All eyes will be on the Federal Reserve policy meeting in the United States next week as markets await the central bank’s response to a firming inflation outlook and rising global trade tensions. The Reserve Bank of New Zealand will too be holding a policy meeting. But it will be a more muted week for economic data, with the main headlines likely to come from inflation and GDP releases, as many Asian markets will be closed at the start of the week for national holidays. There will be no let-up on trade, however, as President Trump turns his attention to Japan in his quest for fairer trade policies.

RBNZ may become less dovish after strong GDP growth

New Zealand’s economy grew by a better-than-expected 1.0% quarter-on-quarter in the three months to June, defying gloomy business confidence indicators. The positive numbers have eased concerns about a slowing economy and the RBNZ could remove some of its cautious language when it announces its latest policy decision on Thursday. The central bank is expected to hold its official cash rate unchanged at 1.75% for yet another meeting. But the New Zealand dollar could extend its gains beyond this week’s 3-week high if the RBNZ strikes a more upbeat tone.

Prior to the RBNZ meeting though, August trade numbers and the ANZ business confidence gauge for September will be looked at on Wednesday.

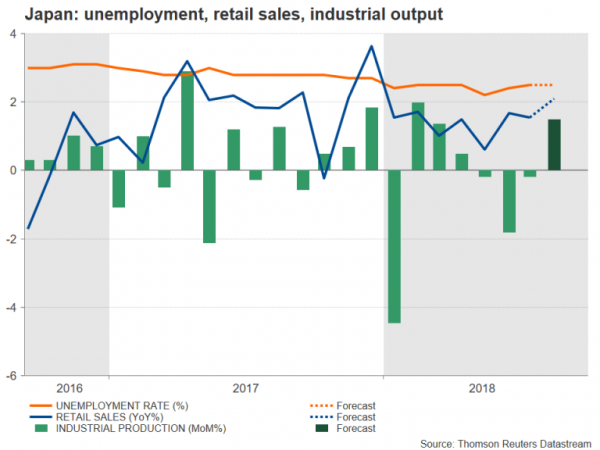

Japanese labour market to remain tight in August

The Bank of Japan pledged at its September policy meeting (the summary of which will be published on Friday) to maintain its massive monetary easing until inflation has reached 2%. The BoJ’s biggest hope in achieving its target is faster wage growth, which lately there appears to be some signs of this materializing. August data on the unemployment rate and the jobs/applicants ratio will therefore be watched closely on Friday for evidence that Japan’s labour market continues to tighten. Also relevant will be the preliminary reading of industrial output and annual retail sales numbers, both for August, due the same day.

A strong set of figures would only add to speculation that the BoJ is gradually moving towards exiting from its ultra-loose monetary policy program, though the yen is more likely to see action from US-Japan trade talks scheduled for September 26. Japanese Prime Minister Shinzo Abe and US President Donald Trump will be meeting beforehand for dinner on September 23 so the headlines could begin arriving prior to the summit.

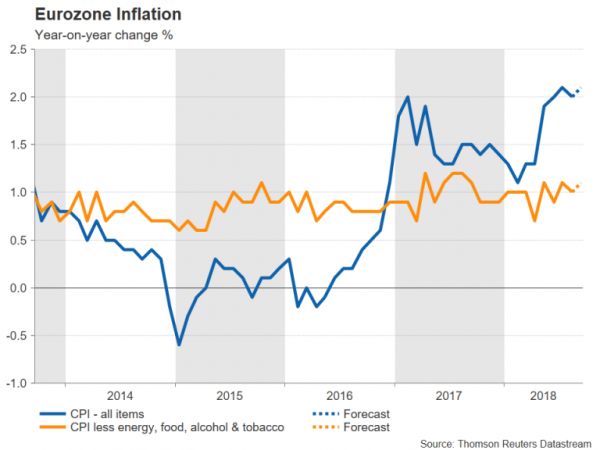

Flash inflation to show Eurozone inflation holding at 2%

The flash estimate of Eurozone inflation will be the main highlight in Europe next week, along with Germany’s Ifo survey, which will start the week on Monday. The Ifo business climate index unexpectedly rose to a 6-month high of 103.8 in August, raising hopes that German businesses are becoming less gloomy about the potential impact from the heightened trade tensions. It is projected to ease slightly in September to 103.2. There will be more business confidence data on Thursday with the release of the European Commission’s economic sentiment index. Finally, the flash CPI numbers are due on Friday. The headline rate of inflation is expected to inch up to 2.1% year-on-year in September. The core rate, which excludes volatile items, is also forecast to creep up by 0.1 percentage points to 1.1% y/y in September.

The euro surged higher during the past week despite lacklustre Eurozone PMIs as a dollar pullback helped the single currency rebound. However, there could be trouble ahead as Italy’s new coalition government will reveal its 2019 budget by September 27. The euro could reverse lower if the proposed budget deficit is sharply above levels recommended by Brussels.

