Here are the latest developments in global markets:

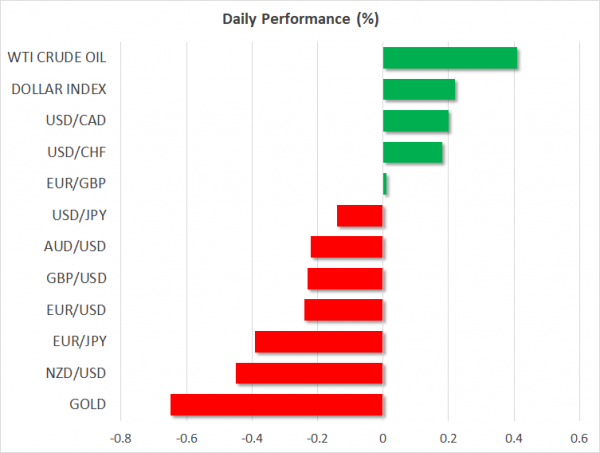

FOREX: The US dollar held steady versus the Japanese yen today (-0.10%), taking a breather after today’s earlier sell-off movement. The US dollar index rose by 0.22% though, currently hovering near the 94.48 level. Traders are awaiting the figures on the Fed’s preferred inflation measure, the core PCE (personal consumption expenditures) index on Friday. Moreover, investors will keep their focus on the Trump administration’s trade and investment restrictions as yesterday the US Treasury Secretary Steven Mnuchin said that potential investment curbs will not target only China but all countries acting unfairly in the US technology sector. Euro/dollar was trading lower by 0.30% during today’s European session, while pound/dollar dived by 0.23% after BOE MPC member John Haskel argued that there must be more slack in the economy which if true, chances for a rate rise could weaken. On the other hand, BOE MPC member, Ian McCafferty, messaged today that waiting too long to put up rates could create bigger shocks in the UK economy. The Antipodean currencies were in bearish mode, with aussie/dollar and kiwi/dollar down at 0.7397 (-0.22%) and at 0.6868 (-0.42%) respectively. Dollar/loonie was last seen at 1.3322 handle (+0.23%).

STOCKS: Following the sell-off in US stocks, European equities retreated on Tuesday after they completed the biggest bearish day in two months during yesterday’s trading session. Today, the benchmark European STOXX 600 advanced by 0.12% at 1100 GMT, while the blue-chip Euro STOXX 50 was up by 0.17%. The German DAX 30 rose by 0.08%, the French CAC 40 edged up by 0.22%, the Spanish IBEX 35 moved higher by 0.20% and the British FTSE 100 jumped by 0.34%. US stock futures were in the sea of green, pointing to a positive open after the aggressive selling interest on Monday.

COMMODITIES: Oil prices held onto gains on Tuesday, finding support from production losses in Canada’s largest oil sands facilities and uncertainties over Libyan exports which are under threat since the official state-owned oil company NOC in Tripoli – the only legal entity to sell oil – will no longer be allowed to handle the oil in the region according to Eastern Libyan commander Khalifa Haftar’s forces. Instead, the control of the oil ports has been transferred to the NOC based in the east. In other news, Iran’s oil minister claimed that there was no figure specifying supply increases in the OPEC agreement, saying that a number of 800,000 was an interpretation by some OPEC members. West Texas Intermediate (WTI) crude was last seen down at $68.35/barrel (+0.21%), while Brent was standing higher at $75.42/barrel (+0.92%). In precious metals, the safe-haven gold was posting significant losses, reaching a fresh 6-month low of $1,256.20/ounce (-0.70%), pressured by the prospect of rising US interest rates amid a strengthening economy.

Day ahead: Trade uncertainties to keep weighing on risk sentiment; Merkel meets coalition for migration talks

Investors will continue to trade with caution amid fears the US trade policy which has recently turned more protectionist against the EU and China, could take risks in global trade wild. Should the US dig its heels in, refusing to drop its threats over a new round of import tariffs imposed against the EU and its fresh warnings of restrictions in Chinese investments, safe havens could see additional demand, while riskier assets such as stocks could face further pressure.

Meanwhile, in Germany, politics will be in the spotlight on Tuesday as the German Chancellor Angela Merkel will be holding private talks with other parties in her coalition government for the first time since last year’s elections, with refugee policy topping the agenda. Note that Merkel’s migration issue became a threat for Merkel’s leadership as her CDU party recently got into a dispute with its CSU junior coalition partner on whether to leave asylum seekers, who have registered elsewhere in the EU, to pass the German border.

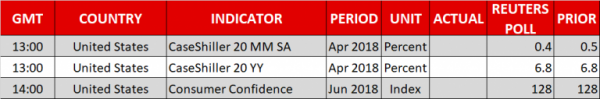

In terms of data, Tuesday’s calendar will be relatively light ahead of a busy Friday, with the US CaseShiller house price index for the month of April and June’s Consumer confidence index attracting the most interest. In the absence of any trade headlines and major data releases, the above measures could push the dollar higher if the numbers come in stronger than expected.

In oil markets, investors will turn focus to the API weekly report on US crude oil inventories at 2030 GMT after OPEC and non-OPEC oil suppliers decided last week to raise output by 1mn barrels, lifting crude oil prices near 1-month highs. A decline in US crude oil stocks could add further gains for oil prices.

As of today’s public appearances, ECB Vise President Luis De Guindos will be talking at 1200 GMT, while Atlanta Fed President Raphael Bostic (voting FOMC member in 2018) and Dallas Fed President Robert Kaplan (non-voting FOMC member in 2018) will be making comments at 1715 GMT and at 1745 GMT respectively.