Economic releases will heat up in the coming week with monthly data on inflation, employment and retail sales certain to keep some traders busy as many head off for their summer holidays. Central bank meetings will take a backseat, though the week will not be totally absent of policy announcements as the Norges Bank meets to decide on rates.

Australian employment in focus for the aussie

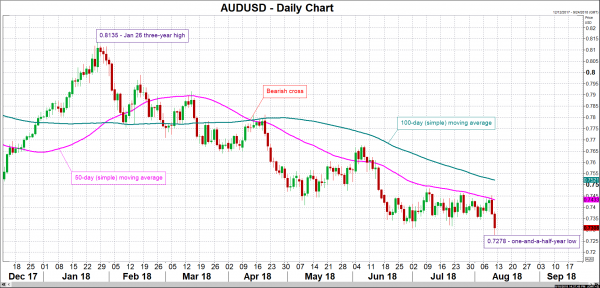

The Australian dollar hit its lowest since January 2017 of 0.7278 this past week, with US-China trade worries weighing on the currency. Previously – since late June – a neutral RBA largely confined the aussie to a range, as the central bank has signalled it wants to see higher wage growth before it begins considering raising rates. Wage growth and employment figures due next week will therefore fall under the spotlight as they could provide some hints as to the timeline of an RBA rate hike. The quarterly wage price index is out on Wednesday and the employment report for July will follow on Thursday. Also attracting attention for the aussie will be survey data, consisting of the NAB business confidence gauge on Tuesday and Westpac’s consumer sentiment index on Wednesday.

Chinese July indicators to be watched for tariffs impact

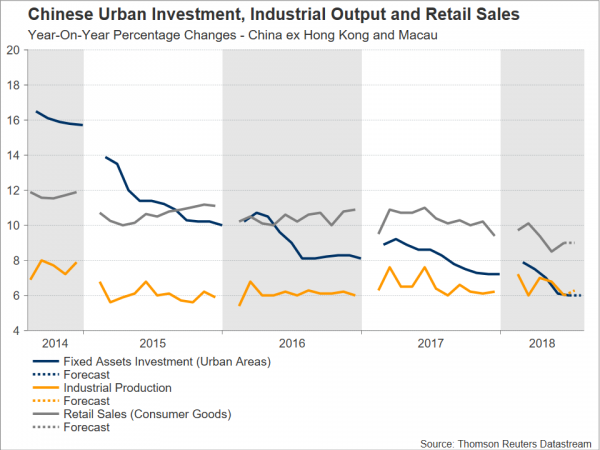

There was some relief this week as trade numbers showed exports from China rose by more-than-expected in July. Specifically, they surged by a solid 12.2% year-on-year, with little evidence so far that the US tariffs on Chinese goods implemented in July had a notable impact. Analysts aren’t forecasting a major drag on industrial output either as the sector is expected to have grown by 6.3% y/y in July, accelerating from the prior 6.0% rate. Investment in urban areas is expected to have risen by 6.0% y/y in the year-to-date in July, the same pace as in June. Growth in retail sales is also forecast to remain steady, at 9.0% y/y in July. The figures are due on Tuesday. While a deterioration in the data is not being anticipated, neither are they expected to point to strong momentum and so may not do much in lifting market sentiment and in turn the aussie which is a viewed as a liquid proxy for “China plays”, given that China is Australia’s biggest export market.

Japanese exports to moderately accelerate in July

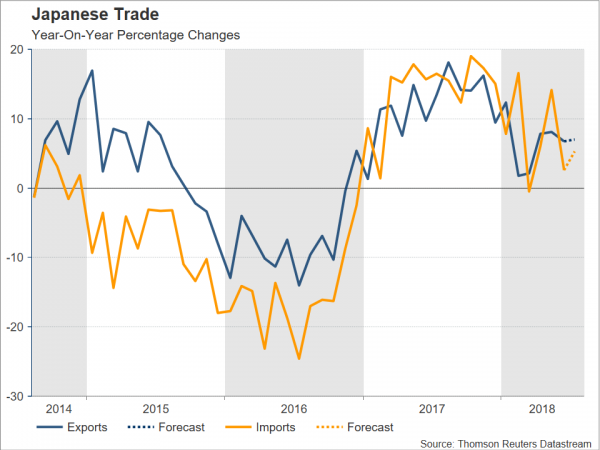

While ongoing trade tensions have kept the yen in demand in recent weeks, growing speculation that the Bank of Japan is slowly moving towards tighter monetary policy have also been supporting the currency. Upbeat trade figures due during Thursday’s Asian session may add to the positive sentiment for the yen. Exports are forecast to increase by 6.3% y/y in July, below June’s 6.7%, while import growth is expected at 14.4% y/y during the same month, at a much higher pace compared to June’s 2.6%. Moreover, data out this week showed Japan’s economy expanded by an annualized rate of 1.9% in the second quarter following Q1’s contraction by 0.9%, suggesting that economic activity in Japan is back on a more sustained path.

Another subdued week for Eurozone data

The Eurozone calendar will be light again in the next seven days with only a handful of major releases. Up first is the ZEW business survey out of Germany on Tuesday, with the economic sentiment index forecast to improve in August, though still remain in negative territory. Also due on Tuesday are Eurozone industrial output numbers for June and the second estimate of GDP growth for the second quarter. No revision is expected to the preliminary print of 0.3% quarter-on-quarter. Finally, on Friday, the final inflation reading for July will be released, with no revision projected either.

