The euro is up slightly against the dollar after Angela Merkel agreed with interior minister Horst Seehofer on a new border control plan.

According to the deal, Germany will set up major holding and processing centres for asylum seekers at the German borders. Horst believes that this will help the country prevent or reduce illegal entry by migrants via the Austrian-Germany border. There is a long way to go before the new policy becomes government policy because the deal requires consent from the social democrats.

In other news, major economic data from the US is expected today including durable goods and factory order numbers, which will give traders an indication of how well the economy is performing. From the EU, releases will include retail sales and employment numbers from Spain.

The dollar index is up after yesterday’s PMI data from the Institute of Supply Management (ISM). The data showed that the PMI was up in June to 60.2. This was better than the expected 58.4 and the 58.7 released in June. The figures served as a positive boost for the dollar at a time when manufacturers are facing a big challenge in their industry. On the other hand, construction rose by 0.4%, which was lower than the expected 0.5%.

In late January, the Australian dollar started to slide after reaching a high of 0.8134 against the dollar. Today, the pair is trading at 0.7338, which is the lowest level since September last year. The decline was due to dovish statements from the RBA and the hawkishness of the Fed. Today, the data on building approvals for the month of May disappointed. The approvals declined by 3.2%, which was worse than the expected 1.0% increase. The RBA left interest rates unchanged at 1.50%.

EUR/USD

The EUR/USD pair is trading at 1.1632, which is higher than yesterday’s intraday low of 1.1590. The latter was the pair’s 38.2% Fibonacci Retracement level while the current price is slightly above the 50% level. Traders will focus on the deal between Angela Merkel and her coalition partners. Depending on the news, the pair could continue the upward momentum, which will see it cross yesterday’s high of 1.1690. The alternative scenario is where the pair slides. If it does, it will likely test the 1.1574, which is the 23.6% Fibonacci Retracement level.

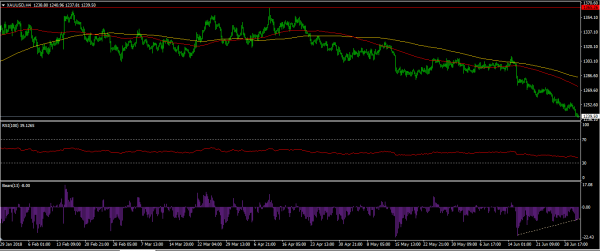

XAU/USD

The XAU/USD pair has continued to slide and is currently trading at the lowest level since December last year. The decline of gold is mostly because of a strong dollar. The pair is currently at $1239.41. The price is below the 100 and 200-day moving average. The pair is likely to remain at these lows as traders wait for the RSI to cross the oversold level of 30.

AUD/USD

The Australian dollar has dropped by almost 6 percent this year. This is partly because of the dovishness of the Reserve Bank of Australia (RBA). The AUD/USD pair is currently trading at 0.7337, which is higher than yesterday’s close of 0.7310. The price is below the 50-day moving average and in line with the 25-day moving average. Today, the downward momentum could continue after the RBA made no major policy changes.