Here are the latest developments in global markets:

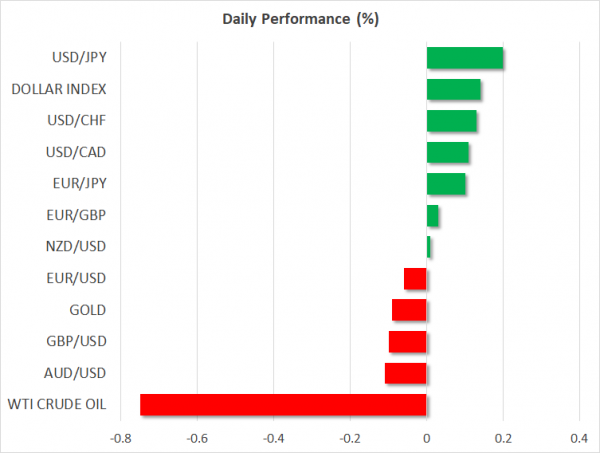

FOREX: The US dollar index is higher by a little more than 0.1% on Wednesday, ahead of the Fed policy decision at 1800 GMT, where the central bank is widely anticipated to raise interest rates. In the UK, sterling managed to rebound against the euro and the yen yesterday, following a vote in Parliament that was interpreted as making a “softer” Brexit more likely.

STOCKS: US markets closed mixed on Wednesday, with the Nasdaq Composite outperforming and rising by 0.57% to close at an all-time high, while the S&P 500 lagged, gaining 0.17%. Meanwhile, the Dow Jones closed fractionally lower, by 0.01%. As for today, futures tracking the Dow, S&P, and Nasdaq 100, are all pointing to a higher open. In Asia, markets were mixed as well, with Japan’s Nikkei 225 and Topix climbing by 0.38% and 0.42% respectively, but Hong Kong’s Hang Seng index declining by 1.01%. Europe looks set to take its cue from Asia, as futures tracking the major European indices are mixed. While the British FTSE 100, the German DAX 30, and the Spanish IBEX 35 are expected to open lower, the opposite holds true for the French CAC 40 and the Italian FTSE MIB.

COMMODITIES: In energy markets, oil prices are lower today, weighed on by a surprising build in the private API crude inventory data released yesterday, which were expected to show a drawdown in stockpiles. WTI and Brent are down by 0.7% and 0.6% respectively, with the theme that OPEC-led producers could agree to raise their output at next week’s OPEC meeting also lurking in the background. In precious metals, gold is down by 0.1%, extending losses from the previous session. Price action in gold remains lackluster, with the yellow metal still hovering in a very narrow range between $1,282 and $1,307 established lately. It will be interesting to see whether the Fed decision later today will be enough to break gold out of its lull.

Major movers: Pound rebounds after Brexit vote; dollar gains ahead of FOMC

Brexit came back under the market’s microscope yesterday, as PM Theresa May managed to avert a rebellion in Parliament. Several lawmakers wanted to include amendments to the Brexit withdrawal bill which would essentially force the government to go back to the negotiating table in a no-deal situation, something that would have likely undermined the PM’s negotiating power. For May to win the vote though, she reportedly had to agree to some concessions, including giving Parliament a greater role in the negotiations.

Markets interpreted the outcome as increasing the probability for a “softer” Brexit, evident by the recovery in the British pound following the vote. Interestingly enough, however, major media outlets like the BBC are reporting that no actual concessions have been agreed, and that the sole agreement was to continue talking. In another interesting twist, UK Justice minister Phillip Lee resigned yesterday in protest over the government’s handling of Brexit, adding another name to the list of departed figures from May’s administration and highlighting the fragility of the Tory cabinet.

Turning to the US, the dollar gained against almost all its major counterparts on Tuesday, and most notably versus the Japanese yen. It looks set to extend its gains today, with dollar/yen rising 0.2% and touching a fresh three-week high of 110.60 as market participants position for the Fed’s rate decision later today. A rate increase is seen as a done-deal, so focus will be on whether the Bank signals a faster pace of tightening for this year, or not (see below).

While the Fed decision today and the ECB one tomorrow will likely keep traders quite busy, it’s worth noting that as the week draws to a close, market focus will turn back to trade. On Friday, the US unveils which Chinese products it will impose tariffs on, something that could provoke a retaliatory response from China, and potentially bring the “trade war” theme back to the forefront. Importantly, President Trump said yesterday the commitment from China to buy $80bn more US agricultural goods was not enough. This implies he may seek more concessions, and judging by his method of operation so far, he may well choose to ramp up the pressure by imposing such tariffs before negotiating.

