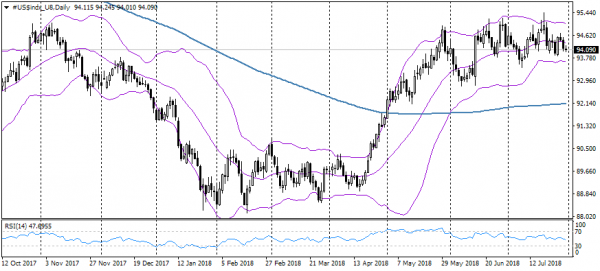

In the currency market, the dollar was under some pressure following the data that indicated a weakening of the inflation in the Eurozone. The slowdown in prices in Germany and Spain can be seen as a harbinger of the inflation easing in the entire euro region, the preliminary statistics on which will be published later today. Low inflation increases the real value of the investment in the euro and makes it a bit more attractive to invest in this currency at a time when the ECB intends not to raise the rate for at least a year. Against this backdrop, the single currency returned to the area above 1.17, and returned back almost completely its fall after the ECB press conference last week.

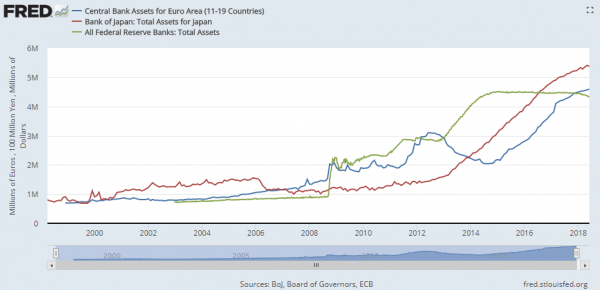

The currency market on Tuesday morning managed to avoid serious fluctuations. The Bank of Japan made only minor tweaks in its monetary policy, promising more flexibility in carrying out QQE and promising to keep the rates “very low” for some time, as the inflation is still far from the target 2%. The markets had feared that the Bank of Japan would start curtailing incentives aggressively, along with the ECB, which is reducing its asset purchases to the balance and with the Fed, which raises rates and reduces its balance. The simultaneous winding down of incentives from the “big troika” would be an even more serious test for markets that are already concerned about the uncertainty surrounding international trade policy.