OPEC, JMMC meetings are taking place today in Vienna with agreement on production levels high on the agenda. This can impact on prices in Oil markets.

Eurogroup meeting are also taking place today in Brussels increasing headline risk in the EUR crosses.

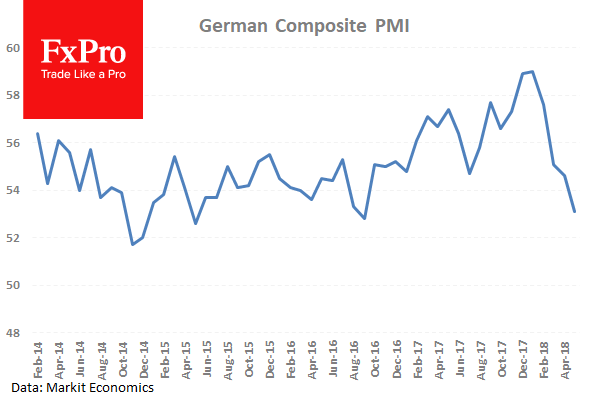

At 07:30 GMT, German Markit Manufacturing PMI (Jun) is expected to come in at 56.2 from 56.9 previously. Markit Services PMI (Jun) is expected at 52.1 against 52.1 previously. Markit PMI Composite (Jun) is expected to be 53.4 from 53.4 prior. The data has now confirmed that the December reading was a short term high. For Manufacturing it was the highest since before the financial crisis and for services it was the highest since June 2011. The headline number is expected to weaken again today and this weakness will continue to worry the ECB. EUR traders will be closely following this data release.

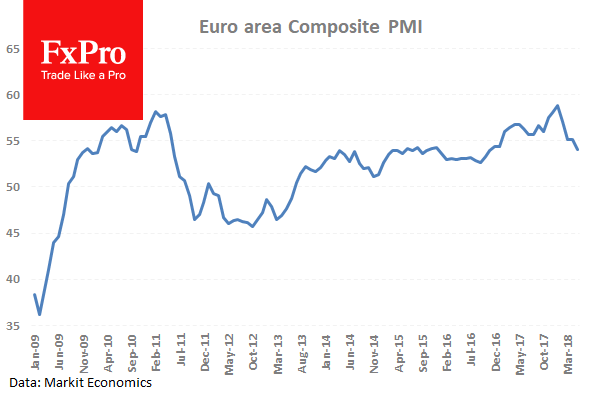

At 08:00 GMT, Eurozone Markit Manufacturing PMI (Jun) is expected to come in at 55.0 from 55.5 previously. Markit Services PMI (Jun) is expected at 53.7 against 53.8 previously. Markit PMI Composite (Jun) is expected to be 53.9 from 54.1 prior. This data is also expected to soften once again from the highs in December. EUR crosses can see a spike in volatility should actual released data differ from the expected consensus.

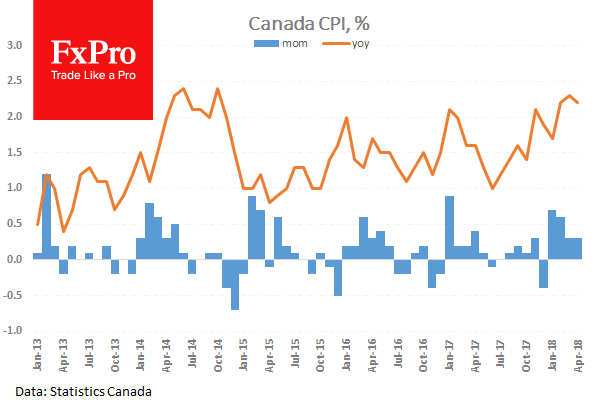

At 12:30 GMT, Canadian Consumer Price Index (May) is expected to be 0.3% (MoM) and 2.5% (YoY) against 0.3% (MoM) and 2.2% (YoY) previously. Consumer Price Index – Core (MoM) (May) came in at 0.0% previously. BOC Consumer Price Index Core (May) is expected to be 0.2% (MoM) and 1.4% (YoY) against0.1% (MoM) and 1.4% (YoY) previously.

Canadian Retail Sales ex Autos (MoM) (Apr) are expected to be 0.5% against -0.2% previously. Retail Sales (MoM) (Apr) are expected to be 0.0% against 0.6% previously. These data points are expected to be mixed this month with some metrics expected to be weaker while others show strength. Retail sales are expected to be flat this month. CAD crosses can be affected by this release especially if the data deviates from expectations.

At 13:45 GMT, US Markit Services PMI (Jun) is expected at 56.4 from 56.8 previously. Markit PMI Composite (Jun) is expected to be 55.1 from 56.6 prior. Manufacturing is expected to maintain its strong improvement since a low in May 2016. USD crosses may be heavily traded as a result of this data.

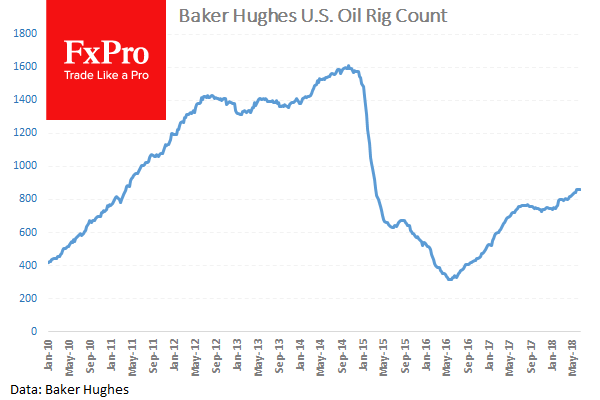

At 17:00 GMT, Baker Hughes US Rig Count numbers will be released. The prior number last Friday showed that there were 863 Oil rigs in operation up from 862 the previous week. With Oil down from its high price levels in recent times, there was bigger than expected draw in inventories on Wednesday, which put a bid under price. OPEC are meeting today and this will further increase volatility in oil prices.