Highlights

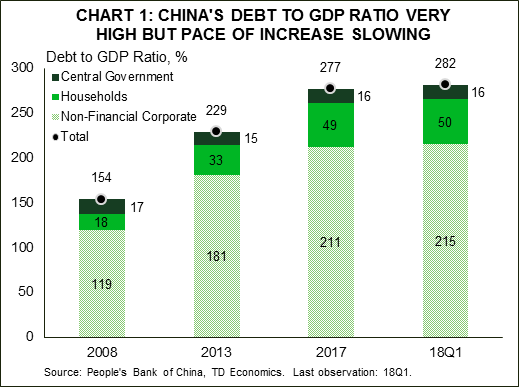

- China’s rapid accumulation of government, household and corporate debt – particularly since 2009 – raises concerns about the risk of a China-centric financial crisis that could trigger a global economic downturn. Chinese authorities have made some progress on curbing credit growth through a combination of ongoing structural reforms, but more still needs to be done.

- The government faces the difficult balancing act of weaning China’s economy off debt-intensive activities while not fueling a dramatic and undesired economic slowdown. The result has been a further, though recently more moderate, increase in the debt-to-GDP ratio.

- U.S. tariffs pose a relatively small risk to the growth outlook for China over the next six quarters. As such, the anticipated drag on economic growth from the announced tariffs is unlikely to result in a sufficient shock to trigger a deleveraging episode. Instead, the tariffs are likely to impede progress by Chinese authorities in trying to wean the Chinese economy off of its credit addiction.

- Over the next few years we anticipate that China will stay the course on credit and product market reforms that gradually bring down debt growth to under that of nominal GDP. Ultimately, however, a debt-restructuring will be necessary to address the mountain of legacy borrowing.

- This process of deleveraging poses risks to the global economy. Still, these risks are mitigated by a number of factors, including China’s relatively closed banking system, its current account surplus, and high domestic savings rate. Moreover, a strong economic growth outlook should ensure government more than enough fiscal space to absorb the cost of a debt restructuring.

Global growth has recovered from the doldrums of the financial crisis, and China has been a big part of the recovery story, having recorded growth averaging a healthy 8.1% annually over the past decade. As a result, China has become the largest economy in the world, comprising 17.7% of global economic activity on a purchasing power parity basis (2016 weights). This pace of economic growth largely reflects strong, above-trend advances in the immediate aftermath of the financial crisis; growth since 2014 has averaged 7%, and is expected to slow to around 6.5% this year.

China’s rapid growth has not come without a cost. In order to maintain a high level of economic activity, authorities have relied upon boosting investment spending, which in turn has been fueled by the creation of new debt. Indeed, the rapid run-up in debt in China over the past decade has hit a peak of 282% of GDP as at the first quarter of 2018 (Chart 1), raising concerns about the sustainability of China’s investment-driven economic growth model. With such a large global economic footprint, an eventual deleveraging episode could post a substantial drag on global economic activity, and possibly trigger a global recession.

Historically, rapid increases in credit have often been followed by a deleveraging cycle, either via a dramatic slowdown in credit growth or an outright contraction in the stock of debt via write-offs. In some cases, a deleveraging episode can result in a dramatic but brief decline in demand, followed by a prolonged gradual recovery, such as that observed in the 2009 financial crisis.1 In the case of China, this could see economic growth fall more than half to a 2-3% pace from its current pace of growth of about 6.5-7%, largely owing to a collapse in investment spending.2

Such a scenario would likely shave off more than 0.7 percentage points off annual global economic activity. In addition, a large decline in Chinese growth could send ripples through the global financial system, as debt-laden Chinese firms and financial intermediaries may have to shed foreign assets to restore balance sheet health. A large devaluation in the renminbi would surely follow, alongside intervention by the People’s Bank of China, with fears of rising domestic inflation facilitating an acceleration of capital outflows from China to safer foreign assets.

