Here are the latest developments in global markets:

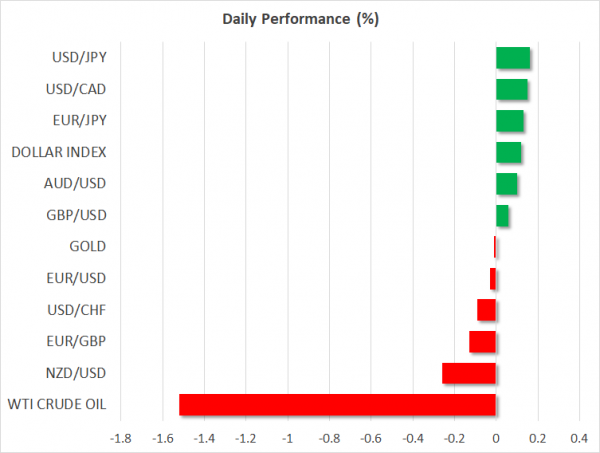

FOREX: The euro and the pound were in a quiet trade a few hours before the European Central Bank and the Bank of England make announcements on interest rates, with euro/dollar edging slightly down to 1.1610 (-0.13%) and pound/dollar consolidating around 1.3045. The Turkish central bank is also scheduled to decide on interest rates later today (1100 GMT) and unlike its European counterparts who are projected to stand pat, it is expected to pick up borrowing costs to save the battered lira which was losing 1.50% versus the greenback ahead of the event. President Erdogan said today that interest rates should be lowered instead. Dollar/yen was erasing yesterday’s losses at 111.43 (+0.16%) after news that the US and China are seeking to resolve trade conflicts with new dialogues. China confirmed and welcomed the invitation for trade talks from Washington despite US warnings to impose tariffs on all Chinese goods. The dollar index was also in recovery, rising to 94.92 after reaching an almost two-week low of 94.73 on Wednesday. Dollar/loonie was marginally up at 1.3009 (+0.12%) after a steep decline yesterday following comments from the Mexican Minister of Economy who expressed that NAFTA’s trilateral nature is a “great asset”, though, the Mexican economy must be prepared for a potential bilateral agreement. In antipodean currencies, aussie/dollar improved to 0.7174 (+0.11%), benefitting from a trade relief and better-than-expected employment figures for the month of August. On the other hand, kiwi/dollar was on the back foot declining by 0.30% to 0.6542. The Chinese yuan retreated by 0.18% in offshore trade.

STOCKS: European equities extended higher for the second day on Thursday except the British FTSE 100 which was down by 0.16% at 0830 GMT. The pan-European STOXX 600 and the blue-chip Euro STOXX 50 rose by 0.28% and 0.30% respectively, with all sectors being in the green apart energy. The German DAX 30 climbed by 0.48%, the French CAC 40 increased by 0.29%, while the Italian FTSE MIB inched up by 0.16%. In Asia, the majority of stocks closed strongly positive, while futures tracking US indices such the S&P 500, Dow Jones and Nasdaq 100 were slightly up, pointing to a softer positive open.

COMMODITIES: WTI crude and the London-based Brent were under pressure early in the European session, trading lower at $69.38/barrel (-1.41%) and $79.05/barrel (-0.87%) correspondingly. On Wednesday, the former reached one-week highs at $71.26, while the latter rallied towards $80.13, the highest since May 25 after the EIA weekly oil report indicated surprisingly a sharper downfall in US oil inventories. Agency’s worries, however, that US-Sino trade conflicts and depreciating currencies in emerging markets could have a negative impact on demand, pushed prices lower today. In precious metals, gold slowly returned back above $1200/ounce, last seen at $1206.9 (+0.05%).

Day Ahead: Spotlight events of the day are ECB, BOE and Turkish central bank interest rate decisions; US CPI pending

Traders are expected to have a relatively busy day at the office on Thursday as central bank events would be in the spotlight with the Bank of England (BOE), the European Central Bank (ECB) and the Central Bank of the Republic of Turkey (CBRT) making announcements on interest rates.

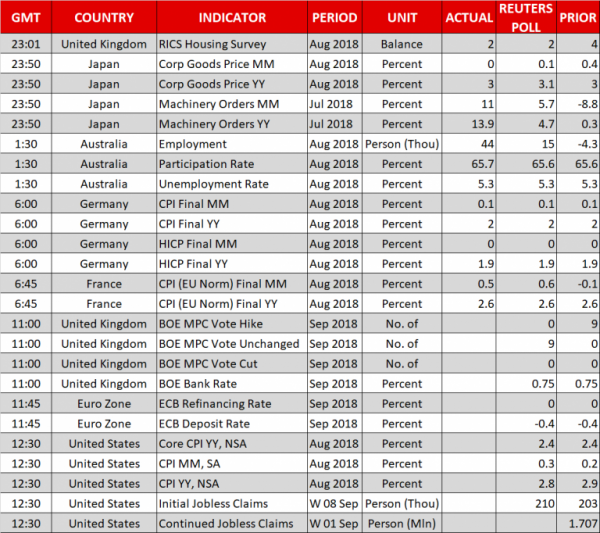

At 1100 GMT, the BOE, concluding its two-day policy meeting, is expected to leave rates on hold while remaining upbeat about recent economic developments, but cautious over Brexit. Following previous month’s rate hike of 25 basis points, no change is expected at September meeting.

A bit later at 1145 GMT, the ECB is widely anticipated to hold benchmark interest rates unchanged as well as the central bank has already guided markets that borrowing costs will remain steady at least through the summer of 2019 as it was agreed in June. Adjustments in the asset purchase program will be also monitored as policymakers plan to reduce monthly asset net purchases from 30 billion euros to 15 billion euros at the end of September before terminating the program in December. Any comments expressing bigger fears regarding US trade protectionism, emerging markets and political conditions in Italy could bring volatility to the euro. Note that policymakers will release fresh economic projections today, while a press conference by the ECB chief Mario Draghi is scheduled at 1230 GMT.

Continuing with central bank meetings, Turkey’s central bank is highly projected to raise its one-week repo rate to 22.00% from 17.75% on Thursday at 1100 GMT. Also, investors are waiting for further guidance from policymakers after the bank said that it “will take the necessary actions to support price stability”.

Out of the US, CPI inflation figures for August will be closely watched at 1230 GMT after PPI data for the same month came in worse than expected yesterday. Headline inflation is predicted to tick lower to 2.8% y/y versus 2.9% in the preceding month. However, the core rate, which excludes volatile food and energy items, is expected to hold the same as before at 2.4%. In addition, initial jobless claims will be available at 1230 GMT, with analysts projecting the number of people claiming unemployment benefits for the first time to increase by 7,000 to 210,000 in the week ending September 8.

Trade developments will continue to affect market sentiment, with investors waiting eagerly to see whether China and the US will re-start negotiations. White House Economic Advisor Lary Kudlow confirmed on Wednesday that the US Treasury Secretary Steven Mnuchin has proposed renewed trade talks with China.

In terms of public appearances, Federal Reserve Bank of Atlanta President Raphael Bostic will be talking on the economic outlook and monetary policy at 1715 GMT.