Thursday September 6: Five things the markets are talking about

Global equities again are on the back foot, with a number of regional bourses trading atop of their lowest close of the year, as investors consider the risk of weaker growth thanks due to emerging market worries.

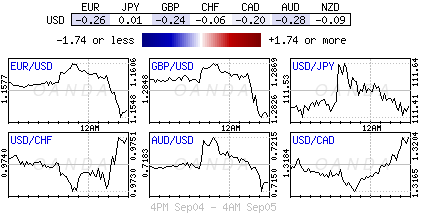

The U.S dollar continues to hang tough, while the yen has its supporters. EM currency pairs are weaker as the South African rand and Turkish lira remain under pressure.

In fixed income, U.S Ten-year note yields are holding steady, while Euro bonds trade mixed.

Sino-U.S tit for tat to persist

Immediate market focus now shifts to China on trade and tariffs. Today is D-day for U.S President Trump to implement fresh tariffs on another +$200B in Chinese imports. Investors can expect China to closely watch the impact from any fresh tariffs and adopt strong counter measures.

Note: The public consultation period on Trumps intent to impose additional tariffs on Chinese goods ends midnight Thursday.

In other trade news, the Canada-U.S trade talks seem to be making progress to revise Nafta, the CAD has found some early Thursday support.

1. Asian shares a sea of red on trade and EM worries

Asian bourses slipped for a sixth consecutive session overnight, with investor confidence shaken by the EM fallout and worries over an escalation in the U.S-China trade war.

In Japan, the Nikkei fell on the back of broad weakness in global equities, while the market waits damage assessments after a powerful earthquake in Hokkaido. The Nikkei share average dropped -0.4%, while the broader Topix fell -0.7%.

Down-under, the Aussie stock market saw ‘red’ amid investor concerns of a house price squeeze as three of the top four domestic lenders hiked their mortgage rates citing higher funding costs. The ASX/S&P closed down -1.1%, as investors digested the prospect that rising rates would hurt home prices further. In S. Korea, the Kospi index fell as EM turmoil and worries over a potentially escalation in the Sino-U.S trade war hurt sentiment.

In China and Hong Kong, shares naturally came under pressure ahead of expected U.S tariffs. China’s blue-chip index fell -1.2% while Hong Kong’s Hang Seng index stumbled -1.5%.

In Europe, regional bourses are trading mostly higher across the board, reversing earlier losses tracking U.S futures.

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx600 +0.2% at 376.2, FTSE +0.1% 7393, DAX +0.4% at 12084, CAC-40 +0.4% at 5279, IBEX-35 -0.5% at 9253, FTSE MIB +0.7% at 20721, SMI +0.2% at 8886, S&P 500 Futures +0.1%

2. Oil dips on EM concerns, but looming Iran sanctions support, gold higher

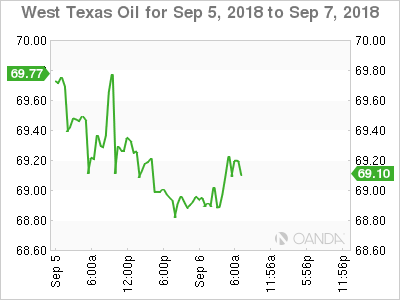

Oil prices have dipped this morning as EM worries weighed on investor sentiment, while Trump’s public consultation period deadline for China nears. However, U.S sanctions against Iran have prevented prices from falling further as they are expected to tighten market supply.

Brent crude futures fell -4c, to +$77.23 a barrel, while U.S West Texas Intermediate (WTI) crude futures are at +$68.59 per barrel, down -13c cents, or -0.2% from Wednesday’s close.

Data yesterday showed that U.S crude stockpiles fell last week as refineries boosted output amid strong consumption. API data showed that U.S crude inventories fell by -1.17M barrels to +404.5M barrels in the week to Aug. 31, while refinery crude runs rose by +198,000 bpd.

OPEC yesterday said it expected global oil demand to break through +100M bpd for the first time this year.

Note: U.S sanctions against Iran are expected to tighten global supply, while Venezuela remains another ‘hot spot’ where a government and political crisis has cut oil production by -50% in the last two-years to more than +1M bpd.

