The latter part of this week will bring key US data releases, with CPI inflation figures hitting the markets on Thursday and retail sales prints due out on Friday, both at 1230 GMT. Forecasts point to a mild cooling in inflationary pressures and a slight slowdown in retail sales, which combined, may weigh on the dollar a little. Beyond economic data, the US currency will also be sensitive to any developments in the global trade arena.

The US economy has been firing on all cylinders in recent months, something that has turned investors increasingly more optimistic the Fed will raise rates another two times this year, thereby acting as a source of support for the dollar. According to market-implied pricing derived from the Fed funds futures, a quarter-point rate increase at the upcoming Fed meeting in September is now practically fully priced in (96.5% probability), while investors also assign 75% odds for a second one by year-end. The quality of incoming US data will hence play a large role in determining whether the latter percentage approaches 100% in the coming weeks, or whether it drifts back towards 50%; the dollar is likely to move accordingly.

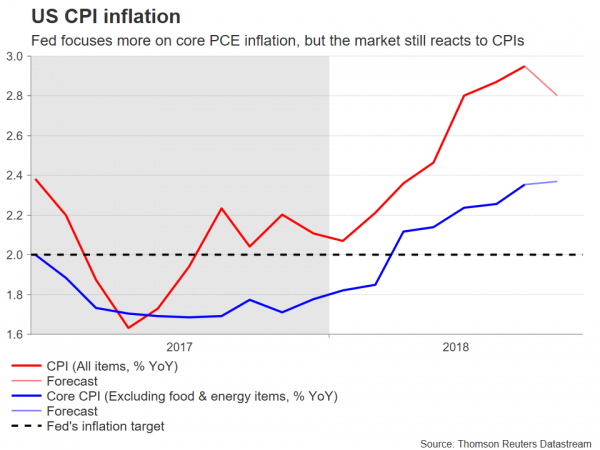

Turning to this week’s data releases, CPI figures for August – due out on Thursday – are projected to show a downtick in the headline inflation rate to 2.8% in yearly terms, from 2.9% in July. The core rate, which excludes the effects of volatile food and energy items, is anticipated to have held steady at 2.4%. Indeed, gauges of prices charged by firms such as the Markit manufacturing and services PMIs revealed that inflationary pressures eased in August, though both surveys stressed that the rate of inflation still remained well-above the trend average.

As for retail sales, they are forecast to have risen again in August, albeit at a slightly slower pace. Specifically, the headline rate is expected to rise by 0.4% in monthly terms, from 0.5% previously, while the core figure that excludes automobiles is projected to clock in at 0.5% after rising by 0.6% in July. While consumer sentiment measures like the Conference Board index were particularly optimistic, touching an 18-year high in August, one has to stress that official retail sales numbers tend to be highly volatile from month to month.

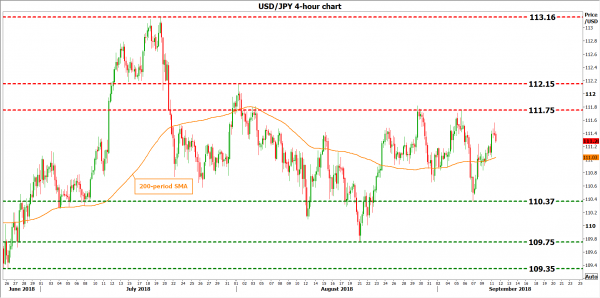

Technically, potential declines in dollar/yen could encounter support around 110.37, the hurdle that halted the pullback on September 7. A downside break may open the way for the August 21 lows of 109.75, with even steeper bearish extensions bringing into scope the 109.35 zone, this being the June 26 trough.

On the upside, a first wave of resistance to advances may be found near 111.75, a territory that capped the pair’s gains both on August 29 and September 5. The next barrier lies 40 pips higher, at 112.15, a level marked by the highs of August 1. Higher still, the 9-month high of 113.16 would increasingly attract attention.

Besides economic data, the other key variable for the dollar will be how trade tensions play out – particularly between the US and China. The greenback tends to gain when frictions escalate, attracting safe-haven flows on the view that the US economy is better prepared than most of its peers to weather any trade standoff. In similar logic, the greenback has underperformed whenever tensions appear to be fading, for instance after the recent US-Mexico deal. Investors are currently on edge, anticipating a fresh round of tariffs between the US and China to be announced at any moment. Meanwhile, the US President has also hinted that Japan may be the next target on his trade-radar, potentially opening another front in his global trade skirmish before long. Besides the dollar, any intensification in trade concerns could also benefit the Japanese yen – the classic haven currency – and probably to a greater extent than the greenback