Here are the latest developments in global markets:

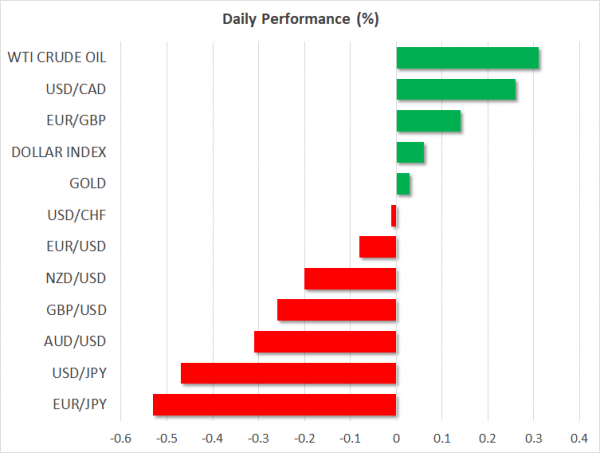

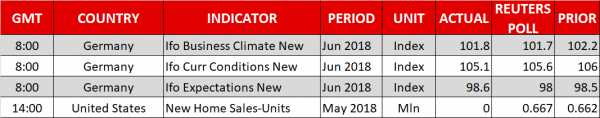

FOREX: During Monday’s trading session, the dollar was moving lower by 0.47% against the Japanese yen after the US President Donald Trump threatened on Friday to impose a 20% tariff on cars imported from the EU. The dollar index though, which tracks the strength of the greenback against six major currencies, managed to climb to 94.58 (+0.08%) as the euro and the pound remained under pressure. Euro/dollar slipped by 0.06% from an intra-day high of 1.1673 to 1.1649. Euro/yen was also under pressure, slipping to 127.50 (-0.58%). Meanwhile, the German Ifo business climate index came in marginally higher than expected in June but was below last month’s reading, at 5 ½-year lows. Pound/dollar is down on the day after two consecutive green sessions, falling by 0.23% to 1.3237 after fears of a breakdown in Brexit talks later in the week. In terms of the antipodean currencies, aussie/dollar and kiwi/dollar were struggling, with the former dropping to 0.7410 (-0.29%) and the latter easing slightly below 0.6900 (-0.20%). Dollar/loonie recovered back above the 1.3300 key-level and added 0.27% to its performance following OPEC’s supply decision to raise supply by 1mn barrels. Meanwhile, dollar/lira entered positive territory after the sharp sell-off during the early European session as Recep Tayyip Erdogan claimed victory in the weekend’s election.

STOCKS: European indices were on the back foot on Monday at 1100 GMT after the US President threatened to impose tariffs on European cars. The pan-European STOXX 600 tumbled by 1.14%, while the blue-chip Euro STOXX 50 was down by 1.27%. The German DAX 30 dipped by 1.41%, hitting a 2-month low, the French CAC 40 dived by 0.84%, the Spanish IBEX 35 slipped by 1.29% and the British FTSE 100 declined by 1.29%. Futures on the Dow, S&P 500 and Nasdaq 100 are currently in the red, pointing to a lower open on Wall Street.

COMMODITIES: Oil had a big winning day on Friday due to announcements OPEC and non-OPEC members would come to an agreement on a supply hike that would be smaller than markets had initially thought, in cooperation with Iran who previously resisted a supply increase. On Monday, however, prices were trading mixed as uncertainties relating to supply were lingering in the markets. West Texas Intermediate crude oil was up by 0.31% at $68.79/barrel, holding below the one-month high of $69.38 per barrel reached on Friday. On the other hand, the London-based Brent dropped by 1.59% to $74.35 per barrel. In precious metals, gold reversed earlier losses, rising back to $1,268.50 per ounce, near its opening price.

Day ahead: Trade issues in center stage; US delivers home sales data

Few economic releases are scheduled for today, though updates on trade issues are those which are likely to keep investors on their toes as the trade dispute between the world’s two biggest exporters shows no sign of receding.

New home sales data out of the US will dominate the calendar at 1400 GMT, with analysts expecting the measure to improve slightly to 0.667 million units in May from 0.662mn in the previous month, remaining near its highest since the end of 2007.

Trade developments will be at the forefront for another week as the US continues to hold a harsh position against Chinese trade activities despite imposing a 25% import tariff on $50 billion worth of Chinese products taking effect on July 6 and threatening to slap fresh tariffs on an additional $200 billion of imports from China. On Sunday, tensions escalated even further after sources with knowledge of the matter reported that the US President is planning to restrict firms with at least 25% Chinese ownership from acquiring US companies in the technology sector. Meanwhile, trade relations with the EU are not in a better position either as Trump warned on Friday in a tweet its European counterparts that all automobile imports from the region will unilaterally face a 20% tariff, twice what the EU charges the US on auto imports. Note that earlier, the EU targeted US goods worth 2.8 billion euros in response to Trump’s tariffs on EU steel and aluminum imports, while China is set to unleash a 25% import tariff on $34bn worth of US products in July once the US activates its trade levies.

Meanwhile, in the UK, Brexit will continue to keep investors cautious. Last week, Prime Minister May’s withdrawal bill aiming to prepare the country to exit the EU got an approval on amendments from the parliament, strengthening her position before the EU summit on June 28-29 where discussions regarding the key Irish border issue will likely attract attention. Uncertainty about the summit is likely to keep the pound within a range ahead of the EU leaders’ meeting.