Day ahead: UK CPI & PPI, eurozone industrial production and US PPI due; Fed decides

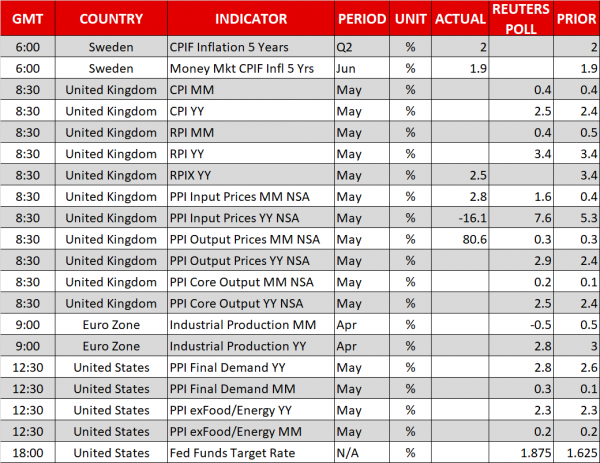

UK inflation figures, as well as the completion of the Federal Reserve’s meeting on monetary policy, constitute the highlights in Wednesday’s calendar.

May’s inflation numbers as gauged by the consumer price index (CPI) are due out of the UK at 0830 GMT. Headline CPI is projected to accelerate to 2.5% y/y, from April’s 2.4% which marked the third month in a row of slowing annual CPI; the BoE’s target for annual inflation stands at 2%. A CPI-beat is likely to stoke market expectations for a Bank of England rate hike sooner rather than later, consequently boosting sterling relative to other currencies. At the moment, market participants do not expect a move during next week’s BoE meeting, while they assign a 44% probability for a 25bps rate increase during the Bank’s August meeting.

Core CPI – forecast to remain constant at 2.1% y/y – and data on retail price inflation and producer prices will be made public out of the UK alongside headline CPI numbers (0830 GMT).

Eurozone industrial production figures for April are scheduled for release at 0900 GMT, with output expected to contract by 0.5% m/m, after rising by 0.5% in March. The contraction discredits, at least in part, those making reference to only a transitory slowdown in the euro area during Q1. Year-on-year, industrial production is projected to grow by 2.8%, below March’s 3.0%.

The US will be on the receiving end of May factory inflation data as measured by the producer price index (PPI) at 1230 GMT. However, the big event for the greenback will be the Federal Reserve’s rate decision, due at 1800 GMT alongside the accompanying statement. The central bank is widely anticipated to deliver its second 25bps rate increase of the year, with the focus turning on whether policymakers see four total increases in 2018 or whether they will stick to the three previously projected by the median dot in the Fed’s dot plot; a hawkish tilt is expected to boost the US currency. Fed chair Jerome Powell’s news conference will follow at 1830 GMT. His comments definitely have the capacity to move markets.

In energy markets, the EIA’s weekly report on crude oil inventories due at 1430 GMT might offer some short-term direction to oil prices. Crude stocks are forecast to have declined by 2.7 million barrels during the week ending June 8, after rising by around 2.1m in the previously tracked week.

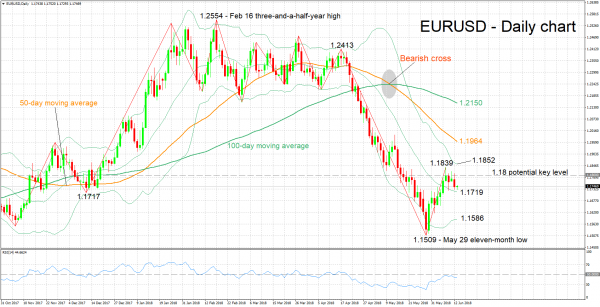

Technical Analysis: EURUSD looking mostly neutral in the short-term

EURUSD has lost some ground after hitting a four-week high of 1.1839 last Thursday. The RSI has halted its previous advance and is largely moving sideways at the moment. This is pointing to a mostly neutral picture in the short-term.

A hawkish tilt by the Fed upon completion of its meeting later in the day is likely to boost the dollar, pushing EURUSD lower. Immediate support to declines could be taking place around the middle Bollinger line (a 20-day moving average line) at 1.1719, including the 1.17 round figure. The area around the lower Bollinger band at 1.1586, that also encapsulates the 1.16 handle, could provide additional support in case of steeper declines.

Conversely, a cautious Fed might weaken the greenback, lifting EURUSD. The 1.18 round figure resisted a successful close above it in previous days despite momentarily being violated. The region around it may act as resistance to advances. Last week’s four-week high of 1.1839 and the upper Bollinger band at 1.1852 might act as additional barriers to stronger gains in the pair.