Friday August 3: Five things the markets are talking about

President Trump’s unpredictability on trade is keeping capital markets on the back foot and a theme that is not expected to change anytime soon.

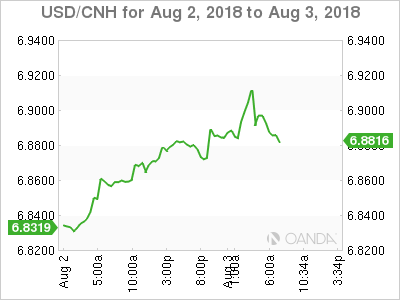

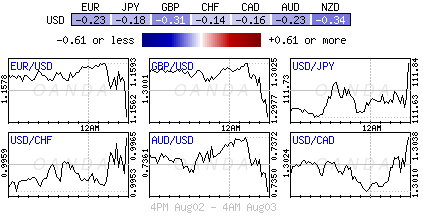

The ‘big’ dollar remains better bid ahead of this morning U.S jobs report (08:30 am EDT), supported mostly by the markets confusion surrounding the escalating Sino-U.S trade conflict.

Nevertheless, this morning’s NFP report is forecasted to show a healthy labor market, with +193K new jobs and an unemployment rate of +3.9%. Many will focus on wage growth, a print of +2.8% could support another dollar leg up as the market prices out four rate increases this year.

The only thing that seems certain is that China will be expected to retaliate if President Trump follows through on a threat to increase tariffs to +25% from +10% on +$200B in Chinese imports.

Worries over protectionism has this week punished global stocks despite a stronger earnings season, supported lower sovereign yields and pushed G10 currency pairs to new weekly lows outright. The Chinese yuan is on track to complete an eighth week decline – its longest losing streak in 25-years.

Elsewhere, Turkish assets and lira remain under pressure after the U.S imposed sanctions on two government ministers over the detention of an evangelical pastor.

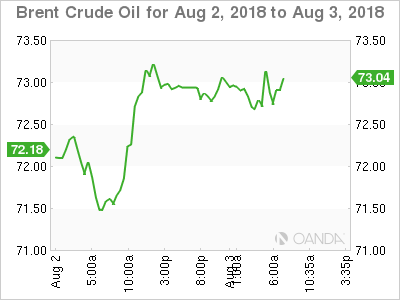

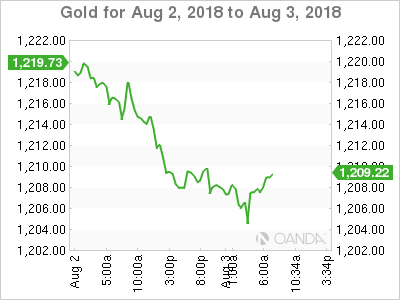

In commodities, oil prices have touched a new two-week low on U.S crude inventories supply concerns, while gold prices remains choppy.

1. Stocks close out the week mixed

In Japan overnight, the Nikkei managed to make a small gain partly due to a sharp rise in Suzuki motors (+8.6% on earnings). The Nikkei average ended +0.06% higher, while the broader Topix fell -0.54% to a three-week closing low on Sino-U.S trade tensions.

Down-under, Aussie shares closed out lower, pressured by the latest exchange of trade threats between the U.S and China, a major market for Australia’s resources exports. At close of trade, the S&P/ASX 200 was -0.10% lower. In S. Korea, the Kospi was +0.77% higher.

In Hong Kong and China, stocks edged lower, dragged down by fears of slowing growth on the mainland, a vaccine scandal that weighed on healthcare shares and persistent worries over the Sino-U.S. trade war. The Hang Seng index fell -0.1%, while the China Enterprises Index lost -0.4%. In China at the close, the Shanghai Composite index was down -1%. For the week, the index lost -4.6%, its worst performance in five months, while the blue-chip CSI300 index was down -1.65%. It lost -5.9% for the week.

In Europe, regional bourses trade sideways despite misses in macro-data. Geopolitical concerns continue to be main theme, with concerns on trade and Brexit negotiation. Market focus turns to non-farm payrolls (NFP).

U.S stocks are set to open small down (-0.1%).

