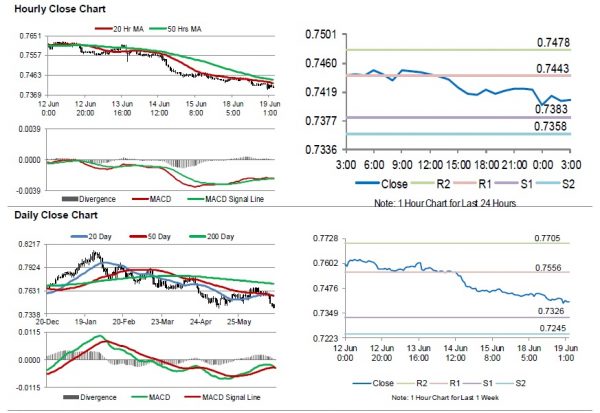

For the 24 hours to 23:00 GMT, the AUD declined 0.20% against the USD and closed at 0.7422.

LME Copper prices declined 2.13% or $152.0/MT to $6987.0/MT. Aluminium prices declined 0.85% or $19.0/MT to $2220.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.7407, with the AUD trading 0.20% lower against the USD from yesterday’s close.

Early morning data indicated that Australia’s house price index slid 0.7% on a quarterly basis in first three months of 2018, falling short of market expectations for a fall of 1.0%. In the previous quarter, the index had advanced 1.0%.

According to the minutes of the Reserve Bank of Australia’s (RBA) June monetary policy meeting, policymakers expect a rise in economic activity. Further, interest rates are expected to remain at the current low levels, in the wake of high household debt and weak wage growth. Also, officials expect gradual improvement in unemployment and inflation. Meanwhile, the RBA warned that rise in the local currency could lead to slowdown in economic growth and inflation.

The pair is expected to find support at 0.7383, and a fall through could take it to the next support level of 0.7358. The pair is expected to find its first resistance at 0.7443, and a rise through could take it to the next resistance level of 0.7478.

Looking forward, traders would await Australia’s Westpac leading index for May, set to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.