of a fall in Iranian oil exports for October are limiting losses.

Brent crude for December delivery has fallen -6c, or -0.07%, to +$80.72 per barrel, while U.S West Texas Intermediate (WTI) crude for November delivery is down -14c at +$71.64 a barrel.

U.S crude stockpiles are forecasted to have risen last week for the fourth consecutive week, by about +1.1M barrels, ahead of reports from the API (data is due at 4:30 pm today) and the U.S DoE’s EIA (will be released at 10:30 am EDT tomorrow).

In the first two weeks of October, Iran has exported +1.33M bpd of crude to countries including India, China and Turkey. That is down from +1.6M bpd during the same period in September.

Note: October exports are a sharp drop from the +2.5M bpd in April before President Trump withdrew from a multilateral nuclear deal with Iran. In May Trump ordered the re-imposition of economic sanctions on the country. The sanctions will come into force on Nov. 4.

Also supporting prices is today’s comments from OPEC’s Secretary General Barkindo who said, “global spare oil capacity was shrinking,” adding “producers and companies should increase their production capacities and invest more to meet current demand.”

Ahead of the U.S open, gold prices are holding steady near yesterday’s three-month high as a number of risk-averse investors seek refuge in the metal amid rising political tensions and economic uncertainty.

Spot gold was little changed at +$1,226.71 an ounce – it touched +$1,233.26 yesterday, its highest print since mid July, as global equities slid on rising tensions between the Saudi’s and the West. U.S gold futures are flat at +$1,230.40 an ounce.

3. German Bund yields edge higher

A cautious, risk-on mood currently prevails in eurozone sovereign bond markets so far this morning, with yields of German Bunds and of other core eurozone bonds up, and Italian bond yields down.

This would suggest that market risk sentiment may be improving following last week’s sudden correction, but the balance remains a tad precarious in the current political environment. German 10-year Bund yield has backed up +1.4 bps to +0.51%.

Note: The +0.50% level in Bund yields remains pivotal and with more debt product coming to market today (Germany offers +€4B in the September 2020-dated Schatz) should be able to back up sovereign yields a tad more.

Elsewhere, the yield on 10-year Treasuries has backed up +1 bps to +3.17%, the highest in a week. In the U.K, the 10-year Gilt yield has decreased -1 bps to +1.603%, the lowest in almost two-weeks, while in Italy, the 10-year BTP yield has declined -2 bps to +3.522%.

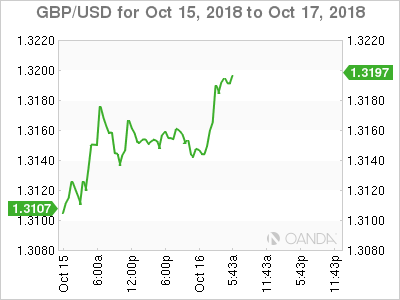

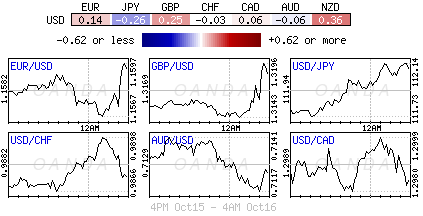

4. G7 currency pairs are little changed

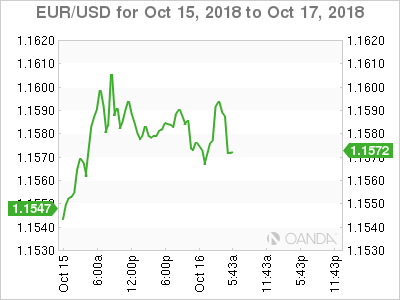

Major currencies (€, £, ¥ and C$) are relatively unchanged ahead of the U.S open.

Dealers and investors have little technical or fundamental data to work with at current levels. In fact, the market is looking for guidance, which may come in the shape of the U.S Treasury forex report, which is likely to be released this week and where the U.S could name China a currency manipulator.

If the U.S were to name China a currency manipulator it would further pressure China on trade and add to the Sino-U.S trade tensions.

EUR/USD is flat at €1.1579 and other major currency pairs are not moving by much either. GBP/USD is up slightly at £1.3163 as leaders struck a conciliatory tone a day after Brexit negotiations broke down and USD/JPY is up +0.3% at ¥112.07

Elsewhere, the performance of several petro-forex (NOK, CAD, RUB) has been held back due to various unique factors that have not translated into a growth boost for these currencies. The ruble has been driven by U.S sanctions, and the Canadian dollar has been held back by NAFTA re-negotiations.

TRY (-0.20% at $5.7865) has retreated after seven days of gains after the country released U.S pastor Andrew Brunson on Friday.

5. U.K wage growth fastest in a decade

U.K data this morning showed that wage growth quickened over the summer at the fastest pace in almost a decade, adding to signs of inflationary pressure.

The ONS said that average weekly earnings in Britain, ex-bonuses, grew +3.1% in the three-months through August.

The figures will likely reinforce market expectations that the BoE remains on course tighten monetary policy over the next 24-months to keep overall price-growth in check, assuming the U.K.’s exit from the E.U goes well.

Other data showed that U.K unemployment in the three-months through August was unchanged on the previous three-months at +4%, while the number of people in work, +32.4M, remained close to its record high.

Note: The BoE hiked interest rate in August and signalled that they expect to do so again two or more times over the next couple of years to bring inflation back to their +2% annual goal.

A weaker pound since the Brexit referendum has to push up the price of imports, squeezing U.K citizens’ purchasing power.