The Aussie jumped slightly against the US dollar in the Asian market session after data showed that the economy grew at a faster rate than traders were expecting. The accelerated growth was attributed to an increase in government spending in Q2. GDP expanded by 0.9% quarter on quarter. This was higher than the expected 0.7%. It was however below the 1.1% growth from the first quarter. On an annualized basis, the growth rose by 3.4%, which was better than expected. This data came a day after the Reserve Bank of Australia (RBA) made no interest rates changes and indicated that the expansionary policies will remain for an extended period. Traders expect a rate hike to come in the first quarter of 2020.

The Japanese service sector picked up in August according to data from Nikkei-Markit. The services PMI was at 51.5, which was higher than the expected 51.3. This was the twenty-straight month that this PMI has remained above 50. PMI numbers above 50 are said to show growth while those below 50 show contraction. The output of manufacturing too was better than expected. As a result, the Nikkei Composite Output Index rose to 52 in August from 51.8 a month before. In addition to this, the employment growth was at a 14-month high. These numbers are positive for an economy that has struggled to attract inflation.

The euro is slightly higher than the dollar as traders wait for PMI numbers from the European Union. The services PMI in the EU is expected to remain unchanged at 54.4. The composite PMI is also expected to remain at 54.4. The same is true with the German services PMI which is expected to remain at 55.7. Retail sales in the region are expected to grow by an annualized rate of 1.3%, which will be better than the previous 1.2%.

EUR/USD

Yesterday, the EUR/USD pair ended the day at 1.1527, slightly below the 50% Fibonacci Retracement level. Today, the pair has jumped slightly as traders wait for the services PMI data. It is trading at 1.1596. If the pair crosses the 50% Fibonacci level, it will likely test the next support of 1.1486.

USD/JPY

On Tuesday last week, the USD/JPY pair crossed the important support and resistance level of 109.4. Since then, the pair has gained, reaching a high of 113.15. This was the highest level since January this year. Today, the pair is trading at 111.53, which is close to the 61.8% Fibonacci Retracement level. It is also on the same level as the 25 and 50-day Exponential Moving Average. If it continues to move upwards, the pair will likely want to test the resistance level of 113.15 and if it moves lower, it will test the 109.77 support.

AUD/USD

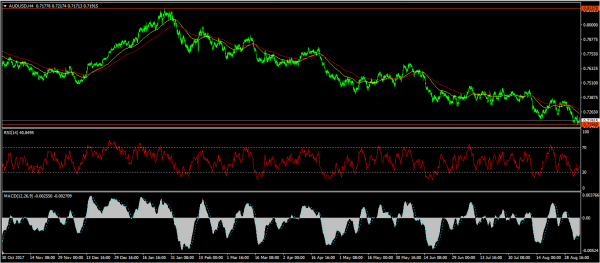

The AUD/USD pair reached a YTD high of 0.8137 in February. Since then, the pair has been making lower lows and lower highs. Yesterday, it reached the YTD low of 0.7156 after the RBA meeting. The RSI has moved from below the oversold level of 30 and is currently at 40, while the MACD remains at lower levels. The price is below the 50-day EMA and 100-day EMA. The pair is likely to continue the downward momentum, though traders need to be careful about a long-term reversal.