While much is at stake, there appears little risk of a China-led global financial crisis over the next few years. For one, foreign investment in China has been limited, including foreign bank lending to the Middle Kingdom. More recently Chinese authorities have promised to nudge the door open to more foreign investment, but foreign banking claims currently remain low given the extensive trade linkages with the U.S. and Europe. Chinese authorities have prioritized rebalancing of the economy away from investment-heavy, debt-fueled growth, and toward less debt-intensive service industries.3 Moreover, authorities have made strides in shutting down excess capacity in inefficient and underperforming industries such as steel manufacturing. But, as GDP growth has eased in lockstep, these measures have thus far only managed to slow the upward climb in the overall debt ratio. Further, these efforts have done little to deal with the legacy of past debts that have accumulated over the years.

As authorities continue to gradually wean the economy off its debt reliance, we see the pace of debt accumulation slowing from last year’s clip of 9.2% towards 6% over the next few years, below our expectations for nominal GDP growth. Ultimately, the large amount of legacy debt will have to be restructured, which is a process that has been attempted in fits and spurts by Chinese authorities with limited success in the past few years. Excessive debt is not a new problem for China. Since 1980, China has undertaken three restructuring episodes for bank debt, and its central bank bailed out a number of lenders in the 2000s after they had become saddled with bad loans. Under the assumption that market reforms and gradual debt restructuring process are well executed, financial stability risks posed from the elevated stock of legacy debt should slowly lessen.

How could the US-China trade spat impact the outlook?

In recent weeks, all eyes have turned to the growing trade spat between China and the United States, which has raised questions around the potential impacts on the Chinese economy and on the government’s financial and market reform efforts. We address these risks in the accompanying text box. In a nutshell, the situation remains fluid and much will depend on whether U.S. actions dissolve into an escalating global trade war and significant erosion in financial market sentiment. Still, the effect of import tariffs (both those poised to be implemented beginning July 6 and recent threats of further retaliation) would most likely delay but not derail progress made by Chinese authorities to scale back the economy’s credit addiction.

A survey of China’s debt mountain from below

China’s dramatic accumulation in debt since 2008 is best exemplified in Chart 1, which shows the debt-to-GDP ratio of China by sector. Although all sectors have added to the total, the non-financial corporate sector, including state-owned enterprises, and the household sector really stand out. However, it’s important to note that this debt is owed largely to Chinese firms and citizens, limiting the potential for a shock to spillover to China’s major trading partners. According to the BIS, foreign banking sector claims on China (on an ultimate risk basis) amounted to just 2.7% of GDP in 2017. In comparison, foreign banking sector claims on the U.S. amounted to about 30% of GDP.4

This rise in debt over the last decade is partly a stimulus story. In response to the global economic downturn, Chinese authorities brought forward a number of infrastructure and investment-heavy projects and effectively subsidized lending to underperforming industries in order to keep them solvent.

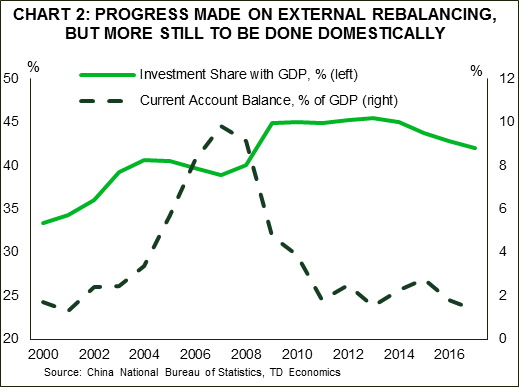

Looser financial conditions post-crisis helped hasten the run-up in debt. Low borrowing rates encouraged Chinese households to invest in real estate, pushing up house prices and household debt to new highs while also supporting the construction sector. At the same time, government and corporate spending helped to drive fixed asset investment to a record 45% of nominal GDP (Chart 2). To provide some perspective, the ratio for Canada and the U.S. has historically averaged about 22%, while developing nations such as India have an elevated ratio near 30%, far below that of China’s.

At the time, China’s stimulus was welcomed by international agencies as it helped create a sink for exports, particularly for commodities and machinery and equipment, at a time when global demand was very weak. Moreover, the employment-intensive construction sector was an obvious choice for Chinese authorities that aim to ensure social harmony at any cost. Any financial stability concerns about the rapid accumulation of debt were brushed aside.

