Here are the latest developments in global markets:

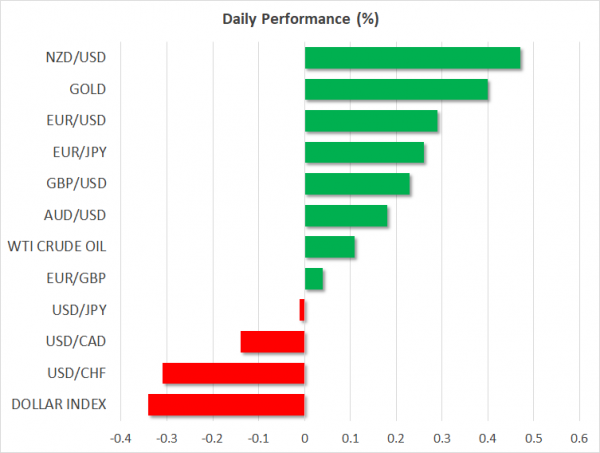

FOREX: The dollar was losing ground against six major currencies on Tuesday, building on yesterday’s losses after some overnight comments by US President Trump; he expressed displeasure with the Fed raising interest rates

STOCKS: The Dow Jones finished Monday’s trading up by 0.35%, while the S&P 500 and Nasdaq Composite edged higher by a bit more than 0.2% and slightly less than 0.1% correspondingly. In Asian markets, the Japanese Nikkei 225 added 0.1% and the broader Topix index lost 0.4%. Hong Kong’s Hang Seng was up by 0.3%. At 0704 GMT, futures markets were pointing to a lower open for major European benchmarks, while contracts on the Dow, S&P and Nasdaq 100 were all close to flat.

COMMODITIES: WTI was up 0.1%, trading around $66.50 per barrel, while Brent crude was lower by the same proportion at $72.10/barrel. Weekly API data on US crude stocks due at 2030 GMT may provide short-term direction to oil prices. In precious metals, gold was higher by 0.4% at $1,194.40 an ounce, gaining on the back of a softer dollar and further distancing itself from its lowest since January 2017 of $1,159.96/ounce hit last week

Major movers: Dollar broadly weaker as Trump criticizes higher-rates policy; Brexit in focus for sterling

The dollar’s index, which gauges the greenback versus a basket of counterparts, was heading lower for the fifth straight day, having touched 95.44, its lowest since August 9 earlier on Tuesday. Its losses yesterday were exacerbated after President Trump said in a Reuters interview that he was “not thrilled” with Fed chief Powell raising interest rates. Moreover, he said that he “should be given some help by the Fed” in propping the economy, while adding that he’ll criticize the central bank if it continues hiking rates.

The greenback was already heavier against major peers on Monday as seemingly easing tensions between the US and China on trade – given that the two will be getting into low-level talks this week that may pave the way for high-level discussions – did not divert safe-haven flows into the currency. Trump’s comments, though, acted as the catalyst for sharper losses.

China and Europe were on the receiving end of fire by Trump, who again said they were manipulating their currencies. Broad dollar weakness helped the euro, which was on its fifth consecutive up-day, trading 0.3% higher on Tuesday and piercing through the $1.15 handle; at its peak for the day, euro/dollar hit 1.1543, its highest since August 9. The offshore yuan was not much changed against the US currency after pulling away from its weakest since January 2017 in the previous days.

Dollar/yen was close to flat and marginally above the 110 round figure, after previously falling below it to record a near two-month low of 109.76. Pound/dollar traded 0.2% higher and not far below its highest in nearly two-weeks of 1.2833. Sterling has in the past and is likely to again prove sensitive to Brexit negotiations taking place on Tuesday and Wednesday; UK Brexit Secretary Raab will be meeting EU’s Barnier later today.

The commodity-linked loonie, kiwi and aussie were all higher versus the dollar. Relating to the latter, RBA minutes pertaining to its meeting earlier in August were relatively dovish, while the currency was also fairly resilient to political uncertainty in Australia; Prime Minister Malcolm Turnbull survived a leadership vote with a very narrow margin. As regards the kiwi, which is outperforming – kiwi/dollar is up by around 0.5% –, analysts said the market was very short on the NZD and susceptible to being squeezed out of those positions.

