Here are the latest developments in global markets:

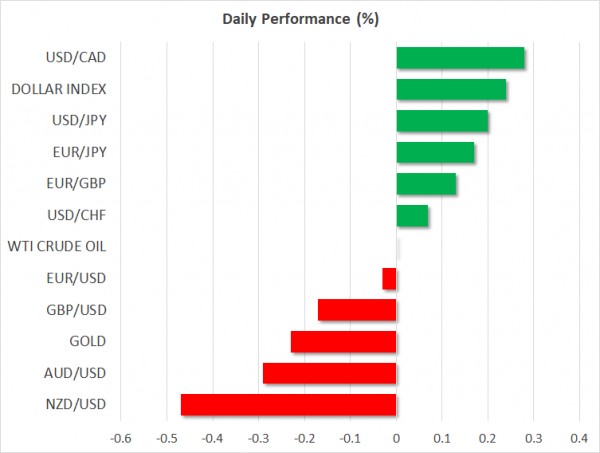

FOREX: The US dollar index is up by almost 0.25% on Friday, touching a fresh 7-month high and extending the spectacular gains it posted yesterday as the currency with the heaviest weight in the index – the euro – collapsed after the ECB policy decision (see below). The yen was on the back foot as well, falling by 0.2% versus the dollar, after the BoJ downgraded its inflation view at its own policy gathering overnight.

STOCKS: US markets closed mixed on Thursday. The Nasdaq Composite outperformed to rise by 0.85%, bringing the tech-heavy index to a fresh all-time high. The S&P 500 gained 0.25%, but the Dow Jones pulled back by 0.10%. Futures tracking the Dow, S&P, and Nasdaq 100 are currently pointing to a lower open today, though note the direction of these indices today will probably depend on whether the US unveils its list of tariffs against China. Asian markets were mostly lower on Friday, perhaps as the threat of US tariffs cast a shadow. In Hong Kong, the Hang Seng fell 0.13%, while South Korea’s Kospi 200 was down by 0.79%. In Japan though, the Nikkei 225 and Topix climbed by 0.50% and 0.29% respectively, buoyed by a weaker yen brightening the outlook for exporting firms. In Europe, futures tracking all major indices suggest a slightly higher open, with the only exception being the British FTSE 100.

COMMODITIES: In energy markets, oil prices were practically flat on Friday, after posting some modest gains in the previous session. The liquid looks set to close the week in positive territory, with reports on Thursday that major Libyan oil ports were closed after attacks counterbalancing concerns of an imminent production increase by OPEC and associated producers. The instability in Libya is expected to lead to a supply loss of 240,000 barrels per day. In precious metals, gold is down by nearly 0.25% today, currently trading just above the $1,298 per ounce level. The metal tried to break above its crucial 200-day moving average at $1,307 yesterday, but was rejected as the dollar gained ground after the ECB decision. It could attempt another test of that territory today should the US announce tariffs against China, triggering another bout of risk aversion.

Major movers: ECB announces end to QE, but euro collapses on dovish rate signals

The European Central Bank (ECB) kept interest rates unchanged yesterday, and announced an end to its asset purchase (QE) program. The Bank will continue buying assets at a pace of EUR 30bn per month until the end of September, at which point it will halve its monthly purchases to EUR 15bn until the year ends, and then stop them altogether. While that would have been a hawkish signal by itself, the Bank also stressed interest rates will remain unchanged at least through the summer of 2019, which was somewhat later than markets expected. Moreover, it included language to tie the QE tapering with the quality of incoming data, meaning it could decide to extend the program again if the outlook becomes less favorable.

These signals sent the euro sharply lower on the decision, and the currency continued to collapse throughout President Draghi’s press conference. Euro/dollar fell by roughly 280 pips on the day to hit a two-week low of 1.1560, as the ECB chief maintained a cautious tone on practically every issue. He mentioned trade risks, suggested the economy’s soft patch may extend for longer than expected, and emphasized the high degree of uncertainty policymakers are operating under, making the case for keeping policy optionality at every step. Overall, he sent the message that any rate increase is still far, far away, and conditional on economic forecasts materializing, which apparently dwarfed everything else in the eyes of investors.

Strikingly, sterling/dollar plunged in the aftermath of the ECB decision as well, which implies the pound could not gain as much as the dollar from a bleeding euro – a testament to the fragile sentiment currently surrounding the British currency.