By 2014, as global economic growth gained firmer footing, concerns started to mount about China’s investment-heavy and debt-fueled growth. Stories of ghost cities became frequent, with analysts coalescing on the view that China had overbuilt infrastructure that could be underutilized for a decade or more. Also, the impulse to growth from past stimulus had waned significantly by then, and Chinese growth had slowed to just over a 7% annual pace from the roughly 8% pace of the previous two years. This fueled concerns about how the accumulated debt would be paid off.

In response, Chinese authorities devised strategies to gradually make economic growth less dependent upon credit-intensive industries like manufacturing and construction and toward consumption and service industries. Most popular measures to date include:

- The shutdown of unprofitable firms in overcapacity and heavy polluting industries. This ensures that they are no longer being kept afloat by refinancing with newly issued debt.

- Rationing credit for households to restrict housing market activity, with the consequence of also slowing home price growth.

- Cracking down on the shadow banking sector, forcing transparency in how financial intermediaries are utilizing off balance sheet vehicles.

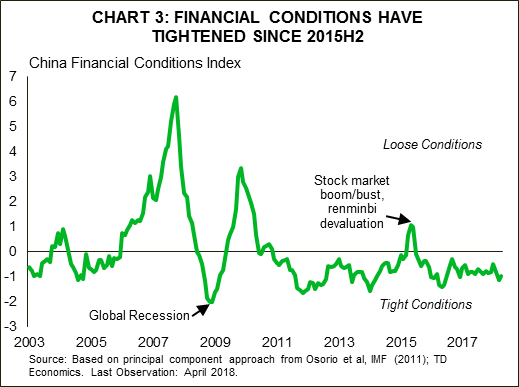

These measures have worked both to make economic activity more dependent on services, and to effectively tighten financial conditions in China (Chart 3).5

As the economy has rebalanced, the government has been generally successful in reducing credit growth particularly in the non-financial corporate and government sector. Progress however, has been slow. Authorities have found it easier to reduce frenzied speculation in the housing market by rationing credit to the household sector. However, both local government debt and non-financial corporate debt has continued to build.

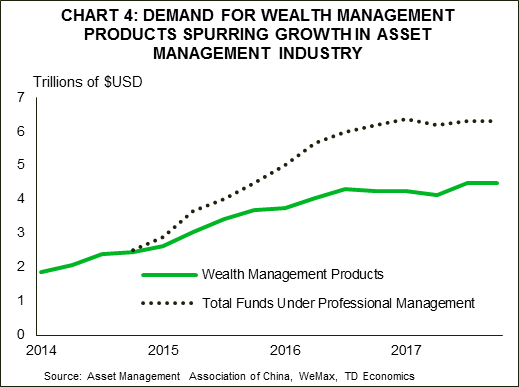

For firms, bank loans, entrusted and trust loans remain the dominant forms of firm finance despite efforts by authorities to develop a market for corporate bonds. A sizable portion of these loans are non-performing, and may even be backed by household wealth management products that promise guaranteed returns (Chart 4). The risk of course is that if the loans turn sour, banks will have to come up with a way to payback investors, which in the least could reduce bank lending to the economy, and may force Chinese authorities to loosen domestic credit conditions in order to ensure adequate liquidity.

State-Owned Enterprises (SOEs) account for a large proportion of non-financial corporate debt. Based on 2017 OECD estimates, the liability to asset ratio of non-financial state-owned enterprises rose from 51% in 2006 to around 60% in 2015, while the ratio of other non-financial corporates stabilized at 55% over the same period. What’s more, the main driver of the advance was short-term debt. However, the government had noticed the high debt ratio and low productivity of SOEs, and therefore announced its plan to reform them in 2014. These largely constitute firms in the mining and manufacturing industries, some of which are critical to regional economies. The reform process remains challenging. With the private sector effectively subsidizing the SOEs, the mixed ownership not only increases the overall return of a notoriously underperforming sector but also raises volatility.

