Here are the latest developments in global markets:

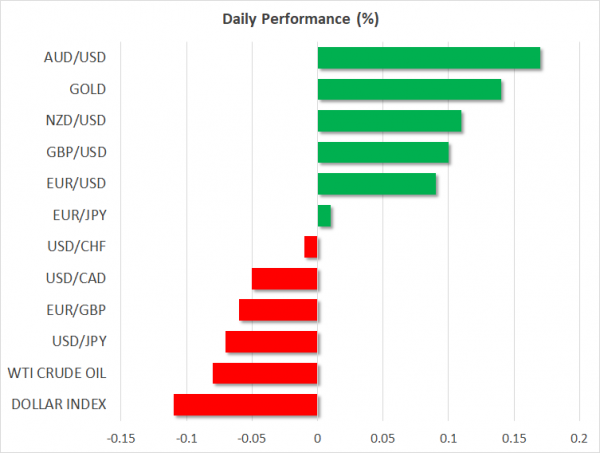

FOREX: The US dollar index is lower by a modest 0.11% on Friday, extending some of the losses it recorded in the previous session, pressured by a recovery in broader risk sentiment. Likewise, the Japanese yen retreated across the board yesterday as well. Meanwhile, the British pound still hovers near its recent multi-month lows, largely unable to draw support from strong UK data yesterday, as the uncertainty stemming from the Brexit negotiations is casting a long shadow.

STOCKS: Wall Street closed higher on Thursday, amid optimism that the US-China trade standoff will soon deescalate, and following encouraging earnings releases from the likes of Walmart (+9.31%). The Dow Jones led the advance (+1.58%), while the S&P 500 (+0.79%) and Nasdaq Composite (+0.42%) followed in its tracks. That said, futures tracking the Dow, S&P, and Nasdaq 100 are all currently close to neutral territory, suggesting these indices may open flat today. In Asia, most benchmarks were in the green on Friday. In Japan, the Nikkei 225 (0.35%) and the Topix (+0.62%) edged higher, as did the Hang Seng in Hong Kong (+0.07%). In Europe, most major indices were set for a more or less flat open, futures suggest.

COMMODITIES: Oil prices held near their opening levels on Friday, with both WTI and Brent trading in very narrow ranges after they posted some modest gains in the previous session. The rebound was likely driven by a recovery in broader market risk sentiment, raising demand for risk-sensitive commodities like oil. In precious metals, gold edged up by 0.13% on Friday, currently trading just above the $1,175 per ounce handle. The yellow metal managed to close the day only marginally lower yesterday, paring most of the losses it posted early in the session, aided by a pullback in the US dollar.

Major movers: Dollar trips as risk appetite recovers

The dollar corrected lower against a basket of six major currencies on Thursday, as a recovery in investors’ risk appetite curbed demand for the US currency, which had been attracting safe-haven inflows in recent days amid jitters in emerging markets. Similarly, the Japanese yen felt the heat as well, retreating against all its major peers, while US stock indices closed notably higher. The rebound in risk sentiment followed news that the US and China are gearing up for another round of trade talks in late August, amplifying expectations that the standoff between them may ultimately be resolved via negotiations.

While markets reacted positively to the trade headlines, it’s worth noting that President Trump poured some cold water on speculation for an immediate solution yesterday, saying: “they are just not able to give us an agreement that is acceptable”. Indeed, his statement perfectly describes how the latest round of negotiations ended, with China offering material concessions only for the US to brush them aside as insufficient. It’s quite difficult to envision China offering much more than it already has and thus, the rift between the two sides appears too large to overcome at the moment – suggesting that markets may be in for a sore disappointment in case these talks fail to bear fruit again.

Elsewhere, the British pound barely advanced, largely unable to capitalize on strong UK retail sales figures. All eyes remain on the Brexit talks, where we may get some fresh comments today. Note, though, that considering the significant losses the pound recorded lately amid speculation for a no-deal EU exit, the Brexit risk premium on the currency is probably quite high already. This implies the risks surrounding sterling from these talks may now be asymmetrical, and tilted to the upside. Continued lack of progress could confirm the current pessimistic narrative and hence keep the currency at current low levels, or even trigger some further moderate losses. In contrast, any hints the negotiations are moving forward may come as a positive surprise, leading to an outsized relief bounce.

In EM, the Turkish lira’s rebound was halted yesterday by fresh developments in the US-Turkey diplomatic showdown. US Treasury Secretary Mnuchin warned that Turkey could face even more sanctions if the American pastor is not released “quickly”, stopping the lira’s recovery in its tracks. Dollar/lira appears to have stabilized around the 5.80 handle.

