The Australian dollar is lower ahead of the interest rate decision by the RBA. The bank is expected to leave rates unchanged although the accompanying monetary policy statement (MPC) will be watched closely. Australia has experienced a few economic problems this year that could make it difficult for the RBA to hike. It has had a major drought that has affected the most populated areas while the housing market has continued to deteriorate in Sydney and Melbourne.

The upward momentum started by the sterling two weeks ago eased yesterday when the GBP/USD pair fell. Today, the pair is trading lower ahead of important inflation hearings. During these hearings, the central bank governor and a few of his colleagues will testify before Parliament on the status of inflation. These will be the first hearings after the bank hiked interest rates in July. The Chartered Institute of Purchasing and Supply (CIPS) will also release important construction PMI data. Traders expect activity in the construction industry to fall to 54.9 in August from July’s rise of 55.8.

The dollar traded higher against its peers in the Asian session as Emerging Markets (EM) worries continues to rise. In recent weeks, leading EM countries like Turkey, Argentina, South Africa, and Indonesia have seen their currencies fall leading to huge losses by EM investors. Yesterday, it was reported that American money manager Franklin Templeton lost more than $1.5 billion last week as Argentina’s peso crashed. Today, the Institute of Supply Management (ISM) will release the PMI data for August. Traders expect the PMI to ease a bit to 57.6 in August from a 58.1 increase in July.

EUR/USD

Yesterday, the EUR/USD pair was little moved as the US participants celebrated the Labour Day weekend. It is now trading at 1.1600. This level is below an important support which the pair crossed yesterday. It is also in line with the 61.8% Fibonacci Retracement level. If the pair moves downwards, it will likely test the 1.1550 level, which is in line with the 50% Fibonacci Retracement level. If the pair moves higher, it will test the important resistance level of 1.1700.EURUSD

GBP/USD

Last week, the GBP/USD pair started falling after reaching the 1.3040 level. The declines were mostly because of the disagreements between the EU and the UK on Brexit. It is now trading at the 1.2857 level, which is the lowest since Thursday. Today’s inflation hearings and the inflation data will likely be the highlight of the day. If sterling continues to weaken, there is a possibility that it will test the 1.2800 support level.

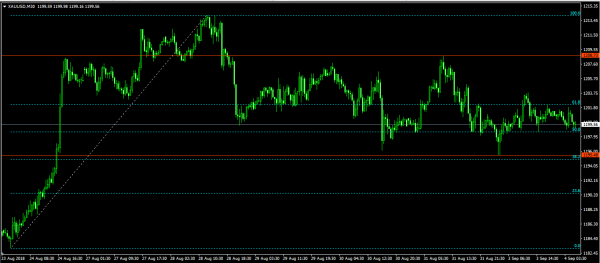

XAU/USD

In the past three days, the XAU/USD pair has traded within the narrow range of 1195.48 and 1208.73. It is now trading at 1200, which is an important technical and psychological level. It is also along the 50% Fibonacci Retracement level. The movement on the pair will depend on the dollar strength or weakness. A stronger dollar will see the pair test the 1195 support while a weaker dollar will see it test the 1205 resistance.