Here are the latest developments in global markets:

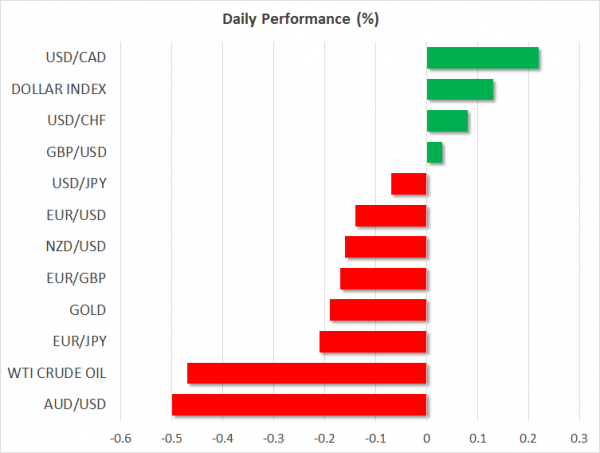

FOREX: The US dollar index – which measures the greenback’s performance against a basket of six major currencies – is up by a little over 0.1% on Friday, recovering some of the losses it posted in previous sessions. The euro is a touch softer following several days of advances, while the safe-haven Japanese yen is under buying pressure, extending the gains it posted yesterday as risk appetite took a hit.

STOCKS: US equity indices closed mixed on Thursday, as risk sentiment soured amid a rout in emerging markets and disheartening signals on the trade front, with President Trump announcing he will leave the G7 meeting early this weekend. The Dow Jones was a winner, advancing by 0.38%, while the S&P 500 and the Nasdaq Composite pulled back by 0.07% and 0.70% respectively. The Nasdaq broke its winning streak and eased from its recent highs as tech stocks like AMD (-4.98%) and Intel (-2.02%) sold off. Futures tracking the Dow, S&P, and Nasdaq 100 are all pointing to a lower open today. Asian markets were a sea of red today too. Japan’s Nikkei 225 and the Topix fell by 0.56% and 0.42% correspondingly, while in Hong Kong, the Hang Seng dropped by 1.99%. Europe was a similar story, with futures signaling that all the major benchmarks will open much lower today.

COMMODITIES: In energy markets, oil prices are lower on Friday, giving back some of their gains from the previous session. WTI is down by almost 0.50% and Brent by 0.45%, with the broader deterioration in risk sentiment and signs that China’s oil imports may have slowed somewhat in May weighing on prices. The broader theme of whether major producers are going to “open the taps” soon continues to loom in the background as well. In precious metals, gold posted another consolidatory day yesterday and is slightly lower today, trading down by 0.2% and failing to attract safe-haven demand even despite the risk-off mood in other assets. The metal remains stuck in a very narrow range, and it will be interesting to see whether it can break out of it next week amid several risk events, including the US-North Korea summit, the Fed meeting, and the US decision to impose tariffs on $50bn Chinese imports.

Major movers: Euro pauses for breath; risk appetite falters amid EM jitters

The euro gained some more ground against all its major counterparts on Thursday besides the safe-havens Japanese yen and Swiss franc, as expectations for a more hawkish tone by the ECB next week remained front and center.

The yen and the franc attracted increased flows during the late European afternoon as risk appetite began to wane, something likely related to discouraging developments in Brazil and a broader rotation out of emerging markets. The Brazilian real sank to a fresh two-year low against the US dollar amid elevated uncertainty ahead of upcoming elections, while the nation’s stock market dived, with the jitters pushing investors into safer assets including US Treasuries. An announcement that US President Trump will be leaving early from the upcoming G7 meeting likely reinforced risk aversion, on speculation the gathering will bear little-to-no fruit in resolving trade frictions.

Elsewhere, the British pound experienced a very choppy session, with Brexit headlines and BoE remarks pulling the currency in opposite directions. First came Brexit news that PM May and Brexit Secretary Davis were in a tense confrontation over the Brexit backstop plan. Specifically, whether to include an end-date or keep it open-ended, with Davis being rumored to quit if an end-date was not agreed. This sent pound crosses lower initially, before BoE policymaker Ramsden stepped up to the rostrum and gave the currency a helping hand, by appearing optimistic on the UK economy.

Brexit is now firmly back under the market’s microscope, especially ahead of the June 28 EU summit. The division within the UK cabinet and the lack of progress in the Brexit talks, combined with expectations for a more hawkish ECB suggest that the path of least resistance for euro/pound may be higher over the coming sessions, at least ahead of the ECB gathering.

