Thursday July 19: Five things the markets are talking about

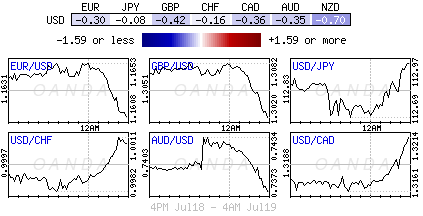

Yesterday, the dollar retreated from a three-week high as the market cashed in on gains the currency made after two days of testimony by U.S Fed Chair Powell reinforced a strong economic outlook.

In congressional testimony on Tuesday and Wednesday Powell said he believed the U.S was on course for years more of “steady growth,” and played down the risks to the U.S economy of an escalating trade conflict. He also noted that the U.S economy “may not yet have reached full employment,” while also noting that risks to domestic inflation forecasts were “roughly balanced.”

Ten-year U.S Treasury yields touched a three-week high after his comments, while this morning, the dollar is extending this week’s gains, further weighing on EM assets, while China’s yuan deepens its losses.

Elsewhere, stocks are edging higher in Europe after a mixed Asia session, while oil retraces some of yesterday’s gain as the market assesses global conflicting supply-and-demand signals. Gold prices are again under pressure for a fifth straight session.

On tap: Initial U.S. jobless claims for the week ended July 14, the Philadelphia Fed Business Outlook Survey and the Conference Board’s U.S. Leading Index (08:30 am EDT).

1. Stocks mixed sessions

In Japan, the Nikkei snapped a four-day winning streak overnight as investors booked profits. The weakness in tourism related equities offset gains in oil names and machinery makers. The Nikkei closed trade -0.1% lower, in line with the broader Topix.

Down-under, Aussie stocks edged higher overnight, helped by buying in financials and material firms. The S&P/ASX 200 index closed +0.3% higher, after having climbed +0.7% yesterday. In S. Korea, the Kospi index and the won both weakened overnight over lingering concerns raised by trade tensions. The index was down -0.34%.

In Hong Kong and China, equities fell on a weaker yuan. The currency (¥6.7066) has dropped to a 12-month low outright after news that Beijing plans to step up monetary easing measures. In Hong Kong, the Hang Seng index fell -0.2%, while the China Enterprises Index lost -0.1%. In Shanghai, the blue-chip CSI300 index fell -0.1%, while the Shanghai Composite Index lost -0.5%.

In Europe, regional bourses trade mostly lower across the board led by the French CAC and German DAX. The FTSE is outperforming on the continued weakness in the pound (£1.3004).

U.S stocks are set to open in the ‘red’ (-0.2%).

Indices: Stoxx600 -0.1% at 386.5, FTSE +0.2% at 7689, DAX -0.4% at 12716, CAC-40 -0.4% at 5425, IBEX-35 -0.1% at 9743, FTSE MIB -0.2% at 21,929, SMI +0.2% at 8951, S&P 500 Futures -0.2%

2. Oil prices fall on record output and stock build, gold lower

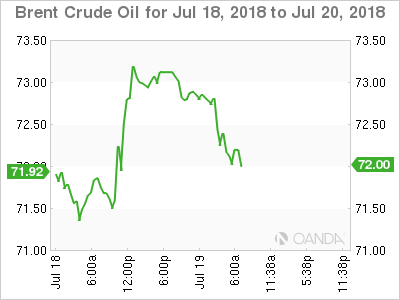

Oil prices remain under pressure after official U.S data yesterday showed an unexpected rise in crude stockpiles – U.S output hit a record high and major oil exporters increased production.

International crude oil benchmark Brent is down -40c at -$72.50 a barrel, while U.S light crude is -20c lower at +$68.56.

Brent has fallen almost -9% from last week’s high above +$79 on emerging evidence of higher production from Saudi Arabia and other members of the OPEC as well as Russia and the U.S.

Note: The EIA indicated yesterday that U.S crude production had reached +11M bpd for the first time – the U.S has added nearly +1M bpd in production since November, thanks to rapid increases in shale drilling.