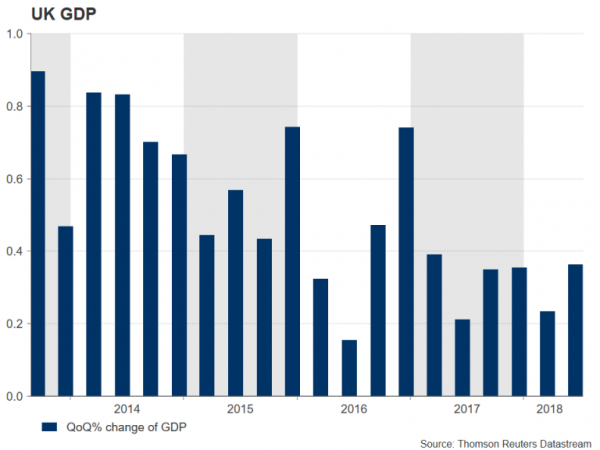

Calmer days ahead for sterling?

While there’s unlikely to be much respite from Brexit-related news for sterling in the run up to the October EU summit, the UK economic calendar will be very light. The only major release out of the United Kingdom will come from the second estimate of GDP growth for the second quarter. Economic growth quickened to 0.4% q/q in the second quarter, according to the initial estimate. No revision is expected in the second estimate. But in the event of a surprise upward revision, the pound could receive some support following the fresh downside pressure after EU leaders rejected Prime Minister Theresa May’s Chequers plan in Austria this week.

Loonie set for volatile week as NAFTA deadline nears

The Canadian dollar rose to a 3½-month high of C$1.2880 to the US dollar this week amid a retreat in the US currency and cautious optimism that a deal on NAFTA is within reach. However, the loonie could retrace its sharp gains over the past couple of weeks if the US and Canada fail to strike an agreement before the October 1 political deadline. Alternatively, the Canadian dollar could enjoy a strong rally if the two sides manage to conclude the overhaul of the 24-year accord.

Economic data due next week could exasperate the loonie’s moves depending on which way the talks go. Monthly GDP figures for July and August producer prices are out on Friday.

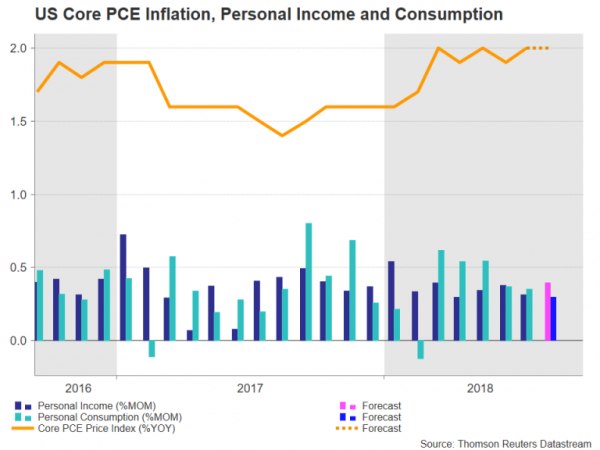

Fed to raise rates but focus on 2019 forecasts

While the Fed’s latest policy decision will be at the forefront of investors’ minds, there will also be plenty of economic indicators from the US to ensure the dollar remains in the spotlight for much of the week. The Conference Board’s consumer confidence index will be the first major data on Tuesday. The closely-monitored sentiment gauge is forecast to slip to 132.0 in September but to hold close to August’s 18-year high of 133.4. On Wednesday, new home sales for August will be watched for clues on the state of the US housing market given some recent weakness in the sector. Thursday’s August pending home sales will be the other main data point on the housing market.

Other releases on Thursday will include durable goods orders and the final estimate of GDP growth for the second quarter, as well as the advance report on the August goods trade balance. Durable goods orders are anticipated to have rebounded by 1.8% month-on-month in August after declining by 1.7% in the prior month, while no revision is expected to the final GDP estimate for the June quarter, which was revised up to 4.2% annualized growth in the second print. Wrapping up the week on Friday, will be the personal consumption expenditures (PCE) report. It’s expected to be another solid month for US personal income and spending, with consensus estimates of 0.4% m/m and 0.3% m/m growth respectively for August. Moreover, annual inflation, as measured by the core PCE price index and targeted by the Fed, is projected to hold steady at the Fed’s 2% objective in August.

As for the Fed, the Federal Open Market Committee (FOMC) will give its latest views on the US economy on Wednesday when it concludes its two-day monetary policy meeting. A rate hike of 25 basis points to a target range of 2.00-2.25% is almost fully priced in by Fed fund futures. But the real focus will be the FOMC’s updated economic forecasts, in particular, committee members’ projections on how many times they expect to lift interest rates in 2019. In June, the FOMC’s dot plot chart pointed to three more rate rises in 2019. Any change to that forecast would likely trigger significant moves for the dollar. A downward revision is possible if FOMC members cite increased trade risks, whereas an upward revision could come if policymakers become more concerned about higher wage growth.