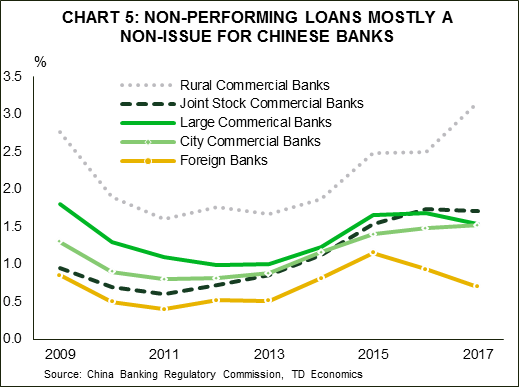

Since bank loans remain the largest source of financing for SOEs, the health of Chinese banks is always in question. Estimated non-performing loans in the IMF’s April 2018 Global Financial Stability Report show that less than 2% of total loans are considered distressed (Chart 5). Bank provisions required to protect balance sheets against non-performing loans (NPLs) has pushed the share of provisions-to-NPLs to over 181%, the highest ratio of all reporting countries suggesting that Chinese banks have set enough capital aside to weather a surge in bad loans. That said, the official measure of non-performing loans likely ignores a number of that have been moved off-balance sheet during the period at the end of 2015 when some of these loans were securitized as corporate debt.

Eerily reminiscent of advanced economy banks prior to the financial crisis, Chinese banks have embraced off balance sheet vehicles, with shadow banking sector assets rising to over 83% of GDP in 2017. Although often assumed to be a blind spot for regulators, authorities in China have done a good job of keeping track of these sorts of lending and are aware of the risks that they pose to its financial sector.

Efforts to rein in excesses paying off

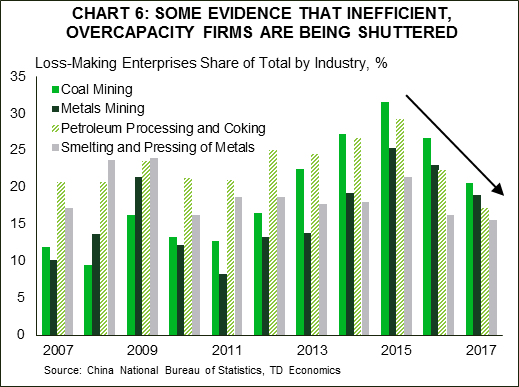

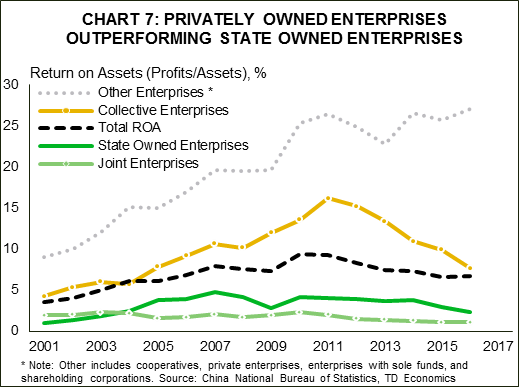

As part of the effort to rein in excess debt, authorities in China have worked to reduce excesses in inefficient and underperforming industries, including shutting down underperforming firms. Since 2015, loss making enterprises in overcapacity industries, such as mining and metals refining, have fallen considerably (Chart 6). Moreover, the adoption of market reforms since 2000 appears to be paying off. As an example, private enterprises have the highest return on assets at about 25% in 2017, while collective enterprises (including SOEs) have generally fared more poorly (Chart 7). Although part of the fall in performance of SOEs could be due to a compositional shift of high-performing SOEs to private enterprises, the trend towards private ownership will likely continue. The strong performance by private enterprises and the trend toward more private ownership may provide an offset to the legacy of underperforming SOE’s, and suggests further progress toward the goal of improving economy-wide productivity.

