Upcoming releases in the next seven days are pointing to a relatively quiet August week. Among the few stand-out readings are flash PMI prints out of the eurozone, Japanese inflation figures and US capital goods orders. In addition, the minutes relating to the Federal Reserve and Reserve Bank of Australia’s latest meetings will be made public next week. Despite a mostly light calendar, comments out of central bankers gathering for the Jackson Hole Symposium, as well as global trade & Turkey-related news have the capacity to provide plenty of excitement, acting as major market movers.

US capital goods orders, FOMC minutes and Canadian retail sales on the horizon; Jackson Hole summit a risk event

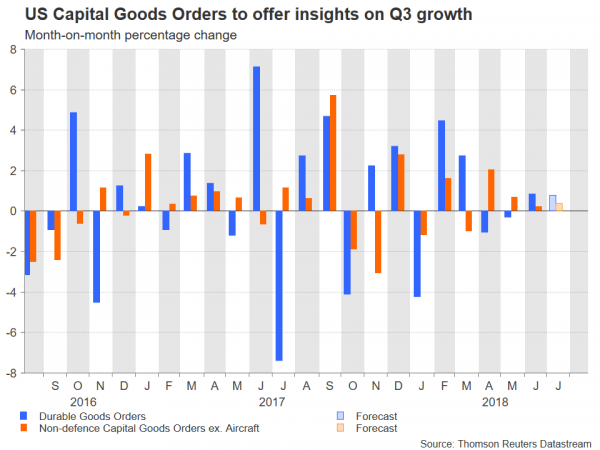

In terms of US releases, the most noteworthy are durable goods orders for July out on Friday – these are expected to give an indication on business spending in Q3 –, as well as the Fed minutes from its July 31 – August 1 meeting out on Wednesday. In terms of the former, durable goods are anticipated to have grown by 0.8% on a monthly basis in July, the same pace as in June. Regarding orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, it is forecast to rise by 0.4%, double June’s rate. GDP models are giving divergent views on the US economy’s performance in Q3. The Atlanta Fed’s GDPNow model continues to predict continued strong growth from Q2, specifically putting the rate of expansion at 4.3% on an annualized basis, while the New York Fed’s tracker suggests a 2.6% rate. Friday’s prints will better inform markets on the state of the US economy during the third quarter.

Tuning to the Fed minutes, FOMC policymakers delivered a “hawkish hold” of rates a few weeks ago; they kept interest rates steady but effectively communicated that they remain on track to continue hiking rates moving forward. Further insights on their thinking provided by next week’s minutes, especially on the odds for two additional quarter percentage point increases in 2018, have the potential to move the dollar.

Other US data out next week include July’s existing and new home sales on Wednesday and Thursday respectively, as well as Markit’s flash manufacturing PMI for August on Thursday.

A risk event taking place in the US from August 23-25 will be the Jackson Hole Economic Policy Symposium. The summit’s overall theme is “Changing Market Structure and Implications for Monetary Policy” and will feature influential central bankers and finance ministers from some of the world’s largest economies; market-sensitive remarks are not to be ruled out.

Remaining in North America, of most significance out of Canada will be Wednesday’s retail sales numbers for June. At the moment, market participants are almost completely pricing in an additional 25bps rate increase by the Bank of Canada by year-end. Robust retail sales readings may lend steam to the narrative that the Canadian central bank is the only one that can somewhat keep up with the Fed in terms of rate normalization, subsequently boosting the local dollar.

Flash eurozone PMIs to dominate attention in Europe; Brexit a sterling mover?

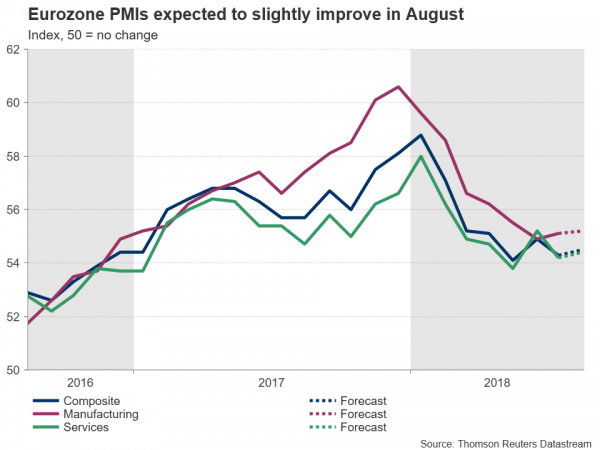

Eurozone flash PMI readings for August will most likely be the focus next week in terms of European releases. The manufacturing and services PMIs, as well as the composite measure that blends the two sectors, are all due on Thursday and are expected to provide further insights as regards economic activity in the euro area during Q3. Overall, all three are forecast to reflect a minor improvement relative to July, as well as comfortably remain in expansion territory above 50.

