The Canadian dollar is lower against its US counterpart on Monday. The USD got a boost of investors taking profit on EUR positions on the aftermath of the Macron presidential win in France. The candidate was favoured by polls to win it, and he did even better than expected which again puts into question the accuracy of polls. The EUR advanced since the first round of elections that put Macron head to head with Marine Le Pen. The loonie was able to capitalize on USD weakness ahead of the weekend etching gains on Friday, but was again on the back foot on Monday as oil prices fell despite the efforts of the Organization of the Petroleum Exporting Countries (OPEC).

Canadian indicators have been mixed after a strong first quarter there are signs that the economy is slowing down. Real estate has proven to be one of the biggest contributors to the economy but the Canadian market has raised red flags for global think tanks and the Bank of Canada (BoC). The Home Trust Capital debacle has put housing prices under the microscope and investors are growing anxious with BoC Governor Poloz fielding a question about the trouble mortgage company while delivering a speech in Mexico city focused on trade.

The US delivered a surprise blow for Canada-US relations with a tariff on soft lumber wood companies and criticism of the Canadian dairy industry. Canadian Prime Minister Justin Trudeau has defended both industries looking ahead to what is turning into a less than congenial atmosphere ahead of a renegotiation of NAFTA.

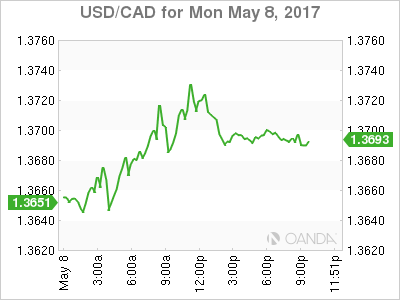

The USD/CAD gained 0.359 percent in the last 24 hours. The currency pair is trading at 1.3698 near 14 month lows. The Canadian currency has been sensitive to the usual factors like the pace of growth and oil prices (a large export) but the rise of combative rhetoric from the Trump administration (3/4 of exports are headed south) and an sensitivity to housing anxiety has put downward pressure on the loonie.

The economic calendar will offer little support to the CAD. The biggest event his week will be the US retail sales and inflation data to be released on Friday. A mild improvement is expected which could validate the market pricing in a rate hike in June from the U.S. Federal Reserve. Fed member added to the optimism with her comments about waiting too long before raising interest rates.

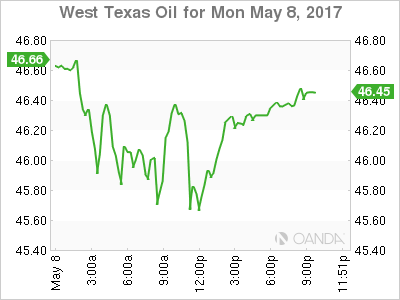

The price of energy lost 0.115 percent on Monday. West Texas is trading at $46.23 in a rollercoaster day for energy traders. The Organization of the Petroleum Exporting Countries (OPEC) said on Monday that they would do whatever it took to rebalance the market. The organization is expected to reach an agreement with non-members to extend the current production cut deal by 9 months. Two factors are keeping prices low. US shale producers have ramped up production to benefit from stable prices and the second and most important reason is that demand for energy continues to stagnate. One of the best indicators of consumer demand is the gasoline inventories. They have shown unexpected large buildups ahead of a traditional high usage driving season.

Market events to watch this week:

Tuesday, May 9

5:30am AUD Annual Budget Release

Wednesday, May 10

10:30am USD Crude Oil Inventories

5:00pm NZD Official Cash Rate

5:00pm NZD RBNZ Rate Statement

6:00pm NZD RBNZ Press Conference

9:10pm NZD RBNZ Gov Wheeler Speaks

Thursday, May 11

4:30am GBP Manufacturing Production m/m

7:00am GBP BOE Inflation Report

7:00am GBP MPC Official Bank Rate Votes

7:00am GBP Monetary Policy Summary

7:00am GBP Official Bank Rate

8:30am USD PPI m/m

8:30am USD Unemployment Claims

Friday, May 12

All day G7 Meetings

8:30am USD CPI m/m

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m

10:00am USD Prelim UoM Consumer Sentiment

Saturday, May 13

All day G7 Meetings