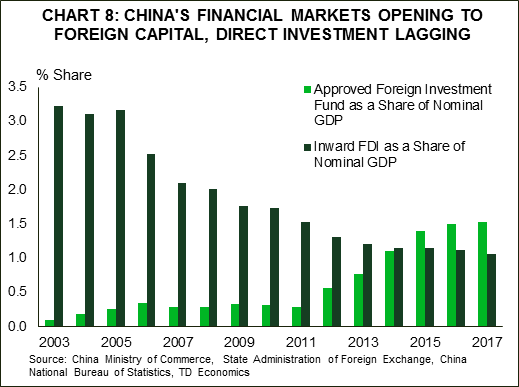

The shift toward private ownership has coincided with promises to open up China’s economy to more foreign investment. This was a message from February’s World Economic Forum, and something President Xi reiterated at April’s Boao in Asia (Asia’s version of the World Economic Forum). There is evidence that China has already begun to open up more to foreign capital. Foreign investment in China’s capital markets rose to about 1.5% of nominal GDP in 2017 from less than 0.5% in 2011 (Chart 8). However, China has not allowed for greater foreign direct investment (FDI). In 2017, inward FDI was 1% of nominal GDP, down from 3.0% in the early 2000s. In other words, China is still very reluctant to let foreign firms and investors own Chinese companies or business interests directly.

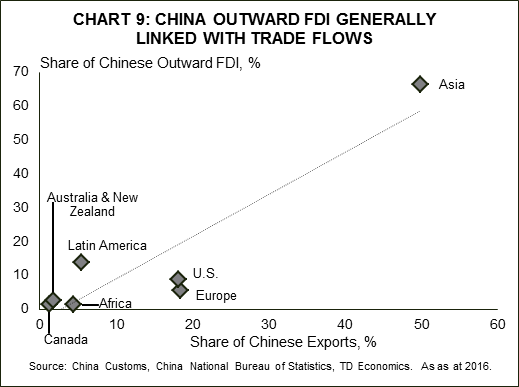

At the same time, China has been fairly aggressive in its efforts to encourage firms to diversify operations and assets across industries and other countries. Chinese firms have acquired foreign automobile manufacturers (e.g. Volvo owned by Geely since 2010), and even soccer teams (e.g. 2016 purchase of Italy’s AC Milan by Sino-Europe Sports Investment Management Changxing Co. Ltd.). Still, most outward FDI from Chinese firms is destined towards those regions with which China has strongest trade links (Chart 9).

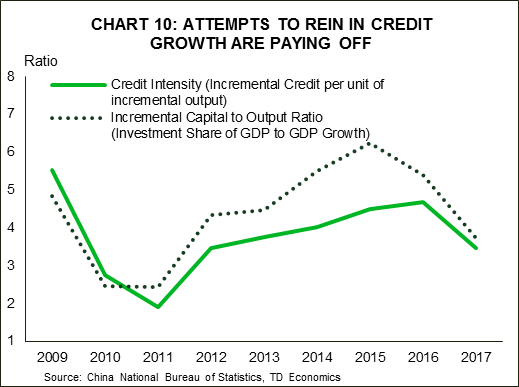

Although the level of debt will remain high for years to come, the best sign that credit growth is being reined in is the decline in two core measures of credit intensity (Chart 10). After peaking in 2016, incremental increases in both credit and capital have slowed relative to the pace of growth in output. Looking ahead, authorities are likely to maintain a tightening credit bias, which will likely see this ratio continue to fall back toward 2011 levels.

Weaning the economy off investment means slower economic growth

As China continues its transition to a developed economy, it will need to build less infrastructure. Moreover, the adoption of market mechanisms will help to ensure that both capital and labor allocations reflect demand and supply conditions rather than government mandates. Although China is still far from achieving developed economy status, it is expected to continue to undertake market-oriented reforms over the next few years that will have implications for domestic and global growth.

To help mitigate the economic drag from slower construction spending, China is aiming to boost household consumption and spending. Currently consumption comprises about 40% of GDP, while the household saving rate has held steady near 40% for more than a decade. An increase in household consumption that corresponds with a decreased saving rate should at least partly offset the decline in investment, holding true to the national saving and investment identity. But changing attitudes and behaviour of Chinese households is proving difficult. Culturally there remains the belief that Chinese males must own property before getting married, putting an enormous burden on the family to save at least for a downpayment. In order to hasten this transition, China plans on implementing a social safety net that should lessen the need for households to save for unplanned health care expenditures and job losses. Indeed, this was mentioned by President Xi as an important part of the Communist Party’s economic plan over the next few years.

