For the 24 hours to 23:00 GMT, the EUR declined 0.13% against the USD and closed at 1.1749.

On the data front, Eurozone’s Sentix investor confidence index unexpectedly climbed to a level of 12.1 in July, defying market consensus for a fall to a level of 9.0. In the prior month the index recorded a reading of 9.3.

Meanwhile, Germany’s seasonally adjusted trade surplus widened more-than-expected to €20.3 billion in May, compared to a surplus of €19.0 billion in the previous month. Markets participants had expected trade surplus to widen to £20.0 billion.

In the US, consumer credit rose $24.6 billion in May, marking its highest level in 6-months and compared to a revised rise of $10.3 billion in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1753, with the EUR trading slightly higher against the USD from yesterday’s close.

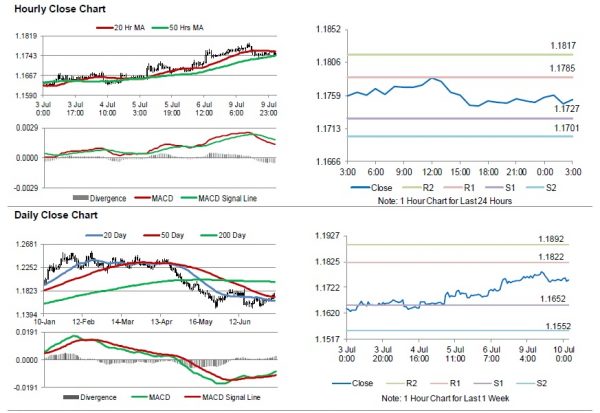

The pair is expected to find support at 1.1727, and a fall through could take it to the next support level of 1.1701. The pair is expected to find its first resistance at 1.1785, and a rise through could take it to the next resistance level of 1.1817.

Moving ahead, investors would await Euro-zone’s ZEW economic sentiment index along with Germany’s ZEW survey indices, all for July, due to be released in few hours. Also, the US NFIB small business optimism for June, will garner significant amount of investor attention.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.