The Bank of England will announce its latest policy decision at 11:00 GMT on Thursday after concluding its two-day meeting. After last month’s rate rise of 25 basis points, no change in policy is anticipated at the September meeting. However, analysts will be looking to see if the Bank maintains its guidance of further “gradual and limited” rate increases as UK growth picks up a gear. But with Brexit negotiations approaching a critical stage, the next hike could be months away.

In August, the Bank lifted its benchmark interest rate to a post-crisis high of 0.75%, defying criticism by many analysts who argued that with Brexit uncertainty prevailing over the economy, it was not the right environment to be raising rates. However, the Bank has been stressing that even with moderate growth of around 0.4% on a quarterly basis, inflation would struggle to fall towards the BoE’s 2% target without rate increases.

GDP figures out this week support the Bank’s view that the British economy has sufficient momentum to withstand moderate tightening in monetary policy. UK GDP expanded by 0.3% month-on-month in July, topping expectations of 0.2% and taking the 3-month rate to 0.6% – the fastest since the thee months to August 2017. The latest job market report was also out this week. It showed annual UK wage growth quickened slightly to 2.6% in the three months to July, underscoring the Bank’s concerns about faster pay increases.

But the encouraging data failed to lift the pound as the British currency seems to react mostly to Brexit headlines these days. Likewise, the Bank of England’s decision on Thursday is unlikely to significantly move the pound, especially as there will be no press conference and quarterly forecasts this month.

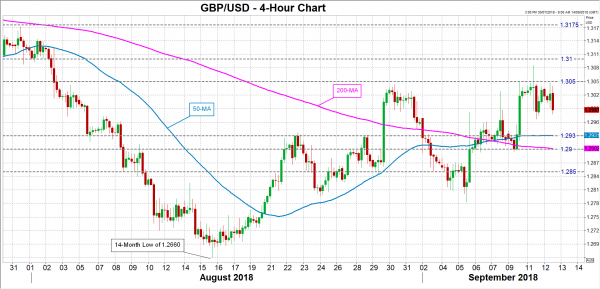

Sterling could break above immediate resistance at the $1.3050 level should the BoE adopt a slightly more optimistic language on the economic outlook following the past week’s solid set of data. Above that level, focus would shift to the $1.31 handle, which has been a heavily congested region in the past and is not too far Tuesday’s 5½-week peak of $1.3086. Stronger gains could see the $1.3175 area acting as a major barrier.

However, should the Bank offer no surprises and maintain its existing language, and perhaps add a bit more emphasis on the progress of Brexit talks, the pound could slip to around $1.2930 (a previous support and resistance level). A drop below this mark would risk breaching the key support at $1.29. Below that, the next support would likely come from the $1.2850 level.

With Brexit talks intensifying this month, as Britain and the European Union strive to avoid a no-deal scenario, the market’s attention is firmly on the negotiations and investors are likely to remain cautious until there is a clear outcome. The EU’s chief negotiator, Michel Barnier, said on Monday that it would be “realistic” to reach a deal with the UK in six to eight weeks, raising hopes that an agreement could be struck at the EU’s October 18 summit. The first big test, though, will be the informal summit of EU leaders in Salzburg, Austria, on September 20.

Successful negotiations could pave the way for the next BoE rate hike to arrive in May 2019, soon after the UK has left the EU. However, in the event of Britain exiting the EU without a deal, the next move could be a reduction.