Also worth keeping an eye on is the policy decision by Norway’s central bank. The Norges Bank is due to announce its decision on Thursday and will probably keep its benchmark rate unchanged at 0.5%. At its last meeting in June, the Bank had reiterated its plans for a rate hike in September and is unlikely to deviate from that view in August. However, investors will still be watching whether there will be any change to the tone of the statement for possible clues as to the path of interest rates beyond September. The Norwegian krone is likely to strengthen on the back of a potentially more hawkish central bank next week, with the opposite holding true as well.

Will UK data put a floor to sterling’s slide?

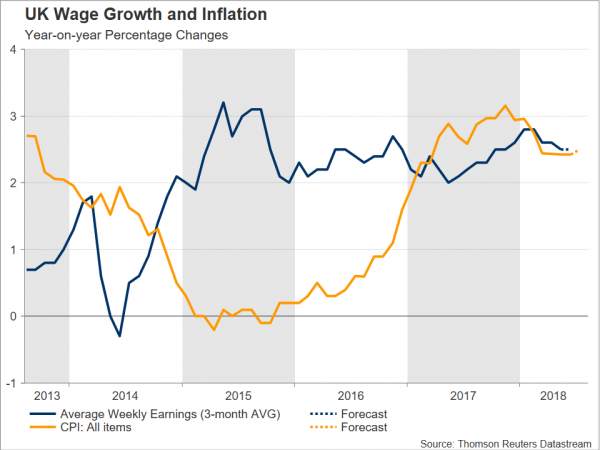

The pound has been in freefall since the Bank of England policy meeting on August 8, as comments by the Bank’s Governor as well as government ministers have fuelled concerns about a no-deal Brexit. However, with cable looking oversold, a batch of data out of the UK next week could help the British currency put an end to its losing streak. Starting with the labour market report on Tuesday, the unemployment rate is expected to remain at the multi-decade low of 4.2% in June, with the number of jobs created during the three months to June projected to come in at the healthy figure of 105k. Another big rise in employment would add support to the BoE’s argument that the labour market is tightening, hence justifying this month’s rate hike. But even more important will be the latest wage growth numbers. Average weekly earnings are anticipated to have risen by 2.5% in the three months to June, exceeding CPI growth – though not by far – for the fifth month in a row and thus translating into positive real income growth.

On Wednesday, the focus will turn to July inflation figures. The annual rate of CPI is forecast to rise by 2.5% from 2.4% in June, while the core rate is expected to remain at 1.9% y/y. After five straight months of below-forecast prints, another miss in July would likely dampen expectations about further rate hikes over the coming months, acting as an additional drag on the British currency. Rounding up the UK releases will be retail sales on Thursday. Those are anticipated to grow by 0.2% m/m in July, bouncing back from a 0.5% dip in June.

Lastly, with Brexit gloom weighing considerably on sterling over the last couple of weeks, any updates on this front are most likely to prove market sensitive; should the cliff-edged Brexit story receive additional traction, then the pound could be in for further losses, and vice versa.

US retail sales and Canadian inflation to be North American highlights

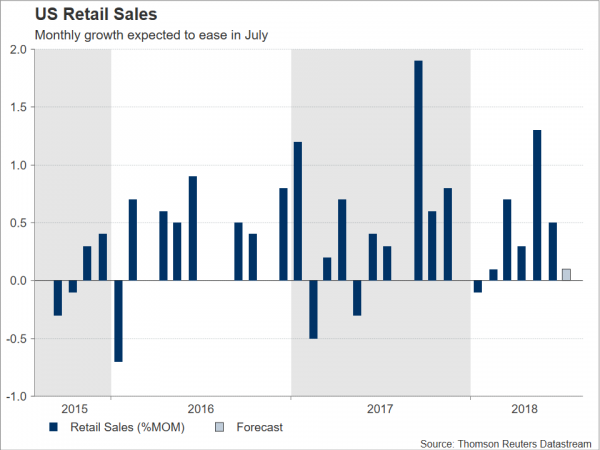

It’s going to be a little busier for US data after the past week’s lull. But it’s going to be a slow start with only July import & export prices on Tuesday to keep traders preoccupied, with things not picking up until Wednesday when there will be a barrage of releases. Among which, the more notable ones will be the New York Fed’s Empire State manufacturing index for August, labour costs and productivity figures for the second quarter, as well as July industrial and manufacturing production numbers. However, the more eagerly awaited release will be the retail sales figures for July as they will provide the first look at the strength of consumer spending going into the third quarter.

Retail sales are forecast to have increased by 0.1% month-on-month in July, slowing from the prior 0.5%. However, the alternative ‘retail control’ measure of sales, which is used in GDP calculations, is forecast to rebound by 0.4% m/m in July after being flat in June. On Thursday, attention will turn to the housing market as both building permits and housing starts are released for July. The Philly Fed manufacturing index is also due on Thursday and there will be more survey data on Friday, this time on consumer confidence in the form of the University of Michigan’s preliminary consumer sentiment reading for August.

A strong set of data could help the dollar index maintain this week’s strong positive momentum, which saw it pierce through the 96 level, rising to a 13-month high.

Turning to the Canadian dollar, which came under pressure this week from a broadly stronger greenback, weaker oil prices and a major diplomatic dispute between Canada and Saudi Arabia, it is likely to prove sensitive to inflation numbers due from Canada on Friday. The 12-month rate of CPI is expected to grow by 2.4% in July, down from June’s 2.5%. Core CPI, as well as the measures of inflation monitored by the Bank of Canada – median, common and trimmed CPI – will also be attracting interest. A data beat is likely to reinforce expectations that the Bank of Canada is the only major central bank that can somewhat keep up with the Fed in terms of rate normalization, subsequently boosting the loonie.

In the big picture, trade tensions and EM considerations which led to a tumble in the Turkish lira and the Russian ruble, having widespread effects on other currencies such as the euro as well, will likely continue attracting attention.