Day ahead: Canadian inflation due; University of Michigan consumer sentiment survey also on the horizon

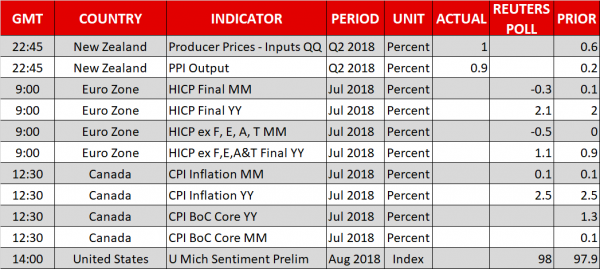

Friday’s calendar features inflation figures out of the eurozone and Canada, as well as the University of Michigan’s survey on US consumer sentiment.

At 0900 GMT, the eurozone will be on the receiving end of final inflation figures for July. The Harmonised Index of Consumer Prices (HICP), that uses a common methodology across EU countries, is anticipated to have contracted by 0.3% on a monthly basis in July, something which would put the annual pace of expansion in the measure at 2.1%, leaving it unrevised relative to the preliminary reading and above June’s 2.0%. The core HICP rate, that excludes food, energy, alcohol and tobacco, is forecast to grow by 1.1% y/y, higher than June’s 0.9%. Given that the numbers constitute the final releases, barring a significant deviation from the preliminary estimates, the euro is not expected to react much to the prints.

Canada’s inflation numbers for July will be made public at 1230 GMT, constituting perhaps the release that has the greatest capacity to lead to considerable movements out of today’s calendar. CPI is projected to have expanded by 2.5% y/y in July, the same as in June and within the Bank of Canada’s target band of 1-3%. Core CPI, as well as the measures of inflation monitored by the Bank of Canada – median, common and trimmed CPI – will also be closely watched by market participants, which have so far almost completely priced in an additional 25bps rate hike by the BoC in 2018, according to Canadian OIS. A data beat may spur speculation for two more rate increases during the year, subsequently boosting the loonie.

Out of the US, the University of Michigan’s preliminary survey on August consumer sentiment is due at 1400 GMT. The relevant index measuring consumer morale is projected to show a marginal improvement relative to July’s print, while the survey’s sub-indices gauging inflation expectations will also be attracting attention.

Meanwhile, sterling is expected to be sensitive to any Brexit related developments.

Also of interest, especially in view of the Turkish drama taking place recently, Standard & Poor’s sovereign credit rating report on Turkey is due out later on Friday; the country’s bonds are junk-rated and an additional cut may exert pressure on the lira.

RBA Assistant Governor Luci Ellis will be giving a speech at 0730 GMT.

In energy markets, the Baker Hughes count of active US oil rigs is due at 1700 GMT.

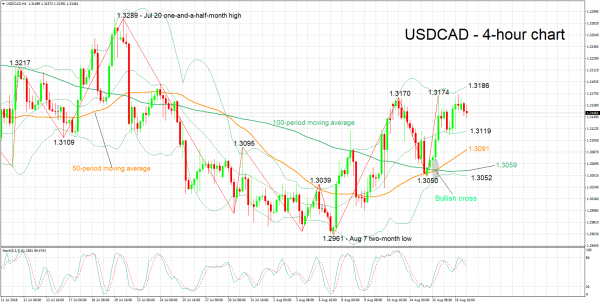

Technical Analysis: USDCAD bearish signal by stochastics in very short-term

USDCAD has eased a bit after touching a three-week high of 1.3174 on August 15. The stochastics are giving a bearish signal in the very-short-term as the %K line crossed below the slow %D one.

An inflation beat out of Canada later on Friday is likely to boost the loonie, pushing USDCAD lower. Support to declines may come around the middle Bollinger line – a 20-period moving average line – at 1.3119; the area around this includes the 1.31 round figure as well. Further below, the current levels of the 50- and 100-period MAs at 1.3091 and 1.3059 respectively, as well as the lower Bollinger band at 1.3052 would be eyed.

Weaker-than-anticipated CPI readings on the other hand, are expected to boost the pair. Resistance to advances could occur around the upper Bollinger band at 1.3186; the region around this encapsulates August 15’s three-week peak, as well as another high from the recent past at 1.3170 and the 1.32 handle. Further above, the one-and-a-half-month high of 1.3289 from late July would increasingly come into scope.