In the meantime, Germany and France, the eurozone’s two biggest economies, will also see the release of their corresponding August PMI prints on Thursday, prior to the euro-wide figures; traders may use these to speculate on what is to follow out of the euro area, positioning themselves accordingly. Also out of Germany will be July’s producer price data due on Monday.

Beyond the abovementioned, preliminary eurozone consumer confidence figures for August on Thursday, as well as updated Q2 GDP numbers for Germany on Friday, may be of interest too.

Turning to the UK, sterling will most probably prove sensitive to any Brexit developments following this week’s discussions; any indication that the EU and the UK are getting closer to a deal will likely lift the British currency and vice versa.

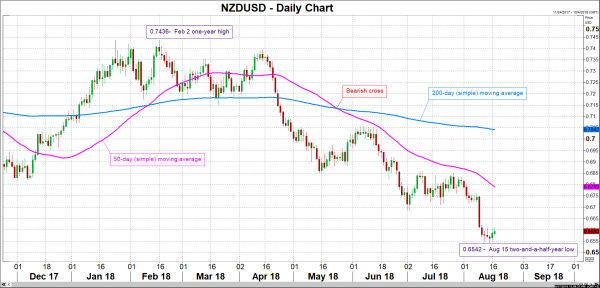

Retail sales on New Zealand’s agenda; RBA minutes due; trade updates to move antipodeans

In the antipodean sphere, New Zealand will be on the receiving end of Q2 retail sales figures during Wednesday’s Asian session. Retail sales volumes grew by 3% y/y in Q1, considerably below the respective number of 5.4% during Q4 2017 and at their slowest pace since Q3 2012. A weak reading next week is anticipated to support the RBNZ’s decision earlier in August to push forward its rate hike projections to late 2020 from late 2019 previously, and will thus likely exert downside pressure on the kiwi.

Other notable releases out of New Zealand are those pertaining to second-quarter construction activity on Wednesday, Friday’s trade data for July, as well as figures relating to Tuesday’s bi-weekly milk auction – dairy products are the nation’s largest goods export earner, with higher prices generally seen as kiwi-positive.

Out of Australia, the official record of the RBA’s latest meeting will be hitting the markets on Tuesday. An upbeat RBA compared to the expectations shaped following its August 7 meeting will likely promote a stronger aussie, with the opposite holding true as well.

However, of most importance for the kiwi – NZDUSD daily chart depicted below – and the aussie alike may prove to be Sino-US trade developments. Should the confrontational stance by the world’s two largest economies give way to a more constructive trade relationship on the back of news of the two getting into talks on August 21-22, then the aussie and the kiwi are likely to gain. Australia and New Zealand are major commodity exporters and their corresponding currencies tend to lose on a deteriorating outlook for global growth and trade.

Japanese inflation on tap

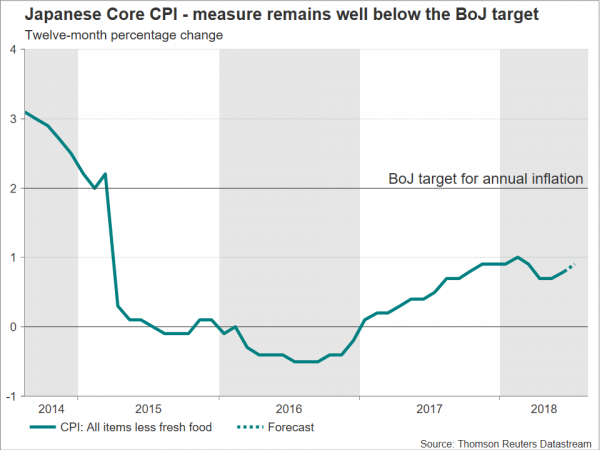

Japanese inflation figures as gauged by the consumer price index (CPI) for July are scheduled for release during Friday’s Asian session. With inflation nowhere near the Bank of Japan’s target of 2% on an annual basis, only a large deviation from analysts’ forecasts may excite market participants, spurring expectations for a change in the Japanese central bank’s ultra-accommodative policies and thus movements in the yen. Projections call for core CPI, that excludes fresh food items but includes energy products and which is closely watched by the BoJ in its policy making, to expand by 0.9% y/y after growing by 0.8% in June. Also out of Japan will be the Nikkei’s flash manufacturing PMI for August, due one day before the prints on inflationary pressures.

The Japanese currency’s direction next week though may predominantly depend on demand for safe havens. Intensifying Sino-US trade tensions, or rising regional uncertainty emanating from Turkey which – at least for now – resists giving in to US demands, are yen-supportive. On the other side of the spectrum, they are negative for riskier assets and risk-on currencies such as the aussie. The opposite effect is expected in the event of easing worries on these two fronts.