After this week’s extremely poor manufacturing and trade gap figures out of the United Kingdom, hopes of a rebound in economic growth in the second quarter have been dashed. That’s put the focus even more on Thursday’s retail sales numbers, scheduled for release at 08:30 GMT. Sterling is headed for further volatility in a week jam-packed with major data releases and Brexit risk events.

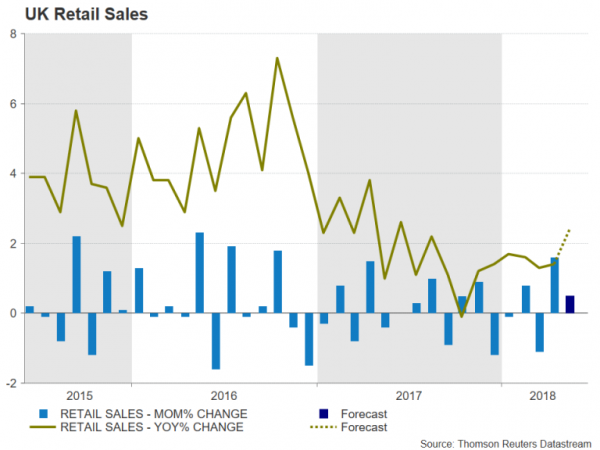

British retail sales jumped by 1.6% month-on-month in April, recovering sharply from a dire performance in the first three months of the year. Sales are forecast to grow further in May, rising by 0.5% m/m. The annual rate is expected to accelerate to 2.4% in May from the prior 1.4%.

With household consumption making up about two-thirds of the UK GDP, a weak set of figures on Thursday, would spell bad news for second quarter growth, especially when other sectors of the economy are not doing any better. Industrial production fell by 0.8% m/m in April and the manufacturing subset performed even worse, with output plunging by 1.4% over the month. The trade deficit also deteriorated in April as exports tumbled by 6.1% m/m.

This week’s employment numbers were more encouraging as a robust 146k jobs were created in the three months to April – although wage growth fell short of expectations, slowing to 2.5% year-on-year. Inflation data also disappointed, as the annual rate of CPI held steady at 2.4% in May instead of ticking higher to 2.5%. If the retail sales figures also miss the forecasts, it would cast further doubt about the chances of a rate hike by the Bank of England in August.

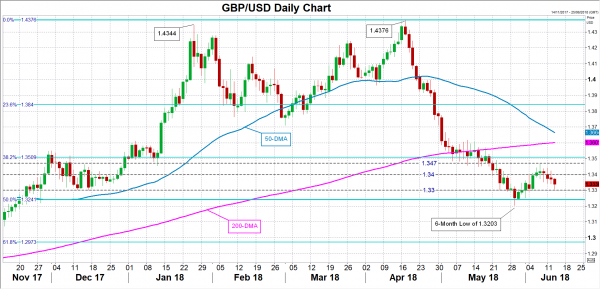

The pound would struggle to hold above immediate support at the psychological $1.33 level if sales fail to point to a further recovery in consumption. A drop below $1.33 would make a breach of the 50% Fibonacci level of the March 2017 to April 2018 uptrend more likely. Declines below the 50% Fibonacci of $1.3240 would signal a longer-term bearish shift for pound/dollar, especially if it crossed May’s 6-month low of $1.3203.

On the other hand, a stronger-than-expected rise in retail sales would keep the possibility of a BoE rate hike in the summer firmly on the table, boosting the pound. A fresh upside attempt would likely see the first resistance coming at the $1.34 handle before challenging the June top of $1.3471. A successful break above this hurdle would clear the way to the next key Fibonacci level at $1.3510.

Adding to the pound’s volatility this week are the votes in the UK Parliament as the House of Lords amendments to the government’s EU Withdrawal bill make their way back to the House of Commons. The retail sales data could get sidelined if MPs were to unexpectedly back an amendment for Britain to remain in the European single market after Brexit in a vote scheduled for later today.