The crises process is intensifying in emerging economies, which also affects their markets and supports the demand for the dollar. S&P 500 lost 0.2% on Tuesday and returned under 2900 level, despite the Amazon’s growth of capitalization over $1 trillion. Asian markets are declining after the data on business slowdown in China. The published Services PMI was weaker than expected, declining for the third month in a row to the lowest levels since last October.

MSCI for Asia-Pacific region ex Japan has been losing 0.5% for the second consecutive day; Nikkei225 has decreases by 0.4%. The Asian bourses remain concerned about the possible announce of the tariffs expansion for Chinese imports by the United States as early as tomorrow. But the markets are not less concerned about the situation in the emerging markets in different parts of the world. The currencies of Argentina, Turkey, South Africa and Brazil are considered vulnerable to changes of the investor sentiment due to large budget and current account deficits.

Investors first of all withdraw money from there due to changing prospects of the global growth. A number of hotbeds of concern and the structural problems of those countries do not allow hoping for a quick solution. Perhaps, the problems will even grow in the coming days. The Argentine peso, the Turkish lira, the South African rand have returned to the area of historical lows. The Indian rupee and the Brazilian Real have updated their lows to the dollar this week and remain close to these levels.

Against this backdrop, there is a growing demand for the dollar as a safe-harbour. The structural deficits in emerging markets are further exacerbated by the introduction of tariffs and threaten to stifle the China’s growth.

The dollar index rose to a maximum of two weeks at 95.65 on Tuesday but lost most of its growth after the data on production activity in the US had been published. It exceeded expectations by regaining the demand for risky assets in the United States and somewhat softening fears. The U.S. is taking away from China the flag of the growth engine for the world economy.

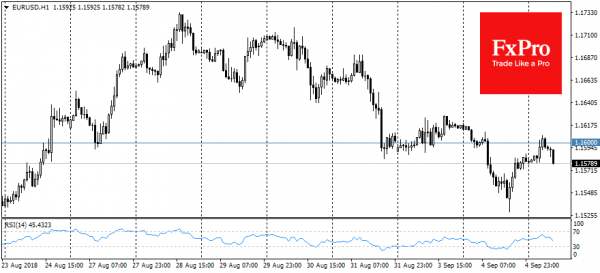

The EURUSD fell yesterday to 1.1530 at one point, but starts the Wednesday close to 1.1600. On Friday and Monday, this level was an important short-term support, but now it looks like a meaningful resistance.

Among the macroeconomic news, the course of trades in the pair may be affected by the final estimates of Services PMI for the Eurozone countries. It is also important for the markets to publish the U.S. trade balance, which can bring the international trade back into the spotlight of the markets.