Here are the latest developments in global markets:

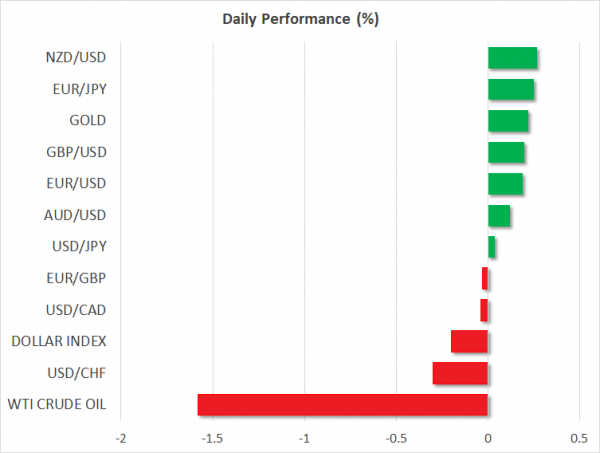

FOREX: The US dollar was trading below the 6-month high of 112.79 today against the Japanese yen, but managed to add some gains to its daily performance (+0.02%) ahead of the release of the US retail sales later in the day. The dollar index, which gauges the greenback’s strength versus six major currencies, moved lower by 0.24%. Pound/dollar rebounded sharply from near the 1.3101 barrier on Friday and drove the price even further to 1.3265 (+0.24%) on Monday. Meanwhile, euro/dollar climbed by 0.23%, surpassing the 1.1700 psychological level once again despite Italy’s Deputy Prime Minister calling the euro “an experiment that began badly”. However, he reiterated that Italy has no intentions to abandon the common currency. In the antipodean sphere, aussie/dollar gained 0.15% and aussie/yen jumped to 83.58 (+0.23%). Kiwi/dollar stood higher as well at 0.6781 (+0.27%). Dollar/loonie pulled back after meeting resistance near its 20-day simple moving average on Friday, and is 0.11% lower today.

STOCKS: European stocks were mixed at 1100 GMT. The pan-European STOXX 600 and the blue-chip Euro STOXX 50 were down by 0.11% and 0.33% respectively, with telecommunications, energy, and utilities leading the losses. The German DAX 30 rose by 0.12%, while the French CAC 40 traded down by 0.21%. The Italian FTSE MIB jumped 0.10%, whereas the UK’s FTSE 100 tumbled by 0.72%. .US stock futures tracking the major indices were pointing to a negative open, while earnings season continues from Bank of America, BlackRock and Netflix’s on Monday.

COMMODITIES: Oil prices were falling on Monday as Saudi Arabia was said to offer extra crude supplies, while Libya’s oil-exporting facilities returned to operation. Meanwhile, comments by the Russian energy minister on Friday stating that Russia and other oil producers could raise supply by 1 million bpd or more in case supply shortages weigh on the market helped prices to move lower. After the aggressive sell-off on Wednesday which pushed West Texas Intermediate (WTI) crude oil below $70 per barrel, WTI was trading at $69.86/barrel (-1.65%). Also, London-based Brent plummeted by 2.03% today, crossing slightly below $74.00. Gold prices recovered some of Friday’s losses (+0.30%), but continue to hover just above their lows for the year.

Day ahead: US retail sales to drive the dollar; Trump-Putin summit in focus

Trade concerns might remain out of the spotlight on Monday as the focus will likely shift to the economic calendar and a crucial summit held between the US President and the Russian leader, Vladimir Putin in Helsinki. Brexit developments will also be on the radar as Brexiteers lawmakers are preparing to challenge the British Prime Minister in a vote on amendments to legislation on the government’s post-Brexit customs relationship with the EU.

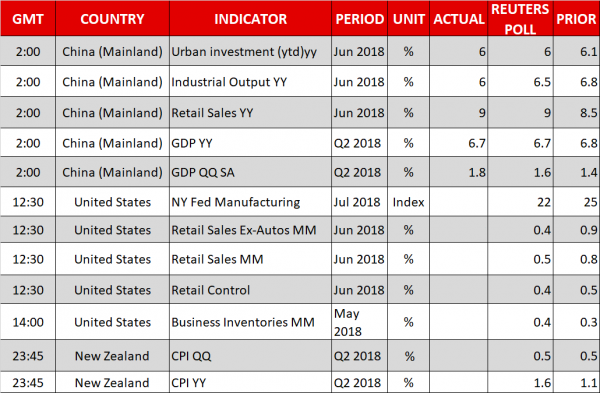

At 1230 GMT, the Census Bureau is expected to say that US retail sales have risen by 0.5% month-on-month (m/m) in June, slower than in May when they grew by 0.8%. In the absence of automobiles, the core measure is also expected to ease, posting a growth of 0.4% compared to a 0.9% expansion in the preceding month. A stronger-than-expected outcome could raise the odds for two more rate hikes this year, giving a lift to the dollar. On the other hand, should the numbers disappoint, and in the absence of any trade or political news, the greenback could move lower. The New York Empire State Manufacturing Index for the month of July will come in light at the same time but forecasts point to a decline as well. Later in the day, US business inventories for May are projected to show a slight acceleration from the previous month (1400 GMT).

In other data releases, inflation readings for the second quarter will be of importance in New Zealand during the Asian trading session (2245 GMT), with analysts predicting that consumer prices have gone up by 1.6% y/y, while on a quarterly basis they believe that the CPI has remained unchanged at 0.5%. Within the Reserve Bank of New Zealand, a rate cut is still a possibility as policymakers weigh low inflationary pressures – CPI below the RBNZ’s midpoint price target of 2.0% – and trade uncertainties. Hence a potential miss in the data would likely persuade policymakers to take that scenario more seriously, pushing the kiwi lower.

Meanwhile in Australia, traders will be waiting for the Reserve Bank of Australia’s (RBA) meeting minutes on Tuesday at 0130 GMT to identify any further details pertaining to the central bank’s decision to leave rates steady on July 3. Not a lot is expected in terms of fresh policy signals, with policymakers likely to highlight the US-China trade tensions, subdued wages, and high household debt levels. Nevertheless, the aussie could experience some upside in case the RBA uses a more positive tone on the country’s outlook. Note that markets price a rate hike coming only in the late 2019.

In the UK, the Brexit plan will head to the Parliament, where lawmakers are scheduled to vote on amendments to the legislation on the government’s post-Brexit customs relationship with the EU. While, the British Prime Minister, Theresa May, is not expected to be defeated, Brexiteers could use a louder voice to demand stricter rules on the exit plan, where a higher number of votes against May’s strategy could bring another political headache and a potential sell-off to the pound. Recall that the UK’ Brexit negotiator, David Davis, and the foreign minister, Boris Johnson, resigned a week ago as both officials said May’s proposals were likely to keep the UK too close to the EU.

As for today’s special meetings, all eyes will turn to Helsinki as the US President, Donald Trump will finalize his European tour – which passed with controversies so far – by meeting the Russian President, Vladimir Putin. After criticizing his NATO allies over their defensive spending in Brussels and the Brexit plan in London last week, Trump is anticipated to discuss Syria, Ukraine, Iran’s nuclear program, and Russia’s meddling in the 2016 US elections at his first summit with Putin, although they have already met in on the sidelines of multilateral talks. Yet his comments to the CBS Evening News showed that he has low expectations of what the summit could bring out, though he added that “nothing bad is going to come out of it, and maybe some good will come out.”

In equities, Bank of America and BlackRock will be reporting quarterly earnings before the US markets open, with Netflix’s respective report hitting the markets after the closing bell on Wall Street.