Here are the latest developments in global markets:

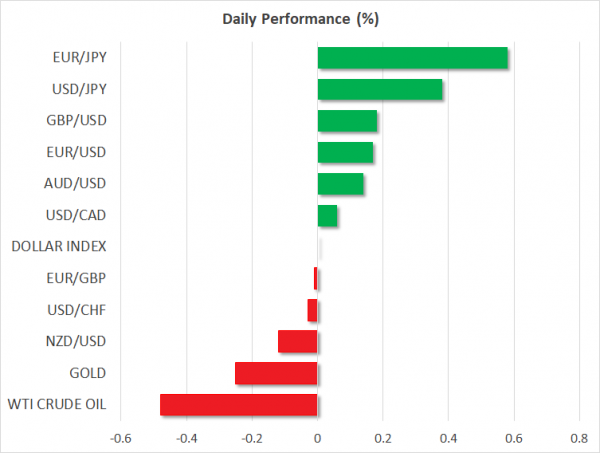

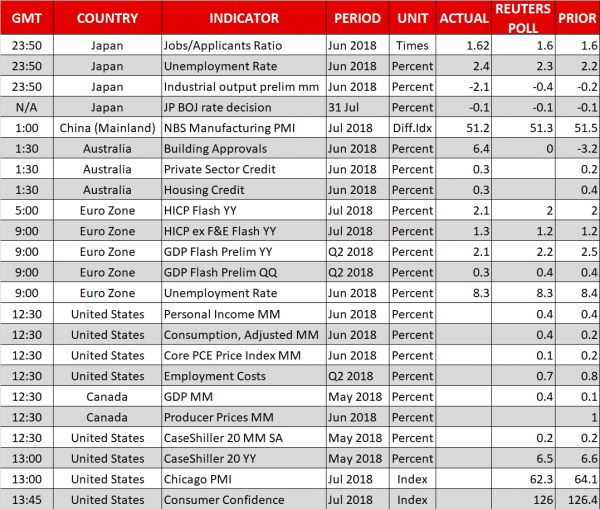

FOREX: The US dollar edged higher against the Japanese yen on Tuesday (+0.37%), reaching an 11-day high of 111.58, after the Bank of Japan (BOJ) tweaked its massive stimulus program to make it more flexible, but disappointed those looking for major hawkish changes. Euro/yen and pound/yen jumped by 0.57% and 0.58% respectively. The dollar index, which gauges the greenback’s strength versus six major currencies remained steady near its opening level of 94.32. Turning to the euro area, annual inflation rose by 2.1% y/y in July 2018, up from 2.0% y/y in June according to a flash estimate, while the bloc’s preliminary GDP rose by 0.3% q/q during the second quarter of 2018, down from 0.4% previously. On a yearly basis, growth decelerated to 2.1% from 2.5% before. Euro/dollar advanced by 0.17% and still stands above 1.1700, while pound/dollar inched up by 0.19%. Meanwhile, the antipodean currencies were mixed. Aussie/dollar showed some strength, adding 0.12% to its performance, though kiwi/dollar fell by 0.13%. Dollar/loonie posted significant gains during the Asian session following a report that Canada was rejected from US-Mexico NAFTA talks. However, it pared its gains in the following hours to return slightly above its opening level at 1.3040 (+0.05%).

STOCKS: European equities traded mixed today, despite another active session for regional earnings. The pan-European STOXX 600 traded marginally higher by 0.03%, while the blue-chip Euro STOXX 50 was up by 0.23%. Meanwhile, the German DAX and the Italian FTSE MIB were trading lower by 0.09% and 0.06% respectively. However, the British FTSE 100 rose by 0.11% and the French CAC 40 climbed by 0.03%. Turning to the US, futures tracking the S&P 500 are pointing to a higher open today, while those following the Dow and Nasdaq 100 suggest a lower one.

COMMODITIES: Oil prices dropped on Tuesday as oversupply concerns returned, following a Reuters poll showing that OPEC’s production in July likely rose further. West Texas Intermediate (WTI) crude oil dipped by 0.47% and fell below the $70 handle again, while Brent declined by 0.28% at $74.76. In precious metals, gold prices fell by 0.25% to $1,218.2 and look set to complete the fourth day of declines in a row.

Day ahead: US core PCE index and Canadian GDP in focus; New Zealand’s jobs data to follow

The most significant data releases left on the economic calendar for Tuesday will be out of the US. Monthly Canadian GDP figures could also attract some attention. Later, during the Asian trading session Wednesday, kiwi-traders will turn their gaze to New Zealand’s quarterly employment data.

At 1230 GMT, the US will be on the receiving end of personal income and consumption data for June. The Fed’s preferred inflation measure – the core PCE price index – is also due out at the same time. Forecasts are broadly optimistic. The core PCE rate is projected to have held steady at 2.0% in yearly terms, exactly in line with the Fed’s inflation target. Meanwhile, both personal income and spending are projected to have risen by 0.4% from the previous month, which would keep the income rate unchanged but would mark a notable acceleration in consumption that rose only 0.2% in May.

Such numbers would likely underscore that the US economy finished Q2 on a strong footing, and to the extent that they amplify expectations for the Fed to deliver another two 25bps rate increases later this year, they could support the dollar – particularly against the battered yen. That said, the greenback’s broader direction will also depend on any signals the Fed sends upon completion of its two-day policy meeting tomorrow, as well as on the quality of the US employment report on Friday.

Other, second-tier releases out of the US include the employment costs index for Q2 (1230 GMT), the Chicago PMI for July (1345 GMT), and the CB consumer confidence index (1400 GMT) for the same month.

In Canada, monthly GDP data for May (1230 GMT) are expected to show an acceleration in economic growth to 0.4% in monthly terms, from 0.1% previously. Producer price data for June will be made public at the same time.

In energy markets, the private API weekly inventory data will be in focus at 2030 GMT.

On the equities front, tech titan Apple will release its quarterly earnings after the US market close.

A few hours later, during the early Asian session on Wednesday (Tuesday 2245 GMT) New Zealand will release its employment figures for Q2. Forecasts point to a generally strong report, but survey-based gauges of the labor market (ANZ job ads, Business NZ PMI) were less optimistic, which likely renders the kiwi vulnerable to a downside surprise.