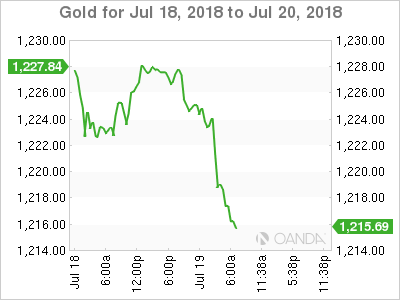

Ahead of the U.S open, gold has extended its fall to a one-year low overnight as the ‘big’ dollar firmed after the Fed asserted the need for further interest rate hikes amid a strong economy. Spot gold is down -0.2% at +$1,223.56 an ounce. The yellow metal slipped to its lowest since July 2017 at +$1,220.41 an ounce earlier in the session. U.S gold futures for August delivery are -0.4% lower at +$1,223.20 an ounce.

3. U.S bill yields back up

This week has seen U.S three-month T-bill yields back up above the +2% mark for the first time since June 2008, just before the global financial crisis erupted in earnest.

Higher yields reflect anticipated further Fed hikes. Currently, there is a +90% probability of another +25 bps increase, to +2%-2.25%, at the Sept. 25-26 meeting of the FOMC. A further hike, to +2.25%-2.50%, has about a +65% chance.

Elsewhere, the yield on 10-year Treasuries has increased +2 bps to +2.89%, the highest in almost four weeks. In Germany, the 10-year Bund yield has advanced +1 bps to +0.35%. In the U.K, the 10-year Gilt yield has climbed +2 bps to +1.226%, the largest increase in more than a week.

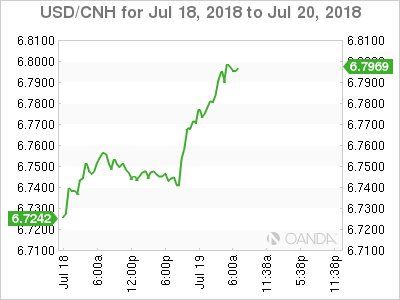

4. Chinese yuan hits a 12-month low

Overnight, the Chinese yuan (¥6.7066) has managed to print new lows not seen since last July, and the gap between onshore and offshore rates continues to widen, suggesting greater pessimism in the market.

To date, the yuan has been hurt by a worsening trade conflict between the U.S. and China, and on expectations that the People’s Bank of China (PBoC) will ease monetary policy further, while the Fed is likely to keep raising borrowing costs.

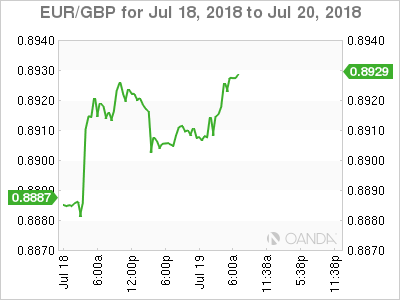

Elsewhere, sterling has dropped below the psychological £1.30 outright after U.K retail sales data disappointed (see below) and EUR/GBP has rallied to a four-month high of €0.8941.

The Bank of England (BoE) is expected to raise interest rates on Aug. 2, but weaker economic data may make it harder for them to do so.

Note: There is a +£2B option with a strike price of £1.3000 expiring later today.

5. ‘Footy’ dented retail U.K sales

Data this morning from the ONS showed that U.K. retail sales declined in June, as Britons chose to watch the soccer World Cup rather than shop.

Sales in June declined -0.5% compared with May, dragged lower by fall in sales of clothing and footwear – retailers are blaming the tournament. However, food stores had a better month, with sales rising +0.1% compared with May, reflecting purchases of barbecue goods during a heat wave.

Despite the decline, sales over the three-months through June grew +2.1%, the strongest three-month period in three-years. The data suggest the economy accelerated in Q2 after a slow start to the year.

Note: The BoE is expected to lift its benchmark interest rate as soon as next month to bring annual inflation back to its +2% goal.