Indices: Stoxx50 +0.3% at 3,479, FTSE +0.4% at 7,609, DAX +0.4% at 12,601, CAC-40 +0.2% at 5,473; IBEX-35 +0.2% at 9,713, FTSE MIB +0.3% at 21,476, SMI -0.1% at 9,149, S&P 500 Futures -0.1%

2. Oil prices edge lower on long-term bearish factors, gold at a record low

Oil prices are down in early trading as the market re-focuses on the ‘bearish’ longer term factors following yesterday’s rally on a report that U.S crude stocks in a key facility fell to their lowest in nearly four-years.

Brent crude futures are at +$73.15 per barrel, down -30c from yesterday’s close, while U.S West Texas Intermediate (WTI) crude futures are at +$68.70 per barrel, down -26 cents from their close.

EIA data yesterday showed that inventories at the key Cushing storage hub in Oklahoma fell by -1.3M barrels, the lowest level in four-years.

However, overall U.S crude oil inventories actually rose by +3.8M barrels last week to +408.74M barrels.

Saudi Arabia, Russia, Kuwait and the U.A.E have increased production to help to compensate for an anticipated shortfall in Iranian crude supplies once planned U.S sanctions come into effect.

Note: Earlier today, China, Iran’s biggest customer, has rejected a U.S request to cut imports from the OPEC member.

Ahead of the U.S open, gold prices have fallen to their lowest print in over a year amid a strong U.S dollar – another loss would be the fourth consecutive weekly. Spot gold is down -0.1% at +$1,206.05 an ounce. For the week, the yellow metal is down about -1.4%. U.S gold futures are -0.5% lower at +$1,214.10 an ounce.

3. Most sovereign yields fall

Turkish data this morning showed that domestic inflation has rallied to a 15-year high of +15.8% year-on-year last month. Numbers like this certainly strengthens the case for further interest rate hikes, however, the central bank faces pressure from the government not to do so.

In Italy, budget concerns have sent the 10-year BTP yields back above the +3.05% to a 10-week high, while lower down the curve, Italian two- and five-year BTP yields have backed up +22 to +25 bps to +1.27% and +2.32% respectively.

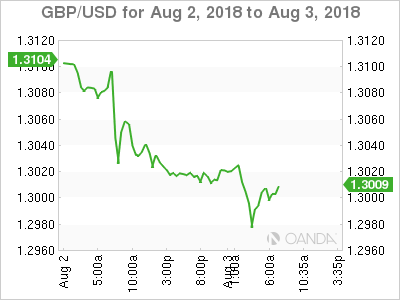

BoE’s Governor Carney in an interview this morning stated that interest rates would not hit the +5% pre-crisis level for a long time. He reiterated that “one” rate hike per year could be seen as a rule of thumb and that the possibility of a no-deal Brexit was uncomfortably high.

The yield on U.S 10-year notes fell -1 bps to +2.98%. In Germany, the 10-year Bund yield fell -3 bps to +0.43%, while in the U.K the 10-year Gilt yield dipped -2 bps to +1.377%.

4. Dollar gets the green light

The ‘big’ dollar is maintaining a firm tone heading into the U.S open.

EUR/USD (€1.1572) has dipped to test new one-month lows as Italian bond yields backed up as Italy Finance Minister Tria holds a top-level budget meeting.

GBP (£1.2997) remains a notable underperformer among G10 currencies despite the fact that BoE officials yesterday ‘unanimously’ voted to hike +25 bps. The market is interpreting the BoE’s decision as a “dovish” hike. Others are arguing that the BoE is heading towards a policy mistake amid heightened Brexit uncertainty.

TRY ($5.0783) managed to hit a fresh record low overnight ($5.1100+). However, slightly better Turkish CPI data helped to push the Lira off its record lows.

China’s Yuan is poised for its longest weekly losing streak on record on continued concerns over a potential trade war. The CNY currency is heading for its eighth weekly decline with USD/CNY approaching the $6.90 area.

Note: CNY is off its worst levels overnight after a large Chinese bank was seen selling USD. It traded as low as ¥6.8965 before paring some of those losses to ¥6.8715.

5. U.K services PMI falls

Data this morning showed the purchasing managers’ survey on U.K. services-sector activity falling to 53.5 in July, missing expectations for 54.7. This morning’s miss reinforces market concerns about weakness in the British economy over Brexit uncertainty.

According to Markit, who compile the survey, “service providers commented that Brexit uncertainty had held back new project wins, reflecting risk aversion and a wait-and-see approach to investment spending among international clients.”