Elsewhere, the closely watched – as of late – Turkish lira continued losing ground versus the dollar despite broad greenback weakness.

Lastly, also dollar-negative on Monday were comments by Atlanta Fed President Raphael Bostic – a voting FOMC member in 2018 – who supported one more rate increase by the Fed in 2018, rather than two, while expressing concerns over risks from trade.

Day ahead: US-Chinese trade talks & Brexit in the forefront; Turkish political turmoil continues

A few economic releases are on the calendar on Tuesday. However, once again, any trade or political update could be of most interest as investors are eagerly awaiting the outcome of the US-Sino trade talks this week, while the Turkish-related turmoil remains in the background as well.

Chinese officials are expected to meet their US counterparts in Washington on Wednesday and Thursday, marking the first official meeting since June’s gathering which secured no agreement. This time, discussions will take place just before US tariffs on $16 billion Chinese imports take effect, with China expected to retaliate in similar fashion; market participants are hoping for the talks to de-escalate tensions. However, since the negotiators are said to be low-level officials, the meetings may not provide much.

Developments relating to Turkey are anticipated to attract attention as well, as the US refuses to back down its standoff with the country over the detention of a US pastor, with President Trump saying yesterday that “there will be no concessions” on this matter. The Turkish President also showed no sign of giving in the previous days and it would be interesting to see how long the dispute could last, as well as whether it would intensify further. Besides the Turkish lira, the euro will be in focus as well given worries that any economic deterioration in Turkey could negatively affect the Eurozone’s banking sector and thus act as a drag on the common currency.

In the meantime and also of importance, the Brexit Secretary, Dominic Raab, will be traveling to Brussels today, where he will hold the latest Brexit talks with his EU counterpart, Michel Barnier, later today. While the scenario of a no-deal Brexit is looking more and more probable, Raab expressed that an agreement is still the most likely outcome.

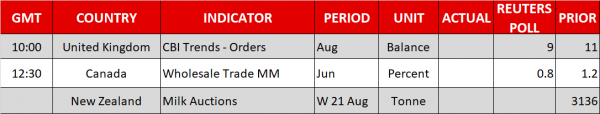

In terms of releases, the Confederation of British Industry’s data on factory growth are due at 1000 GMT, while Canadian wholesale trade numbers will be hitting the markets at 1230 GMT. Meanwhile, the outcome of today’s bi-weekly milk auction could dictate short-term positioning on the kiwi; dairy products are New Zealand’s largest goods export earner, with higher prices generally seen as kiwi-positive. The auction figures lack a specific time of release.

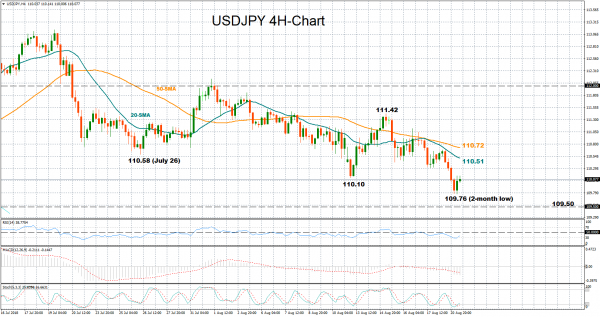

Technical Analysis: USDJPY rebounds from 2-month lows but negative risks remain

USDJPY extended losses towards an almost two-month low of 109.76 today after breaking the previous low of 110.10 printed on August 13. Both the RSI and the stochastics are attempting a rebound on the four-hour chart which may constitute a sign that the bearish momentum is fading. Also notable and relating to the latter, the %K line moved above the slow %D one, this being a bullish sign in the very short-term. However, it should also be kept in mind that the MACD continues to move in negative territory and below its red signal line.

Should political and trade risks intensify, shifting funds to the safe-haven yen, the pair could revisit the bottom created at 109.76, while a sharper decline could also send the market down to 109.50, a frequently tested area between April and June. Even lower, the door could open for the 109.00 round figure. Still, it is worth mentioning that the dollar has been acting as a safe-haven as well in previous days.

Conversely, easing tensions could push USDJPY back above 110.10, with scope to retest the area between 110.30 and 110.60, formed by the lows on July 26 and August 17. A leg higher could overcome the 20-period SMA and target the 50-period SMA at 110.72.