We anticipate that infrastructure investment is likely to fall to below 40% of GDP within the next few years. After peaking at 45.5% of output in 2013, infrastructure investment has receded to 42.8% in 2016, and should fall below 40% by 2020. The slowdown in infrastructure investment after almost two decades at 40% of annual output follows the post-war development of neighbouring Japan and South Korea, and is therefore largely anticipated.

A slowdown of this magnitude is expected to shave off about 0.3 percentage points from domestic output for each 5% decline in the share of investment, assuming no offset from another sector such as household consumption. Although the direct effect on global growth implies a rounding error of less than 0.1%, second order effects on commodity and international trade flows are likely much larger. For example, the IMF has found that for each 1% permanent decline in Chinese GDP growth, output in advanced economies could be 0.1 percentage points weaker, while the negative impact on its neighbours in emerging Asia is likely to be stronger, with an expected drag of up to 0.3 percentage points.6 Moreover, if the slowdown in growth is accompanied by financial market volatility, the estimated growth impacts could be double those mentioned for both advanced and neighbouring emerging Asian economies.

Deleveraging with some debt restructuring likely ahead

Ultimately, Chinese authorities have a number of tools to limit the fallout from slower credit growth and weaker economic activity. A currency devaluation is one with the aim being to offset the drop in domestic demand with a boost to export demand. However, this can prove inflationary and can deplete foreign currency reserves at least temporarily, while also creating widespread fears of a trade war. Moreover, the resulting uptick in inflation could stoke domestic unrest as the average citizen’s purchasing power would deteriorate. In turn, this could exacerbate domestic financial risks, as Chinese citizens are likely to rush and pull out their deposits from domestic banks and move them overseas.

Instead, a gradual debt restructuring can accomplish the deleveraging required while also proving a convenient means for authorities to choose who bears the brunt of the impact. Since households are likely to hold banking deposits authorities would be less inclined to saddle banks with bad debt, and instead focus on shutting down highly indebted and underperforming firms, or forcing them to merge with more productive businesses that can absorb the debt.

Attempts have been made to transform liabilities in such a fashion. For example, in late 2015 there was a push by authorities to restructure corporate loans into bonds, with little evidence of bad loans being written-off. Ultimately the plan failed, since without deep developed fixed income markets the pricing of corporate bonds in China remains more art than science.

Publicly, monetary authorities have begun to acknowledge that non-performing loans in the government and corporate sector will have to be restructured. The fallout from a write-down of this debt will likely be contained within China, as this debt is largely domestically held. As part of this restructuring and to ameliorate financial market volatility domestically and bank stresses more broadly, Chinese authorities are likely to inject liquidity into the banking system but only enough to ensure that financial system will still function and thus support economic activity.

As a whole, China is well positioned for a debt restructuring of its corporate and local government debt. It maintains a current account surplus and owes little to the rest of the world. Its banking system has a stable source of deposits due to a high domestic saving rate, but at the same time part of these deposits are a reflection of risky lending practices by banks. Lastly, a strong economic outlook should ensure that government has more than enough fiscal space to absorb the cost of debt restructuring, but a financial crisis could rapidly deplete this cushion.

Bottom line

China’s rise toward becoming the world’s dominant economic growth engine has been funded in part by a domestic binge on credit in order to maintain high targets for economic growth. However, a history of loose credit policies has resulted in bad debts piling up in some sectors that have yet to be dealt with.

As a consequence, Chinese authorities have made it a priority to tackle the financial stability concerns that high debt typically pose in order to stave off a potential deleveraging episode that could have negative spillovers into the global economy. As a result, over the next few years we anticipate that China’s credit growth should slow to the pace of real GDP growth, which is expected to fall to a still relatively strong 6.2% next year. Similarly, credit growth will slow below nominal GDP growth, bringing down the debt ratio.

