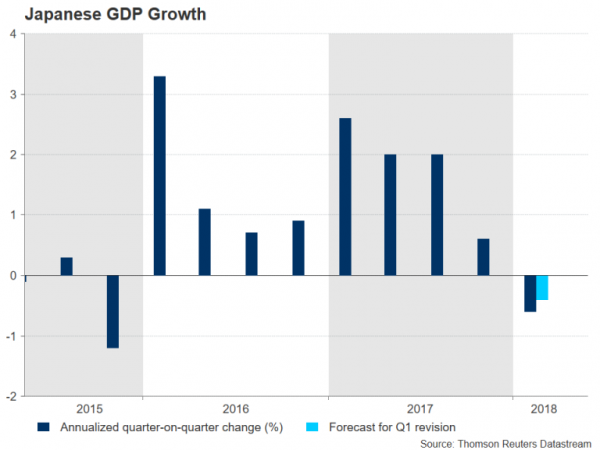

Japan will publish revised GDP numbers on Friday (Thursday, 23:50 GMT) for the first quarter. Growth is expected to be revised higher on the back of stronger than initially estimated capital expenditure during the period. However, the revision is unlikely to allay fears of a recession unless growth is revised to positive, as household spending remains weak.

The preliminary estimate of GDP showed Japan’s economy ended a streak of eight consecutive quarters of growth – the longest since the 1980s – in the first three months of 2018, by contracting at an annualized pace of 0.6%. That figure is expected to be revised up to -0.4% on Friday, and the quarter-on-quarter rate from -0.2% to -0.1%.

If growth is revised even higher and turns positive, it would eliminate the risk of Japan slipping into technical recession in the second quarter (defined as two consecutive quarters of contraction). While business spending may have supported growth in the first quarter, early indicators point to ongoing weakness in household spending and industrial output going into the June quarter, suggesting no rebound in sight just yet.

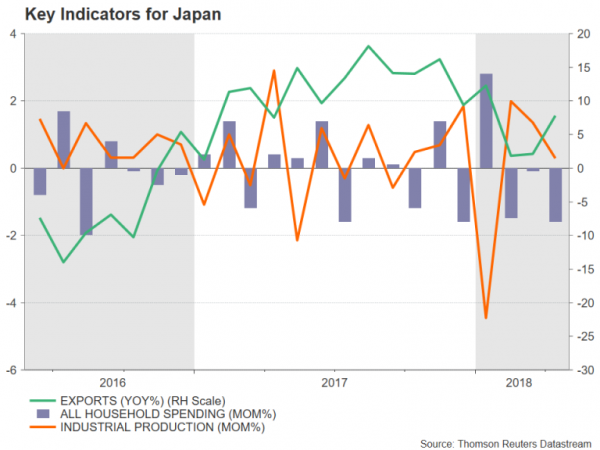

Household spending declined for the third month in a row in April, falling by 1.6% month-on-month and confounding forecasts of a 0.7% increase. Industrial production has fared better after a big slump in January, but output growth eased to 0.3% m/m in April, missing expectations of 1.2%. Exports have also been rising at a slower pace following the surge in the second half of 2017, although they did bounce back strongly in April.

But with rising trade tensions weighing on investor sentiment and slowing demand in some parts of the world, the outlook for manufacturers and exports is a bit patchy. There also doesn’t appear to be much relief for consumers anytime soon either as wage growth remains subdued.

Annual growth in real wages was flat in April, dampening expectations of a rebound following a surprise 0.7% rise in March. Wages in Japan have failed to pick up despite a very tight labour market and repeated calls by the Abe government on businesses to award higher pay increases.

Without a recovery in wage growth and in turn, household consumption, Japan’s economy runs the risk of becoming increasingly reliant on exports to drive growth. It also poses a problem for the Bank of Japan as inflation is unlikely to make a sustained move upwards without higher domestic demand, making it difficult for the Bank to exit its massive stimulus program.

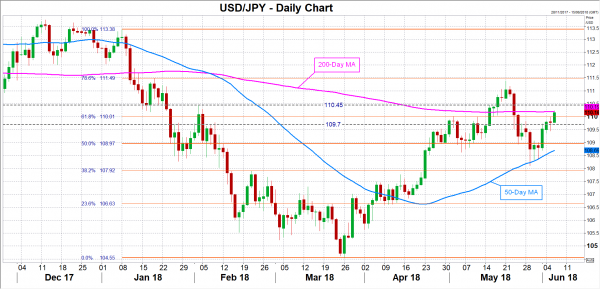

The Japanese yen doesn’t typically see much reaction to domestic data but big surprises in Friday’s numbers could still generate some volatility for the yen crosses if they impact expectations about BoJ policy normalization. If growth is substantially revised higher, dollar/yen could seek support from the 109.70 level – a recent congestion region. A break below this support would see the pair retesting the psychological 109 level, which if breached, would increase the risk of price action dipping below the 50-day moving average.

However, if there is a negative surprise and GDP is revised even lower, dollar/yen could head towards the 110.45 resistance area. A break above this level would open the way towards 111.50, which is the 78.6% Fibonacci retracement of the downleg from 113.38 to 104.55.