Normalcy Returns to Currency Markets

A sense of normalcy has returned to the Forex desks this morning as the final round of the French elections had the expected results. While this morning’s currency movements have been rather subdued, most of the early fanfare was about pre-positioning on risk trades if anything else, as EURJPY traded 124.55 USDJPY 113.10. And while US equity futures opened a touch higher, the overhang from last week’s oil price action is still too fresh in investors’ minds to press higher into uncharted territory this morning.

European equity markets had a bounce in their step heading into the weekend and we expect this positivity to hold near term. I suspect the bigger question for the Forex market will be the interest rate markets reaction to the Macron victory and how the ECB views the current landscape. After round one of the French elections, ECB previously acknowledged that political risks are petering out and data releases remain stable, but Draghi is still unwilling to tack too far off their charted course. Until there’s a definitive change in the ECB stance, the EURUSD upside momentum could struggle. Markets need some hint of policy convergence from the ECB to kick the long EUR trade into high gear.

Friday’s US non-farm payroll data did little to excite the Dollar bulls. While the headline print came in above consensus, a despondent wage growth component has weighed on dollar sentiment. However, headline data is very consistent with the Federal Reserve Board’s message, as the strong labour market paves the way for a June interest rate hike.

In China, we have key trade data coming out today. This print will be closely monitored as concerns ratchet higher over China’s tightening of financial conditions. Over the weekend, it was reported that Chinese FX reserves rose for a third straight month, which is more than markets had expected. FX reserves rose USD21bn to 3.03tn in April vs. consensus expectations of 3.02tn. The Yuan has been incredibly stable this year’s the US dollar ascent has tempered and capital outflows are receding.

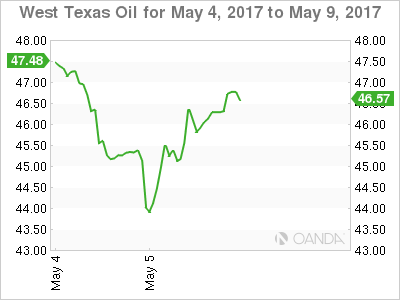

WTI

I guess the big question for commodity traders is what next for oil prices? I think one takeaway from Friday’s oil price tumble was the lack of panic in the equity market. That, despite the significant drop in equity sector stocks, in general, major indices remained relatively composed and the currency market, as a whole, behaved in a contained manner.

The near-term outlook is clouded as a mix of bargain hunters play au contraire. The catalyst that triggered the wave of negativity on Friday, the global supply gut, is real and showing little signs of shrinking. Clearly, OPEC is unable to turn the oil markets upside down as they’re done in the past. While we may have seen the worst of the near move, the supply concerns are still with us and WTI will struggle to regain the $50.00 mark near term, despite a possible extension of OPEC production cuts at month’s end.

Australian Dollar

The Aussie is still feeling the overhang from the latest commodity unwind, which is weighing on any upward momentum. Until base metals show signs of convincingly reversing higher, I expect the Aussie bulls to remain very defensive. In this equation, China will be the force majeure, as the market is still deeply concerned with mainland’s weaker economic data in the face of rising domestic interest rates.

On the plus side for risk, there has been little contagion from last week’s oil price plummet, as the global equity market remained buoyant.

In early trade, the Aussie has breached the .7400 handle on very disappointing Australian Building approvals for March coming in at -13.4 % vs -4% expected

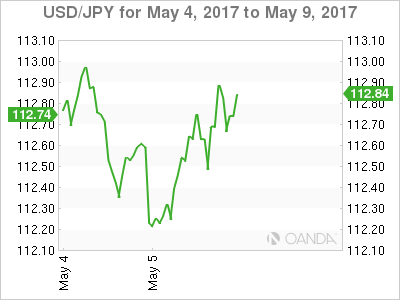

Japanese Yen

With much of the French election storyline priced in this morning, USDJPY bounces above 113.0 on risk appear to be unwinding, as the markets pivot back to last Friday’s weaker than expected average hourly wages component of NFP. However, much of this morning reversal has much to do with the unwinding this morning of the EURJPY trade, which topped near 124.50 in early trade.

Euro

There are no real surprises this morning as the markets had priced in this outcome. Now dealers will pivot back to the ECB expectations while taking profit on the long EURUSD, as there was little follow through on EURUSD topside this morning.