Here are the latest developments in global markets:

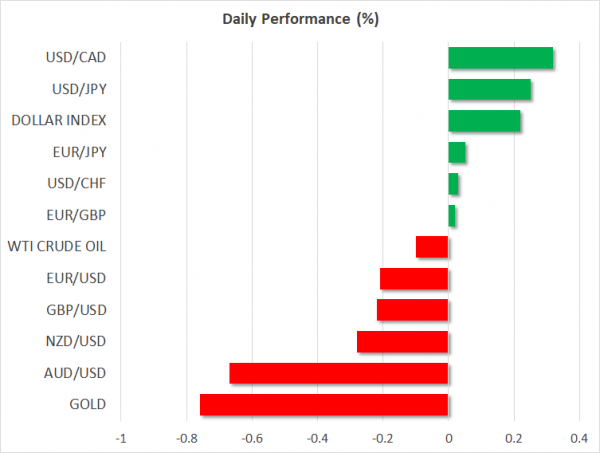

FOREX: The dollar was 0.2% higher against a basket of currencies on Thursday after declining for six straight days. Potential catalysts for the currency’s direction during the remainder of the week are ongoing developments on the trade front and the Jackson Hole summit that will feature influential central bankers; Fed chief Powell will be giving a speech at the event on Friday.

STOCKS: Wall Street finished Wednesday’s trading mixed. The Dow Jones lost 0.3% and the S&P 500 edged marginally lower. Meanwhile, the Nasdaq Composite continued rising, adding 0.4%. In Asian markets, the Japanese Nikkei 225 rose 0.2% and the broader Topix index fell on the margin on Thursday. Hong Kong’s Hang Seng was down by 0.5%. At 0703 GMT, futures tracking major European benchmarks were painting a mixed picture, though they were not far away from neutral levels. Contracts on the Dow, S&P and Nasdaq 100 traded marginally lower.

COMMODITIES: WTI was 0.1% down at $67.80 per barrel after surging yesterday following the EIA report which showed the biggest crude stockpile drop in four weeks. Brent crude traded 0.4% lower at $74.47/barrel. In precious metals, gold was 0.75% down, at around $1,187.00/ounce. The dollar-denominated metal was suffering as the greenback strengthened during today’s trading.

Major movers: Dollar higher across the board; Aussie tumbles on political uncertainty

The dollar index, which gauges the greenback against a basket of six major currencies, is moving higher on Thursday after losing ground in the six previous days and recording its longest streak of declines since February. On Wednesday, the index touched 94.93 at its lowest, a level last experienced on August 2. This compares to its current level of 95.34.

The minutes of the Federal Reserve’s latest policy meeting released yesterday confirmed that the US central bank remains on track to continue normalizing rates.

In Australia, rising political uncertainty following the resignation of three of the government’s senior ministers is putting PM Malcolm Turnbull’s leadership under question and is weighing on the local dollar, which is a stark underperformer on Thursday; aussie/dollar is 0.65% down, having fallen below the 0.73 handle. The kiwi is also down, perhaps declining in “sympathy” to the Aussie but also on the back of broad dollar strength.

The sell-off in the Aussie may have acted as the catalyst for the US currency’s safe-haven allure, which was especially evident in previous weeks, to come back to the fore. Australasia’s Turnbull said he would hold another leadership vote on Friday, after the one earlier in the week, if he received a letter signed by the majority of the ruling Liberal party.

Euro/dollar and pound/dollar were both down by around 0.2% after posting some hefty gains in the days that preceded that pulled them away from multi-month low levels. Drivers for the euro in today’s trading are likely to be flash PMI figures for August and the ECB minutes pertaining to its July meeting. For sterling, any Brexit updates will again be eyed. Recent comments spurred some optimism for a deal with the EU; the nation is preparing for a no-deal outcome as well.

Dollar/yen was moving further away from the near two-month low of 109.76 hit on Tuesday. The pair was last roughly 20 pips below the 111 handle. Any escalation in US-Sino trade relationships is likely to bring the Japanese currency under buying interest.

In EM, the Mexican peso was losing ground versus the dollar, though it held most of Wednesday’s sizable gains which came on rising hopes for a breakthrough on NAFTA.

Day ahead: ECB publishes meeting minutes; flash PMIs pending out of the eurozone & US; Jackson Hole Economic Policy Symposium kicks off

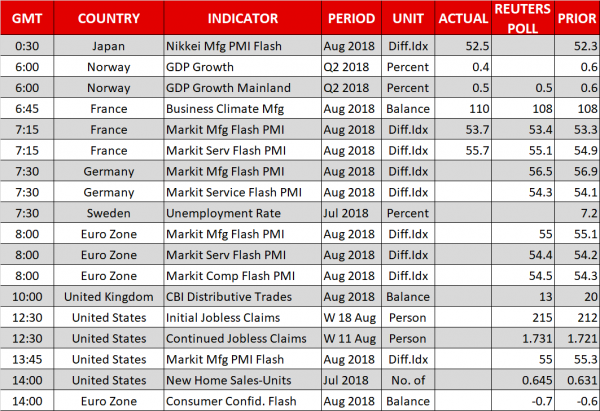

Thursday’s calendar features flash Markit PMI readings out of the eurozone and the US, as well as preliminary readings on eurozone consumer confidence. Accounts of the ECB’s latest monetary policy meeting will be a highlight as well, after the FOMC meeting minutes released yesterday paved the way for higher interest rates “soon” and viewed the ongoing trade disputes and actions an important source of uncertainty and risk.

