UK employment data for April will be made public on Tuesday at 0830 GMT, with May’s inflation numbers scheduled for release at the same time the following day. The relevant prints would constitute the last releases before the Bank of England concludes a monetary policy meeting next week, and thus might carry more weight in investors’ minds. On top of the various releases, this is a relatively important Brexit-week, something which overall brings sterling pairs to the spotlight.

Tomorrow’s jobs data are projected to show April’s unemployment rate remaining at the multi-decade low of 4.2% for the third straight month. Meanwhile, employment is expected to rise by 110k in the three months to April, down from March’s robust figure of 197k, but still at relatively healthy levels. Most attention though, might fall on wage growth numbers, which despite being on the rise overall during the last few months, they still remain subdued given that the unemployment rate is standing at its lowest in 42 years. In this respect, the three-month average of weekly earnings is forecast to grow by 2.6% y/y, the same as in March. Excluding bonuses, average earnings are anticipated to grow by 2.9%, again the same pace as in March. In the meantime, the number of unemployment claimants during May will be released at 0830 GMT as well.

Despite less-than-stellar pay increases, if earnings growth meets expectations, April would constitute the third consecutive month wage growth would exceed price increases as gauged by the consumer price index (CPI), thus translating into a positive contribution to purchasing power for UK consumers. May’s inflation numbers due on Wednesday though, are projected to show CPI accelerating to 2.5% y/y, from April’s 2.4% which marked the third month in a row of slowing annual CPI; the BoE’s target for annual inflation stands at 2%. A CPI-beat is likely to stoke market expectations for a Bank of England rate hike sooner rather than later, consequently boosting sterling relative to other currencies. However, if the forecasted increase in price pressures is not met by (at least) an equivalent expansion in wages during May, then BoE policymakers may again need to factor in the squeeze in households’ spending power caused by inflation growing faster than wages; a factor weighing on the odds for a rate hike to be delivered soon.

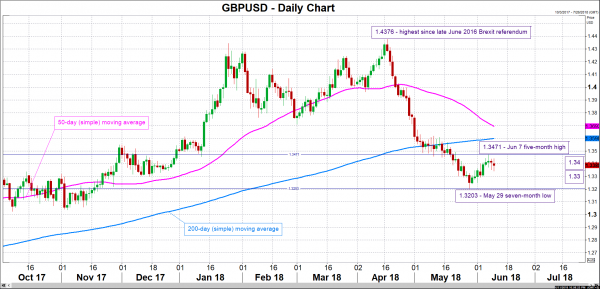

Data releases supporting a more aggressive tightening cycle by the BoE, such as upbeat earnings numbers, are anticipated to boost sterling. Focusing on GBPUSD, a first-line of resistance to price gains could come around the 1.34 round figure which failed to provide support earlier on Monday and may instead act as a barrier to the upside. Stronger bullish movement would shift the focus to Thursday’s five-month high of 1.3471, with the 1.35 handle lying not far above. Conversely, poorer-than-forecasted numbers are likely to exert downside pressure on the pair. The 1.33 handle may offer psychological support, with the attention increasingly turning to the seven-month low of 1.3203 from late May in the event of steeper losses.

Meanwhile, Brexit developments are likely to rank high on the agenda of sterling traders. Specifically, PM Theresa May will be facing votes in parliament tomorrow that could push forward a softer Brexit than envisaged by her administration. The situation is “delicate” in terms of positioning though. On the one hand, whenever a soft Brexit gains traction, sterling tends to gain. However, such an outcome is likely to be linked with a weaker May, raising fresh doubts on her leadership; political uncertainty of this sort has in the past acted to the detriment of the British currency. Investors would thus need to balance the situation based on developments and act accordingly. Still, some pound volatility could emerge around the vote.

In terms of reaction in GBPUSD, it should also be kept in mind that the US will be on the receiving end of important data during the week, including CPI and PPI numbers on Tuesday and Wednesday respectively, and retail sales on Thursday. Moreover, a Fed rate decision is on the agenda on Wednesday, while “Trump risk” might also play out in light of trade deliberations (the Trump administration said it will release a list of $50 billion of Chinese goods that will be subject to another 25% tariff for alleged intellectual property violations by June 15) and the US-North Korea summit taking place in Singapore on Tuesday.

Other important UK data as the week unfolds are Thursday’s retail sales for the month of May. For the record, market participants do not expect a move by the BoE when it completes its meeting on monetary policy on June 21. In particular, UK overnight index swaps put the odds for such an outcome at slightly less than 9%; weaker than expected industrial and manufacturing output figures for April released earlier on Monday further weighed on the relevant probability. At the moment, markets have mostly priced in a 25bps rate increase during Q4.