Here are the latest developments in global markets:

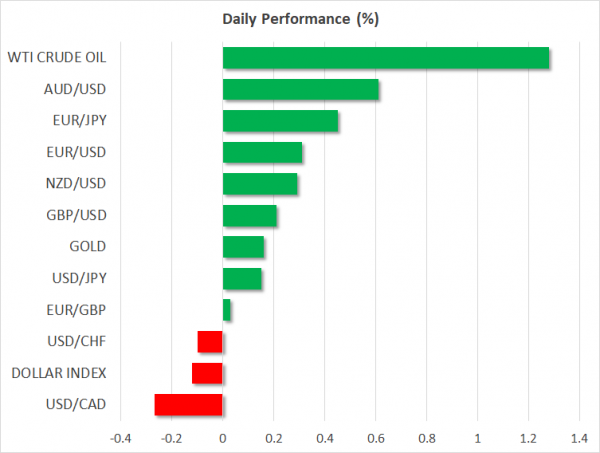

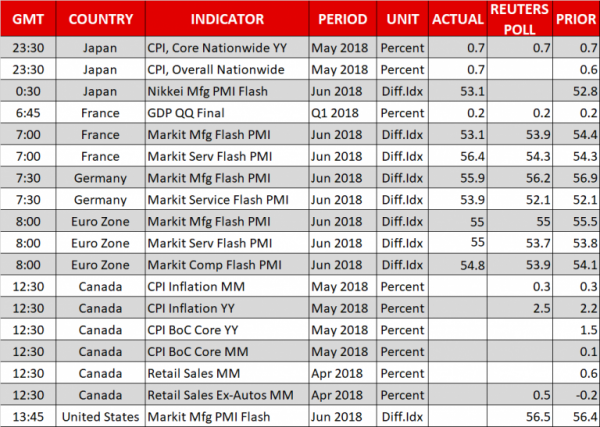

FOREX: Dollar/yen was posting moderate gains on Friday, inching up to 110.14 (+0.14%) as uncertainties around US-Chinese trade relations were still high. The two giant world exporting economies exchanged additional threats of import tariff measures this week, with the Chinese Ministry of Commerce characterizing US trade protectionism on Friday as “self-defeating and a symptom of paranoid delusions”. The dollar index was down for the second day, last seen at 94.62 (-0.12%) as the euro and the pound remained in bullish mode. Euro/dollar jumped to a one-week high of 1.1675 before it slid to 1.1637 (+0.31%) as preliminary Manufacturing and Services PMI figures of the Eurozone surprised to the upside. Meanwhile, in Germany, sources stated that Merkel’s coalition party, the SPD, was discussing the prospect of new elections last week. Euro/yen printed a stronger rally, breaking the 128 key-level to hit a session high of 128.58 (+0.44%). Demand for the pound continued to increase as well following an unexpected shift in BoE rate votes yesterday, with three out of nine policymakers backing a rate rise compared to two back in May. The move increased speculation that policymakers could feel more confident to push borrowing costs up in August. Euro/pound edged to 0.8755 (-0.05%). In antipodean currencies, aussie/dollar and kiwi/dollar were recovering, with the former bouncing up to 0.7426 (+0.65%) and the latter heading up to 0.6895 (+0.31%). The commodity-linked dollar/loonie retreated to $1.3275 ahead of the release of Canadian CPI data later today, weighed on by increasing oil prices.

STOCKS: Stronger-than-expected PMI data out of the eurozone helped European stocks to move higher on Friday at 1100 GMT, with the pan-European STOXX 600 and the blue-chip STOXX 50 both being up by 0.77% and 0.87% repsectively, led by financials. The German DAX 30 gained 42%, the French CAC 40 climbed by 0.85%, while the Italian FTSE MIB surged by 1.11%. The Spanish IBEX 35 and UK’s FTSE 100 rose by 0.82% and by 0.98% respectively. In Asia, equities closed mixed, while in the US, futures tracking the major indices were in the green, pointing to a positive open.

COMMODITIES: Oil prices stretched higher on Friday after OPEC and its allies were said to have cooked a deal of a 1 million output hike at the early stage of the meeting which concludes on Saturday. Speaking from Vienna, the Saudi Arabian oil minister, Khalid al-Falih messaged that the majority of his colleagues are supporting a gradual and a pro-rata output increase. WTI crude and Brent were last trading at $66.46/barrel (+1.40%) and at $74.09 (+1.46%) respectively. In precious metals, gold was higher at $1,269/ounce (+0.24%).

Day Ahead: Spotlight events of the day are OPEC meeting & Canadian CPI

All eyes today will be on Vienna, where the Organization of the Petroleum Exporting Countries (OPEC) and major non-OPEC oil producers including Russia are gathering to review a supply cut agreement signed in December 2016. OPEC, Russia, and several other non-OPEC producers agreed to cut output by 1.8 million bpd starting from January 2017, to support oil prices, which had more than halved by that time, notably due to global oversupply and increasing US shale production. Now, the media reports suggest supports that the meeting is close to delivering a supply hike of 1mn barrels per day (bpd), probably persuading Iran, who recently warned to veto any output increase, to collaborate.

Also, another main event will be in Canada, where data on inflation and retail sales are scheduled to be published at 1230 GMT. The headline inflation rate for May is forecasted to rise by 2.5% y/y versus 2.2% previously, however, month-on-month the rate is expected to remain steady at 0.3%. April’s retail sales are expected to tick down to 0.0% m/m versus 0.6% in the prior month, the lowest since December 2017. Core retail sales, which exclude automobiles, are projected to grow by 0.5% m/m from -0.2% before. If the stats beat expectations, then the Canadian dollar could extend today’s gains even further.

Out of the US, at 1345 GMT, Markit’s preliminary PMIs for the month of June might also attract some attention. Analysts are expecting the Manufacturing PMI to tick lower to 56.5 compared to 56.4 before, while the service index is anticipated to inch lower by 0.4 points to 56.4. The composite flash reading is forecasted to decline to 55.1 versus 56.6 previously.

In energy markets, the US Baker Hughes oil rig count is due at 1700 GMT, however, the most important event for investors is the OPEC two-day meeting.