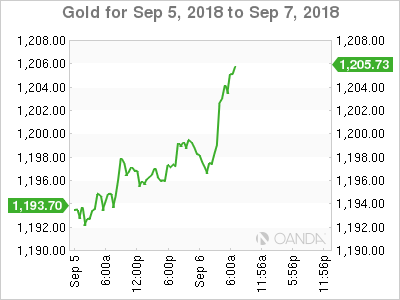

Ahead of the U.S open, gold prices have inched a tad higher, supported by physical buying and as the ‘big’ dollar remained range bound, but a weaker yuan amid worries of pending U.S tariffs on China is capping the ‘yellow’ metals gains for the time being. Spot gold is up +0.1% at +$1,197.38, after rising +0.5% yesterday. U.S gold futures have rallied +0.1% at +$1,202 an ounce.

3. Sweden’s Riksbank changes tightening timing

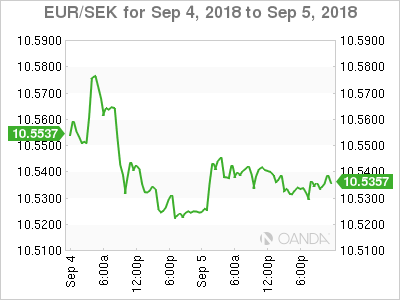

This morning, Sweden’s Riksbank left interest rates on hold at -0.5% and pushed back its forecasts for when it expects to raise interest rates. The Riksbank said it expects to leave rates on hold next month (dovish), raising them in either December or February, having previously flagged a likely rate rise in Q4, 2018. The Riksbank cut its average repo rate forecast for Q4 to -0.5%, from -0.43% previously.

Note: Although Sweden’s inflation is close to the +2% target, this is largely due to higher energy prices, and while measures of underlying inflation indicate inflationary pressures are “still moderate.” EUR/SEK has rallied +0.6% to around €10.6050.

The rally in Italian government bonds this week, which has been driving yields lower, has been pushing German Bund yields higher (+0.38%), indicating less appetite for safe-havens. The spread of Italy’s 10-year bonds over Germany’s has climbed +16 bps.

Note: German Bund yields are expected to come under more upward pressure today with heavy bond supply from Spain and France pending.

Elsewhere, the yield on U.S 10-year Treasuries fell less -1 bps to +2.90%. In the U.K, the 10-year Gilt yield has gained less than +1 bps to +1.404%.

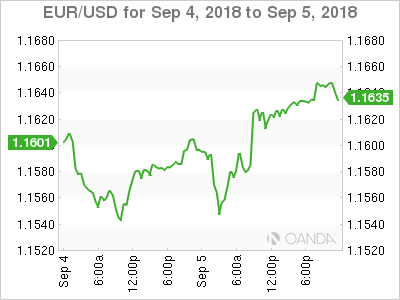

4. Dollar trades steady

A lack of market appetite for safe havens currency pairs overnight has kept the USD confined against G7 FX pairs – EUR/USD at €1.1623 area, USD/JPY at ¥111.35 and GBP/USD at £1.2935 ahead of the open stateside.

The EUR/SEK is higher after the Riksbank pushed back its first potential rate hike until Dec/Feb period from its prior view of around year-end. The cross is holding above €10.58.

Down-under, a fall in Australia’s exports in July resulted in a narrowing of the country’s trade surplus. Data released this morning showed that Australia July Trade Balance registered its seventh consecutive surplus – A$1.6B vs. A$1.9B prior. AUD/USD slid marginally with the pair currently trading at A$0.7185.

Emerging market currencies continue to weaken with South Africa’s ZAR trading atop of its new two-year low around the $15.30, while TRY is off its intraday session highs at $6.6016.

5. German manufacturing orders drop

Euro data this morning showed that Germany’s manufacturers registered weak orders in July amid a sharp drop in demand from outside the eurozone. This would suggest that global trade tensions are already weighing on companies’ appetite for investments.

Total manufacturing orders fell -0.9% on the month, worsening June’s -3.9% orders drop. Market expectations were looking for a headline gain of +1.7%.

Germany’s economics ministry said that “global uncertainties from trade conflicts” as well as “temporary bottlenecks” in the approval of new passenger cars due to the new WLTP emissions-testing protocol were partly to blame.

“The backlog of orders in the manufacturing sector is still very high and the business climate has even improved recently,” the ministry said.

Digging deeper, while domestic orders rose +2.4% in July m/m, foreign orders dropped -3.4% led by a -4.0% fall in demand from outside the eurozone.