The US jobs report for September due on Friday at 1230 GMT is undoubtedly the week’s data highlight. Despite the prominence of the release and barring a significant deviation from expectations, the numbers are unlikely to alter the US central bank’s monetary policy outlook. Still, some near-term volatility in dollar pairs is likely to emerge as the relevant prints are made public.

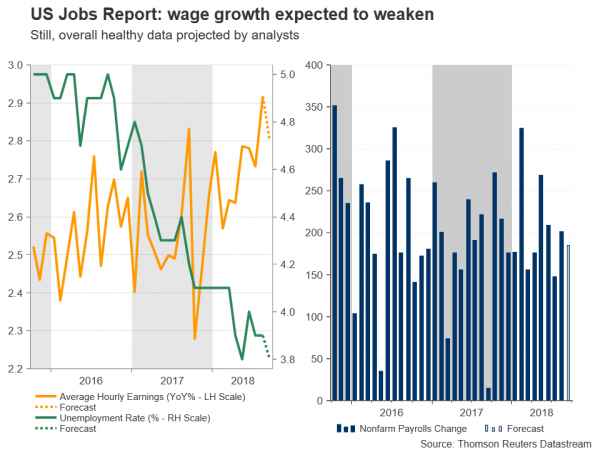

According to forecasts, the US economy added 185k positions in September, below August’s 201k but nevertheless a healthy figure. The unemployment rate is predicted to tick down to 3.8%, a number also recorded in May of the current year and which would match a low last tracked in April 2000. Turning to wage growth which continues to attract most lights, average earnings are anticipated to have grown by 0.3% m/m, below August’s 0.4%. This would put the annual rate of expansion in earnings at 2.8%, weaker than August’s 2.9% that constituted the biggest annual gain for the measure in more than nine years. Overall, despite the projected easing in job creation and salaries growth, the readings are anticipated to come in at relatively robust levels.

Excluding a shock in the figures, the Federal Reserve’s rate hike guidance, which projects another 25bps rate increase by year-end, is unlikely to be altered in a meaningful manner by Friday’s release; market participants currently assign a 78% probability for a December hike. Still, better-than-expected data, especially on the wage front which can act as an inflation driver, can push those odds closer to a done deal, consequently supporting the US currency, while worse-than-expected figures could bring down the probability of another hike this year. For the record, August’s core PCE price index – this being the Fed’s preferred inflation gauge – released last week, remained at the Bank’s 2.0% annual target.

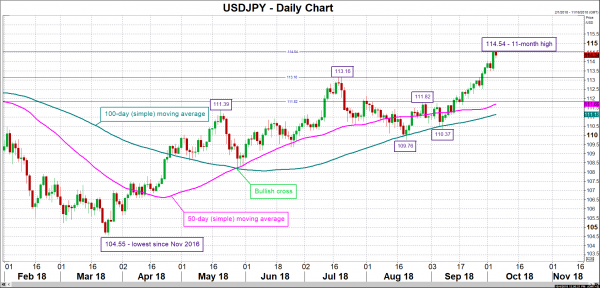

In FX markets, a data beat is expected to lead to a stronger USDJPY. Immediate resistance to gains may take place around 114.54, the freshly hit 11-month high. Given an upside violation, the focus would shift to the 115 round figure, with the 116 handle increasingly come into scope further above. On the downside and in case of weaker-than-forecasted prints, support could emerge around 113.16, this being a previous peak. Further below, another top from the recent past at 111.82 and the current level of the 50-day moving average line at 111.69 would be eyed. Upbeat releases out of the US as of late, including a better-than-expected ADP employment report on the number of positions added to the economy by the private sector, may render a beat in the numbers more likely.

For perspective, dollar/yen is trading higher by 1.5% year-to-date, after losing as much as 7.2% when it touched its lowest since November 2016 of 104.55 in late March. It should be kept mind that the Japanese currency still outperforms compared to most other major currencies which are deeper in losses versus the greenback in 2018. For example, EURUSD and GBPUSD are down by 4.2% and 3.9% correspondingly during the year.

Returning back to Friday’s release, the Sino-American trade skirmishes appear to have had a minimal impact on the US economy so far. It is of note, though, that manufacturing jobs exhibited negative growth in August for the first time in 13 months. It would be interesting to see if September’s figures start showing a negative trend for factory jobs. Also of interest would be the extent the sector is affected from additional tariff action in the months to come.

Remaining on trade, the reading on August’s trade balance out of the world’s largest economy will be made public at the same time as the employment report. The relevant deficit is expected to widen to $53.5 billion from $50.1bn in July, which was the highest since February. The politically sensitive trade gap with China that rose to an all-time high in the previously reported month will be coming to the fore. Now that Trump managed to strike a North American trade deal with Canada and Mexico, his administration may turn back its sights to China. Intensifying tensions between the two economic superpowers are not to be ruled out, especially in light of November’s midterm elections in the US; an escalation in the dispute may resonate well with the Republican base. Of course, such an outcome will also have implications for currency markets, diverting funds to perceived safe havens, such as the yen and the Swiss franc.