Wednesday September 5: Five things the markets are talking about

A new month, but the same mantra – trade concerns continue to simmer and erode risk appetite as emerging markets slide.

Yesterday it was EM currencies, today its global equities that are under stress, pressured by EM contagion fears. The ‘big’ dollar continues to find support for a fifth consecutive session while commodities fall, led by oil. The U.S 10-year note yield hovers atop of +2.89%.

On the trade front, Canada resumes Nafta talks in Washington today and is determined not to back down on key issues despite threats from President Trump to retaliate against the Canadian economy.

Also in focus is the Bank of Canada (BoC) monetary policy meeting (10:00 am EDT). Market consensus expects the BoC to leave its key rate unchanged (odds are at +18% for a rate hike). Nevertheless, there are arguments for a rate increase this morning because raising the key rate would reinforce Governor Poloz data-dependent stance at a time when the Canadian economy is operating at full capacity and growth has been strong.

1. Asian stocks stumble on hump day

Soured sentiment has left several Asian stock markets with their biggest declines in a fortnight, at least since the bout of EM worries that were fuelled by the TRY’s plunge.

In Japan, equities held up better than most, perhaps helped by the overnight yen softness (¥111.47). Nevertheless, investors remain worried that Sino-U.S tariff war could escalate weighed on sentiment. The Nikkei share average dropped -0.51% for a fourth consecutive session while the broader Topix fell -0.77%.

Down-under, Aussie shares extended their losses for a fifth consecutive session overnight, closing down -1%, brushing aside a robust economic growth report (Q2 GDP +0.9% vs. +0.7%) as materials stocks slid on weaker commodity prices. In S. Korea, the Kospi plunged -1.03% as trade war fears intensify.

In Hong Kong, stocks posted their biggest loss in 11-weeks on growth and trade war fears. Overnight, investors’ dumped property, energy and tech stocks amid worries about China’s economy and the Sino-U.S trade war. The Hang Seng index fell -2.6%, while the China Enterprises Index lost -2.3%.

In China, anaemic growth prospects have again pressured regional indexes. The Hang Seng index fell -2.6%, while the China Enterprises Index lost -2.3%.

In Europe, indices trade lower across the board. Leading the way is the French CAC, which is underperforming on a lower revised PMI reading and weakness in oil giant Total.

U.S stocks are set to open deep in the ‘red’ (-0.3%).

Indices: Stoxx600 -0.7% at 377.0, FTSE -0.4% 7426, DAX -0.7% at 12118, CAC-40 -1.2% at 5279, IBEX-35 -0.7% at 9315, FTSE MIB -0.1% at 20580, SMI -0.8% at 8880, S&P 500 Futures -0.3%

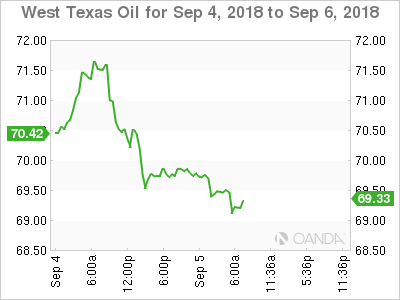

2. Oil falls as U.S storm threat ease, gold prices rally

U.S crude oil prices are under pressure as a tropical storm Gordon has hit the U.S Gulf coast much weaker than expected, offsetting support from forecasts of lower U.S inventories and sanctions against Iran.

Crude prices rallied yesterday as oil companies shut a number of offshore platforms in anticipation of damage from the tropical storm – the market had anticipated the storm would strengthen to a hurricane.

Brent crude fell -47c to +$77.70 a barrel – yesterday, intraday prices climbed to +$79.72, their highest in three-months – while U.S light crude (WTI) is down -72c at +$69.15.

Investors will take their cue from today’s inventory report – API releases its supply report at 04:30 EDT, a day later than usual because of the Labor Day holiday on Monday.

Crude prices could gain support if this week’s U.S inventory reports show a drop in crude stocks, as expected. The market is expecting a drawdown of around -2M barrels million barrels last week.