In other news, the Turkish central bank arrested the lira’s slide yesterday, hiking interest rates by another 125bps to 17.75%, which was more than markets anticipated. The move likely reassured investors the Bank is ready to act to defend the currency, and may help to stem any further declines in the lira for a while

Day ahead: G7 summit turns focus on trade yet again; Canadian employment data due

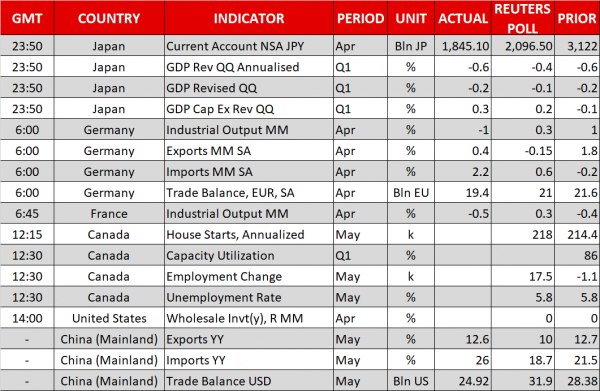

Friday’s agenda features a G7 summit in Canada, as well as data on employment from the same country.

The much-awaited – due to the latest developments on the trade front – G7 summit in Quebec, Canada commences today and will conclude tomorrow. A US confrontation with its traditional allies, after the former’s decision to levy tariffs on imports, should not be ruled out. Meanwhile, a joint statement after the conclusion of the summit tomorrow may not materialize; Germany and France have signaled that they will not sign any statement that does not recognize common ground on the Paris Climate Accord, Iran and tariffs. Escalating tensions could lead to a risk-off mood, diverting funds into traditional safe havens at the expense of riskier assets.

On the data front, Canadian housing starts for May are scheduled to be made public at 1215 GMT. Employment figures for the same month, though, are more likely to act as a loonie driver. Those are due at 1230 GMT and are expected to show the addition of 17.5k positions in the economy, which compares to a contraction of 1.1k in April, while the unemployment rate is anticipated to match the multi-decade low of 5.8% from the three previous months. Canadian overnight index swaps currently put the odds for a 25bps rate hike during the Bank of Canada’s July meeting at close to 69%. An upbeat report has the capacity to push that probability even higher, consequently boosting the loonie. First-quarter capacity utilization figures will also be released at the same time (1230 GMT).

Out of the US, wholesale inventory data for April are due at 1400 GMT, while the Baker Hughes report on active oil rigs in the country is slated for release at 1700 GMT and might give some short-term direction to oil prices.

ECB executive board member Yves Mersch will be delivering a keynote speech at the International Risk Management Conference in Paris at 0715 GMT.

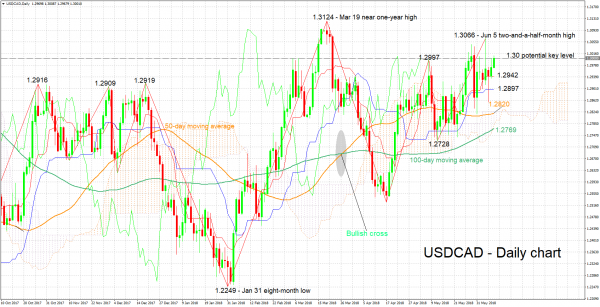

Technical Analysis: USDCAD short-term bullish; positive momentum may be easing

USDCAD has advanced by more than 2.5 cents after touching a one-and-a-half-month low of 1.2728 on May 11. The positively aligned Tenkan- and Kijun-sen lines are projecting a bullish picture in the short-term, though the fact that both have flatlined could signal easing positive momentum.

An upbeat Canadian jobs report later today is anticipated to boost the loonie, pushing USDCAD lower. Support to declines may come around the current levels of the Tenkan- and Kijun-sen lines at 1.2942 and 1.2897. Notice that the area around them also encapsulates numerous tops from late 2017.

Weaker-than-forecasted employment data, on the other hand, are likely to weaken the loonie, leading to a stronger USDCAD. Price action is currently taking place marginally above the 1.30 round figure, but still the area around this level may be proving immediate resistance. A more conclusive break above would turn the attention to Tuesday’s two-and-a-half-month high of 1.3066, with the near one-year high of 1.3124 from March 19 being eyed next in case of stronger bullish movement.

It should be kept in mind that any updates on trade can also affect the pair.