The eurozone’s flash manufacturing and services PMIs, as well as the composite reading that blends the two sectors, are all due on Thursday at 0800 GMT. The prints, which are expected to provide further insights on economic activity in the euro area during Q3, constitute the most important releases out of the eurozone in the current week.

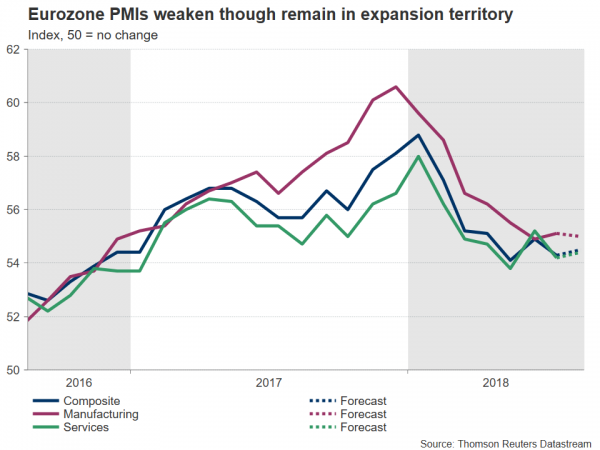

Analysts are projecting manufacturing PMI to fall to 55.0, only marginally below July’s 55.1, which was the first rise in the indicator after declining for six straight months. The services and composite PMIs are anticipated to slightly improve relative to July’s release – the latter is viewed as a good overall growth indicator for euro area economies. Specifically, they’re forecast to stand at 54.4 and 54.5 correspondingly, up from the previous month’s 54.2 and 54.3. Overall, despite considerable easing since late 2017 – early 2018, all three measures remain comfortably in expansion territory above 50.

PMI readings so far in 2018 are painting a picture of weakening economic momentum in the eurozone compared to last year, lending credence to views that the 0.7% q/q growth reported in the last three quarters of 2017 represents a cycle peak. Worries over a deteriorating outlook for global trade have been a factor weighing on PMIs and could well continue doing so, despite a constructive meeting between US President Donald Trump and European Commission President Jean-Claude Juncker in late July. US steel and aluminum tariffs remain in effect for the EU, something which is likely to act as a drag on manufacturing PMI, while other risks for European businesses remain in the background. In particular, an emerging market crisis, which is seen as more and more probable as of late, may have spillover effects into Europe. Moreover, US action against Iran will probably sooner or later hurt European companies doing business in the country. Also, weather factors – a hotter-than-expected summer – could have also affected activity.

On the monetary policy front, the ECB plans to end its asset purchases by the year-end, while it continued to guide markets for steady rates “at least through the summer of 2019” at its latest meeting, something which was firstly communicated in the meeting that preceded and was widely perceived by markets as a dovish rate-hike guidance. At the moment, market participants have mostly priced in a 10bps increase in the Bank’s deposit rate during the October 2019 meeting. A PMI miss tomorrow will likely reinforce the dovish rate outlook, leading to a weaker euro, while a beat may push expectations for a rate hike closer in time, thus lifting the currency. For the record, the ECB will next be deciding on policy on September 13; new economic forecasts will be made public during that meeting as well. Furthermore, the official record from the Bank’s July meeting will be hitting the markets tomorrow at 1130 GMT.

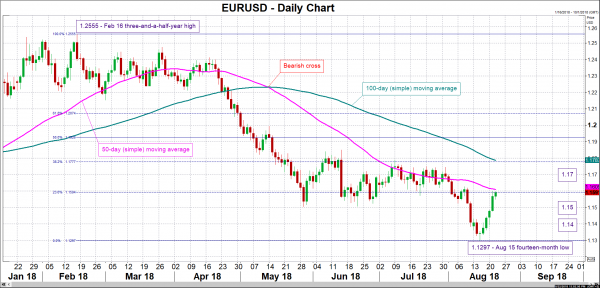

Turning back to PMIs, encouraging prints on Thursday are expected to boost the common currency, allowing EURUSD to extend its recovery after falling to a 14-month low of 1.1297 on August 15. Technically, a rising pair may meet resistance around the 1.17 round figure, given that first a convincing break above the 23.6% Fibonacci retracement level of the February 16 to August 15 downleg at 1.1594 takes place; the region around this point includes the current level of the 50-day moving average at 1.1609 and, consequently, the 1.16 handle. Further above, the 38.2% Fibonacci mark at 1.1777 would be eyed; notice that zone around this acted as a barrier during July. On the downside and in case of disappointing data, support could come around the 1.15 and 1.14 handles.

Lastly, Germany and France, the eurozone’s two largest economies, will see the release of their respective August flash PMI numbers on Thursday, prior to the euro-wide figures; market participants may use these to speculate on what is to follow out of the euro area, positioning themselves accordingly.