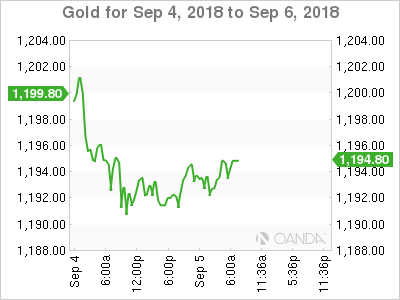

Ahead of the U.S open, gold prices are a tad higher on technical buying amid worries over inflation in EM. Nevertheless, gains remain capped as the ‘big’ dollar rallies on heightened concerns about international trade conflicts. Spot gold is up +0.2% at +$1,193.24, while U.S gold futures are mostly steady at +$1,198.40 an ounce.

3. Italian yields extend their fall on E.U budget remarks

Italian bond yields are under pressure after the Italian government moved to reassure investors that E.U fiscal rules would be respected. Nevertheless, further budget talks may affect BTP yields further.

Italy’s 10-year yield spread over Germany (+257 bps) is at its narrowest point since Aug. 10, but it still remains elevated at some +50 bps above recent lows in July, and +150 bps wider than pre-election levels.

Note: The market remains concerned that increased government spending will see Italy breach E.U fiscal rules and back up Italian yields even further.

Elsewhere, the yield on U.S 10-year notes declined less than -1 bps to +2.89%, while the yield on U.S 2’s fell less than -1 bps to +2.65%. In Germany, the 10-year Bund yield increased less than +1 bps to +0.36%, the highest in a week

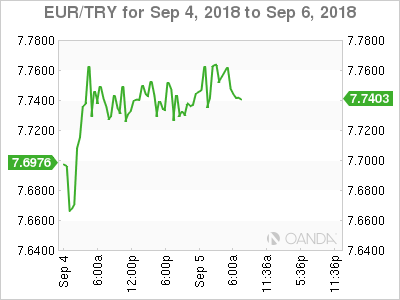

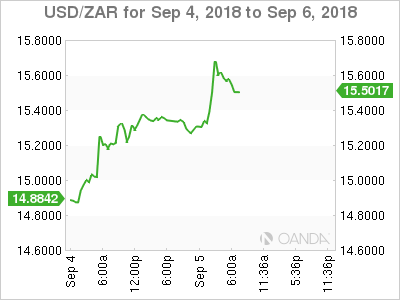

4. EM contagion fears support U.S dollar

September is carrying on August’s trend – safe-haven flows continue to support the U.S dollar for a fifth consecutive session as the ‘public comment period’ related to the U.S’s proposed tariffs on +$200B of China goods is due to end tomorrow.

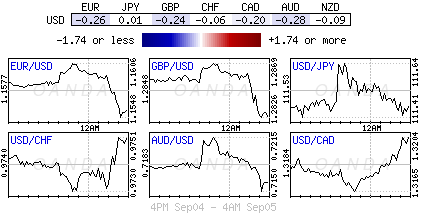

EUR/USD (€1.1569) is softer, trading below the psychological €1.1600 handle despite ‘bullish’ comments from Italian government officials that they will respect E.U budget laws.

GBP/USD (£1.2802) continues to probe its multi week lows on Brexit concerns. The BoE is likely to remain on hold until after the March 2019 Brexit deal. Better Services PMI data (see below) helped to support pound into the U.S session.

Emerging market currencies continue to weaken with South Africa’s ZAR hitting a new two-year low around the $15.70 level earlier this morning.

Note: In South Africa, the country officially entered a recession after yesterday’s GDP data. Q2 GDP annualized q/q: -0.7% vs. +0.6%E; y/y: +0.4% vs. +1.0%E – moves into recession for first time since 2009.

5. U.K services PMI does not budge sterling

Data this morning showed that Britain’s large services sector picked up more strongly than expected last month, bucking a slowdown for manufacturers and construction firms, but Brexit worries are dampening investment plans and confidence for the next 12-months.

The IHS Markit/CIPS Purchasing Managers’ Index (PMI) increased to 54.3 in August from 53.5 in July, beating market expectations.

“Adding in manufacturing and construction sector data published on Monday, the PMI pointed to a repeat of the overall economy’s +0.4% quarterly growth rate recorded in the three-months to June,” IHS Markit said.

Note: The U.K economy has slowed since the June 2016 Brexit vote, its growth rate slipping from top spot amongst the G7 group to elbowing with Japan and Italy for last spot in the growth rankings.