Overnight, the Bank of Japan (BoJ) kept its ultra-loose policy framework unchanged via an 8-1 vote, providing little-to-no fresh guidance. It downgraded its view of consumer inflation, now seeing it “in a range of 0.5 to 1 percent” from “around 1 percent” previously. The yen moved lower on the decision, though the move was relatively minor. BoJ still seems unlikely to even consider altering its stimulus program anytime soon, which in isolation, is a factor arguing for a weaker yen from a relative rates perspective, especially against currencies of nations who are normalizing policy, like the dollar.

Day ahead: Eurozone inflation, US industrial production and University of Michigan survey due; trade developments eyed

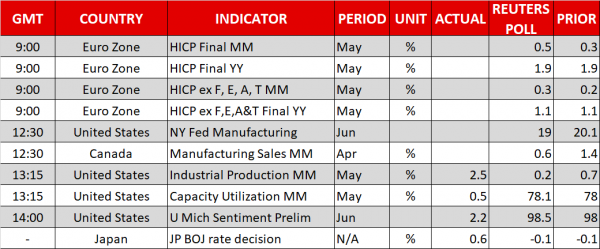

Revised eurozone inflation figures, US industrial production data and the University of Michigan’s survey on consumer sentiment are some of the releases attracting attention out of Friday’s calendar. Trade developments though, that have the capacity to escalate tensions between the US and China, could well end up dominating attention during today’s trading.

The eurozone’s final inflation numbers for the month of May are scheduled for release at 0900 GMT. Annual growth in the headline Harmonised Index of Consumer Prices (HICP) that uses a common methodology across EU countries is expected to be confirmed at 1.9% y/y. The core measure that excludes volatile food, energy, alcohol and tobacco items is anticipated at 1.1%, again the same as in the preliminary release.

At 1230 GMT, the New York Fed manufacturing index will be made public out of the US; a decline is projected in the index during June relative to May. Canadian manufacturing sales pertaining to the month of April will be released at the same time.

Perhaps of more importance out of the US are industrial production numbers for May due at 1315 GMT. Industrial output is projected to slow compared to April, while manufacturing production – a subset of industrial output – will also be closely watched. Data on May’s capacity utilization are also due at the same time.

Lastly in terms of important releases, the University of Michigan’s preliminary survey gauging consumer morale in June is slated for release at 1400 GMT and is forecast to show a slight improvement in sentiment relative to May. Meanwhile, the surveys sub-indexes on inflation expectations will also be attracting attention.

An expected announcement on the Trump administration’s list of $50 billion of Chinese goods imported into the US and targeted for higher tariffs is on the horizon on Friday. China’s response will be awaited; the trade war saga might receive a new chapter, diverting funds into perceived safe-haven assets to the detriment of riskier ones. The world’s second-largest economy said it will walk away from commitments made in bilateral talks with the US if the Trump administration eventually pushes forward with the imposition tariffs.

In the meantime, politics might be at play in the UK with PM Theresa May potentially on the receiving end of a Tory rebellion, as some members within her party favoring a softer Brexit were left unsatisfied – to say the least – in relation to efforts for a compromise with the government on key Brexit legislation.

In energy markets, the US Baker Hughes will be hitting the markets at 1700 GMT.

In terms of policymakers’ appearances, ECB executive board member Benoit Coeure and Dallas Fed President Robert Kaplan (non-voting FOMC member in 2018) will be giving speeches at 0845 GMT and 1730 GMT respectively.

Technical Analysis: Gold looking bearish in short- and very short-term

Gold has lost ground after touching a one-month high of 1,309.19 during Thursday’s trading. The RSI is declining in support of a negative short-term picture, while the stochastics are also giving a bearish signal in the very short-term; the %K line is below the slow %D one and both lines are heading lower.

Rising trade uncertainties may divert funds into the perceived safe-haven asset. Resistance to advances may come around the 1,300 round figure that may carry psychological significance (the area around this encapsulates numerous peaks from the recent past as well – see chart), with yesterday’s one-month high of 1,309.19 being eyed in case of stronger gains.

Receding trade risks on the other hand are likely to weaken gold, benefitting riskier assets. Support to declines could come around the current levels of 100- and 50-period moving average lines, at 1,298.16 and 1,297.85 respectively. Attention would next turn to the region around 1,290 which captures a number of bottoms from previous days and weeks.

The greenback’s direction can also affect gold; given that the yellow metal is denominated in dollars, a stronger US currency renders it less attractive to non-dollar holders.