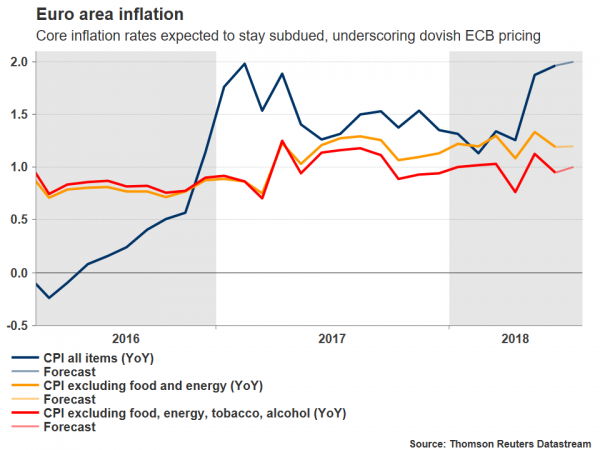

The Eurozone will see the release of its preliminary inflation data for July, as well as the first look at GDP for Q2, both on Tuesday at 0900 GMT. Forecasts are pointing to largely unchanged inflationary pressures and economic growth, something likely to solidify dovish expectations around ECB rate hikes, potentially keeping any advances in the euro limited for now.

The euro is still licking its wounds following the latest European Central Bank (ECB) meeting last week, where President Draghi endorsed the relatively dovish market pricing around a potential rate increase late next year. He was essentially seen as applauding the fact there is some uncertainty involved with current pricing, highlighting that the Bank wants to keep its options open and not pre-commit to anything so early. As a result, bets for a 10bps rate increase in September next year faded a little, with the implied probability for one now resting at 69%, EONIA swaps and Euribor futures suggest. That said, markets are much more confident that such a move will occur by October 2019, something that is fully priced in already.

This week’s data dump out of the Eurozone seems unlikely to alter this pricing in a material manner, at least according to forecasts. In July, preliminary figures are projected to show that the bloc’s headline inflation rate held steady at 2.0% in yearly terms. The core CPI rate which excludes energy and food items is also anticipated to remain at 1.2%, while the measure that also ignores tobacco and alcohol is forecast to tick up to 1.0% on a yearly basis, from 0.9% previously. As for GDP growth, it’s expected to come in at 0.4% in quarterly terms in Q2, unchanged from Q1. This would drag the yearly growth rate down to 2.2%, from 2.5% previously. The bloc’s unemployment rate for June is also due out.

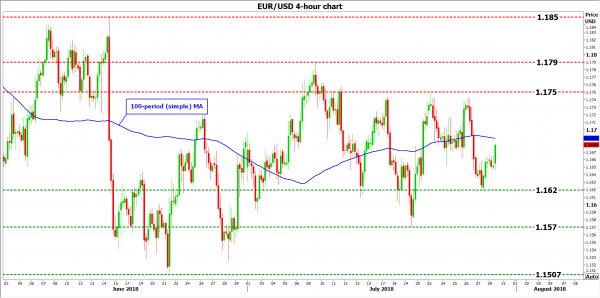

In case these data come in stronger than projected, particularly on the core inflation and GDP fronts, markets could become a little more confident regarding the likelihood of a September 2019 ECB rate hike and hence, push the euro a little higher. Technically, looking at euro/dollar, a first line of resistance in case of advances is likely to be found around 1.1750, the peak of July 23, with the area around it also encapsulating a few tops from the recent past. An upside break could open the way for the 1.1790 zone, marked by the July 9 top, with even greater advances opening the way for the June 14 top of 1.1850.

On the downside, and in case of a data miss that turns investors even more pessimistic around a September 2019 rate hike, immediate support to declines may come from 1.1620, the low of July 27. Even lower, the July 19 trough of 1.1570 would come into view, before the 1.1506 hurdle attracts attention.

Note that the US will also release crucial data just a few hours after the Eurozone. Those can also move the pair.