At 0800 GMT, Markit’s preliminary manufacturing PMI reading for the eurozone for the month of August is expected to come at 55.0, slightly lower compared to July’s 55.1. Meanwhile, the services PMI is anticipated to rise by 0.2 points to 54.4, and the composite PMI, which blends the manufacturing and services sectors, is projected at 54.5 from the 54.3 seen previously. Note that in December, the manufacturing PMI reached an all-time high of 60.6 before it headed downwards in the following months. The services and composite indices peaked in January.

While all PMI measures continue to comfortably hold above the 50 threshold, which separates contraction from expansion, any negative or positive surprise in the numbers could move the euro accordingly before the release of the ECB meeting minutes at 1130 GMT. The record, which will provide a detailed description of what was discussed at the central bank’s latest meeting in July, is expected to reiterate plans to end the Banks’ asset purchase program by the end of 2018 and communicate that interest rates will remain steady “at least through the summer of 2019”, with the latter bringing some confusion to investors when was first announced in July as question marks were created on how it should be interpreted. Despite ECB chief, Mario Draghi, saying that this means not until September, investors will likely want to see whether some ECB policymakers disagree with this interpretation, pushing for a hike earlier in time. Any dovish tweaks in the language could push the euro lower and vice versa. Comments on the trade front could also bring volatility to the common currency.

Also euro-related, flash eurozone consumer confidence figures for the month of August are due at 1400 GMT. A slight deterioration in the relevant index, which holds in negative territory, is forecasted by analysts.

Meanwhile in the US, Chinese and US “low-level” officials resume their trade talks later today after Washington activated its tariffs on $16 billion Chinese imports, prompting Beijing to retaliate in similar fashion. The action also raised a voice in China, with the Chinese Commerce Ministry saying it would file a complaint to the World Trade Organization (WTO).

Staying in the US, the Jackson Hole Economic Policy Symposium is scheduled to commence today, hosting central bankers and finance ministers from some of the world’s largest economies. Trade, EM uncertainty and Turkey and monetary policy are some of the topics that are likely to attract interest. The Fed’s chief, Jerome Powell, will be giving a speech at the event on Friday.

In terms of data out of the US, the flash Markit manufacturing PMI for August due out at 1345 GMT is forecast to ease by 0.3 points to 55.0. Initial jobless claims and new home sales figures will be available for review at 1230 GMT and 1400 GMT respectively.

Bundesbank chief Weidmann, whose name is often cited as a possible successor to ECB chief Draghi when his term expires in late 2019, will be speaking in Berlin at 0900 GMT.

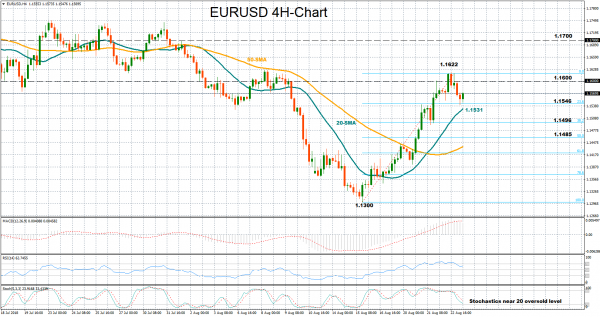

Technical Analysis: EURUSD declines after climbing above 1.16; downside may continue

EURUSD declined from the two-week high of 1.1622 reached on Wednesday after the RSI and the stochastic oscillators fell below 70 and 80 respectively – overbought levels – on the four-hour chart, hinting that the rally triggered at roughly 1.1300 was overdone. Turning to the MACD, it has fallen below its red signal line, which may indicate that further declines are likely.

Should the price rebound, the market could try to overcome the 1.1600 round figure before it retests the 1.1622 peak. If the latter fails to halt upside movement, resistance could run towards the area between 1.1680-1.1700 which has been frequently approached in July.

On the other hand, an extension to the downside could meet immediate support at the 23.6% Fibonacci of the upleg from 1.1300 to 1.1622, around 1.1546, where the market paused today; the 20-period simple moving average lies not far below at 1.1531. Even lower, the 38.2% Fibonacci of 1.1496 and the 50% Fibonacci of 1.1485 could also restrict bearish corrections, with the latter bringing stronger downside pressures if violated.