But, the big question is when authorities will decide to begin a process of restructuring legacy debts, particularly in the government and non-financial corporate sector. The sooner China cleans up its bad loans, the faster it will be able to convince outside investors to begin to invest in its financial markets as it moves ever closer to achieving its goal of opening up its capital account to foreign investment.

Box 1: Tariffs to Impede, Not Derail, Chinese Efforts to Deleverage

The U.S. administration has announced tariffs targeting about US$265 billion in Chinese goods exports. The tariff rates range from 10-25% depending on the type of good targeted. Moreover, an additional US$19.5 billion in Chinese automotive exports could face tariffs if the U.S. administration follows through with its threat to place a 25% tariff on all automobile imports at some point over the next year.

The U.S. is China’s second largest export market for goods, with about 19.1% ($430.7 billion) of total exports ($2.25 trillion) arriving in the U.S. last year. As such, the $265 billion in goods exports targeted by U.S. tariffs amounts to about 2.2% of Chinese annual GDP, a relatively small amount. Moreover, Chinese authorities have promised to level reciprocal tariffs on an equivalent amount of U.S. agricultural and industrial goods exports. All told, announced tariffs (both planned and threatened) by the U.S. administration together with the planned reciprocation by Chinese authorities would put about 0.5 percentage points of Chinese growth at risk over the next six quarters. This means that China may see economic growth of about 5.7% next year rather than the 6.2% anticipated.

Overall, this relatively small drag on economic activity is unlikely to trigger an intense bout of deleveraging by Chinese firms or households. On the contrary, Chinese policymakers are likely to inject stimulus in support of economic activity to ensure that growth doesn’t fall below trend, estimated at about 6%. China’s central bank has already moved to support demand by cutting its main policy rates, and its reserve requirement for banks (effective July 5th, 2018), suggesting that they are willing to put off tightening credit further.

Although the announced tariffs are unlikely to derail plans by Chinese authorities to slow credit growth and restructure existing debt, an escalation to a full blown trade war could send Chinese economic activity spiraling well below trend. Policymakers are likely to respond to such a negative scenario by engaging in fiscal stimulus, including pulling forward debt-financed infrastructure spending that will further exacerbate domestic imbalances. A devaluation in the renminbi will likely ensue as well, which could result in a surge in capital outflows that authorities will push back against. Ultimately we believe that cooler heads will prevail, avoiding such a negative trade war scenario. However, the anticipated economic drag from the announced tariffs is likely to impede progress by Chinese authorities to wean economic activity off of its overdependence on credit growth.

End Notes

- For example, Reinhart and Rogoff found that financial crisis induced recessions are more severe and have a much more prolonged recovery period of typically eight years. Source: Carmen M. Reinhart and Kenneth S. Rogoff (2009). This Time is Different: Eight Centuries of Financial Folly. Princeton University Press.

- See Michael Pettis (June 14, 2017). Can China Really Rein in Credit? Retrieved from: http://carnegieendowment.org/2017/06/14/can-china-really-rein-in-credit-pub-71284.

- For more details see our note on the evolution of China’s services sector: Tracking China’s Re-Balancing to Services-Based Economy.

- Source: BIS Consolidated banking statistics as of 2017Q4.

- The financial conditions index follows the methodology utilized in a working paper from the IMF in which the first principal component is taken of the following Chinese monthly financial variables: 3-month deposit rate, spread between the 90-day interbank rate and the deposit rate, spread between the 1-yr and 90 day deposit rate, creidt growth, percent change in the nominal effective exchange rate, percent change in the Shanghai Dow Jones index, and percent change in the MSCI China stock index. Source: Osorio, C et al. (2011). A quantitative assessment of financial conditions in Asia. IMF Working Paper WP/11/170. https://www.imf.org/external/pubs/ft/wp/2011/wp11170.pdf

- Source: Dizioli, A. et al. (August 2016). Spillovers from China’s Growth Slowdown and Rebalancing to the ASEAN-5 Economies. IMF Working Paper WP/16/170. http://www.imf.org/en/publications/wp/issues/2016/12/31/spillovers-from-chinas-growth-slowdown-and-rebalancing-to-the-asean-5-economies-44179