Here are the latest developments in global markets:

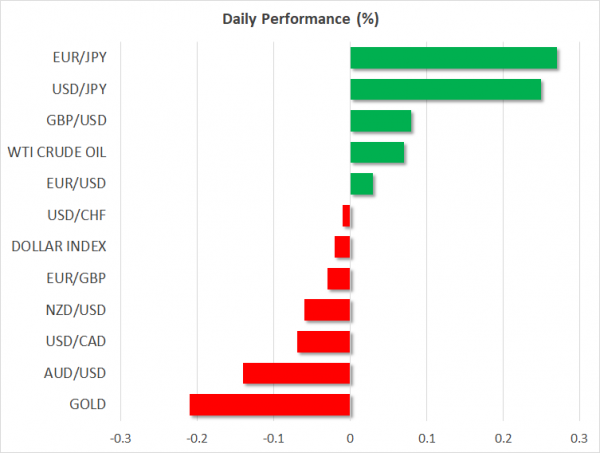

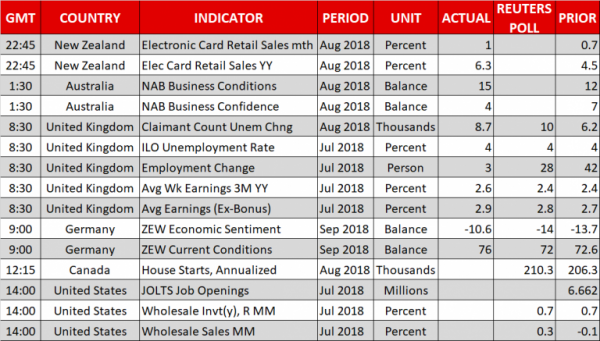

- FOREX: An upbeat employment report in the UK helped pound/dollar to briefly rally toward a fresh five-week high of 1.3086 during the early European session as the data showed that average weekly earnings picked up speed to 2.6% y/y in July, surpassing the forecast of 2.4%. Excluding bonuses, British wages recorded a stronger growth as well, expanding at 2.9% compared to the 2.8% estimate and the previous mark of 2.7%. Regarding the number of people claiming unemployment benefits, this increased by 8.7k, by less than analysts thought, while the unemployment rate remained unchanged at 4.0% as expected. The pair, however, lost ground soon thereafter, spiking down to 1.2987 before it rebounded to 1.3035 (+0.08%) with Brexit hopes for a deal before November providing support to the market. In the eurozone, the German ZEW Economic Sentiment Index for the month of September came in better than expected as well, though euro/dollar shrugged off the numbers and continued to erase earlier gains which led the pair to an intra-day high of 1.1643. Euro/dollar was last seen at 1.1595 (-0.03%). Meanwhile in Italy, the Minister of Economy provided further relief to investors by saying that the government will go ahead with reforms while reducing the debt ratio. Still, the euro was unable to gain on the comments, as markets remained focused on the US-Sino trade dispute which shows no sign of calm. Based on WTO sources, China prepares to ask the institution for authorization to impose sanctions against the US, probably in case Washington unleashes tariffs on $200 billion Chinese imports as it has warned. Dollar/yen pulled back to 111.38 (+0.25%) after unlocking 1-week highs at 111.75. Dollar/loonie eased slightly to 1.3151 (-0.08%), while the dollar index weakened marginally to 95.10 (-0.05%). In the antipodean currencies, aussie/dollar and kiwi/dollar changed hands lower at 0.7104 (-0.18%) and 0.6522 (-0.08%) respectively, both holding near 2 ½-year lows.

- STOCKS: European stocks were in negative territory at 1000 GMT after a mixed session in Asia, as trade tensions kept investors nervous. The pan-European STOXX 600 and the blue-chip Euro STOXX 50 declined by 0.44% and 0.50% respectively. The Italian FTSE MIB dropped below one-month highs, losing 0.50% on the day, while the German DAX and the UK’s FTSE 100 both fell by 0.70%. Futures tracking US indices were in the red, pointing to a negative open.

- COMMODITIES: Crude oil prices were heading up early in the European session, supported by speculation that renewed US sanctions against Iran in November could limit oil supply and thus add upside pressure to the market. Washington has advised other countries to cut imports from Iran, with Japan, India and South Korea showing signs of obeying. Yesterday, the US Energy Secretary held a meeting with his Saudi Arabian counterpart in Washington, with the US Energy Department asking the Trump Administration to encourage big-oil producing countries to keep output levels high ahead of the sanctions. WTI crude was last seen at $67.63/barrel (+0.13%), while Brent stood at $77.80 (0.54%) a barrel. In precious metals, gold slipped to $1,193.8/ounce (-0.13%).

Day Ahead: JOLTs Job Openings awaited; Canadian housing starts on the agenda

With the economic calendar lacking major releases, the trade turmoil will remain front and center as China has no intention to give up the trade game despite Trump’s recent threats. Trump threatened to escalate tensions by targeting $267 billion Chinese imports on top of the $200 billion of Chinese products which are expected to come into effect soon.

As of data releases today, US JOLTs Job Openings will gather some attention at 1400 GMT, while in Canada, the Mortgage and Housing Corporation will deliver figures on housing starts for the month of August at 1215 GMT. The number of new constructions is anticipated to tick higher by 4,000 to 210,300.

Later at 2030 GMT, the focus will turn to the API weekly oil report which will indicate changes in US crude inventories in the week ending September 3. Crude prices and the oil-linked loonie are expected to face some volatility in the wake of the data.

Brexit will also keep investors busy following worrisome remarks by the former Conservative leader William Hague on Tuesday, who said that Britain will face the “most serious constitutional crisis” for at least a century if the Chequers-Brexit deal fails. On the other hand on Monday the European Union’s chief Brexit negotiator Michel Barnier raised optimism that an agreement with the UK is “realistic” and “possible” within eight weeks.

In terms of public appearances, at 1245 GMT Riksbank Governor Stefan Ingves will discuss the Swedish central bank’s monetary policy at an event arranged by Goldman Sachs. Moreover, Russia’s President Vladimir Putin will have a meeting with Chinese President Xi Jinping.