Here are the latest developments in global markets:

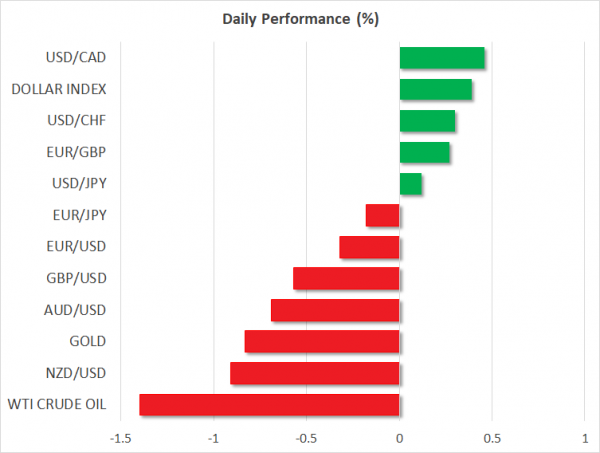

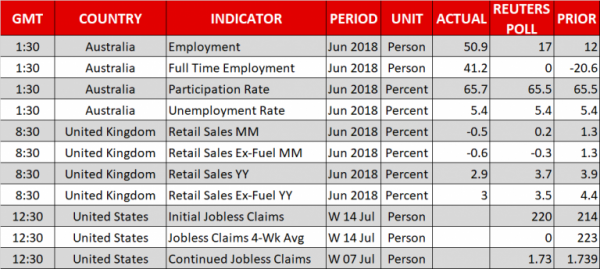

FOREX: Sterling tumbled by 0.69% against the greenback on Thursday, hitting a fresh 10-month low of 1.2970 in the wake of worse-than-expected retail sales figures out of the UK. Month-on-month retail sales dropped 0.5% in June from 1.4% in May, missing market expectations of a 0.2% gain. On a yearly basis, the index increased 2.9% versus 3.7% expected and May’s mark of 4.1%. Yet, the report revealed that quarter-on-quarter retail sales growth was the strongest since Q1 2004. The dollar index versus six major currencies added 0.47% to its performance, registering a one-year high of 95.55. An upside movement was seen in dollar/yen on Thursday as well, with the pair trading higher by 0.12%, surpassing the 113.00 handle again. On the other hand, euro/dollar was down by 0.27%, near the 1.1600 key level. In the antipodean sphere, aussie/dollar reversed earlier gains, edging sharply lower (-0.76%) to 0.7342, while kiwi/dollar plunged by 0.93% to 0.6730, paring the gains of the previous three days. Meanwhile, dollar/loonie rose by 0.50% to 1.3233.

STOCKS: European equities were trading mostly lower on Thursday with an exception the Euro STOXX 50 and the British FTSE 100 index , which advanced by 0.20% and 0.07% respectively at 1130 GMT. The pan-European Stoxx 600 dived by 0.13% with basic materials and utilities leading losses. The German DAX 30 and the Italian FTSE MIB were also moving down, by 0.45%, and 0.35% respectively. Also, the Spanish IBEX 35 declined by 0.35% and the French CAC 40 lost 0.51%. Futures on the Dow, S&P 500 and Nasdaq 100 traded higher yesterday and are pointing to a higher open today on Wall Street.

COMMODITIES: Oil prices dropped considerably today after an unexpected rise in US crude stockpiles yesterday. The report also showed that US output hit record highs at 11mn barrels per day. West Texas Intermediate (WTI) crude oil plummeted by 1.25% near $68 per barrel, erasing some of Wednesday’s gains. In addition, London-based Brent plunged by 1.32% to around $72. In precious metals, gold prices dropped by 0.83% to $1,216.2 per ounce, silver dipped by 1.82%, while copper tumbled by 3%, all of them recording new 1-year lows.

Day ahead: US Philly Fed Manufacturing index pending; Japan reports on inflation

Data releases will be relatively light in the remainder of the day, with Philadelphia’s Fed Manufacturing Index being a key delivery investors will pay attention to confirm the Fed’s chief recent upbeat assessment on the US economy. Trade headlines will be in focus as well, as the US keeps the pressure on China and the EU with scope to persuade its allies to soften their trade restrictions on US products.

Following Jerome Powell’s two-day testimony on Wednesday and Thursday, in which the Fed chief highlighted that the US economy could bear higher interest rates this year and trade risks will not keep the central bank from proceeding accordingly, the Federal Reserve Bank of Philadelphia is scheduled to publish its manufacturing index at 1230 GMT, adding further evidence on the country’s economic performance. According to forecasts, the index compiled by a survey from 250 manufacturers in the Philadelphia district, has bounced from 19.9 to 21.5 in July, remaining near the average of the past two years; a sign that the industry is growing at a healthy pace – as long as the measure holds above zero. In the event of an upward surprise, the dollar could expand well into the 113 handle and even reach fresh peaks. Initial jobless claims for the week ending July 14 will be out at the same time, although the greenback has shown little reaction to the data in the past few months.

In the trade front, the tariff turmoil continues to weigh in the background, maintaining some degree of risk-off sentiment in the markets. Yesterday the White House National Economic Council Director, Larry Kudlow, blamed China for stalled trade talks, with China’s foreign ministry saying today that it doesn’t want a trade war but it’s not afraid of one, pointing its finger to the US instead. Regarding relations with Mexico, Kudlow characterized negotiations as a “promising avenue”, a week after the US Secretary of State Michael Pompeo, traveled to Mexico to meet with both Mexico’s current administration and incoming president.

Elsewhere, Japan will see inflation readings early in the Asian session at 2330 GMT, with forecasts being for a slight pickup in consumer prices. Particularly, analysts expect the nationwide core CPI to inch up by 0.1 percentage points in June to 0.8%, remaining far below the BoJ’s 2% price target.

As for today’s public appearances, a meeting between the Russian Energy Minister Alexander Novak and Chinese officials in China to discuss energy cooperation could attract some interest, while in Buenos Aires in Argentina, the ECB Executive member, Benoit Coeure will be participating at the G20 finance ministers and central bank governors and deputies meeting, which will conclude on July 22.

In equity markets, the earnings season continues with Microsoft Corporation being among companies to release quarterly results after the market close.